Dash price analysis: DASH/USD drifts lower amid slow market

- Dash has been controlled by bears since the beginning of the previous week.

- The critical support is created by the the area on approach to $66.00.

Dash has been losing ground since November 11. Now the 22nd largest digital asset with the current market value of $626 million, DASH/USD is changing hands at $67.67, down over 4% on a week-to-week basis. DASH has an average daily trading volume of $330 million. It is most actively traded against BTC on P2PB2B.

DASH's technical picture

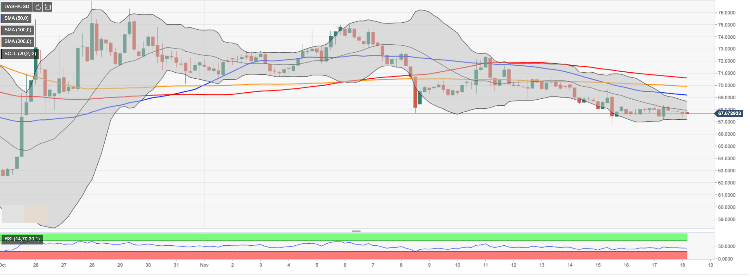

DASH/USD has been moving in a tight range limited by $67.00-$67.20 on the downside and $68.00 on the upside. The support area is created by the lower line of 4-hour Bollinger Band, while the upper boundary of the above-mentioned area is strengthened by the middle line of 4-hour Bollinger Band. Once it is out of the way, the upside is likely to gain traction with the next focus on $68.68 (the upper line of 4-hour Bollinger Band) and $69.20 (SMA50 (Simple Moving Average) 4-hour).

On the downside, we will need to see a sustainable move below $67.00 for the sell-off to gain traction. The next support is created by $66.70 (November 15 low and the lower line of the Bollinger Band) and psychological $66.00.

DASH/USD, 4-hour chart

Author

Tanya Abrosimova

Independent Analyst