- Mobile Topup in Thailand is supported by VISA, MasterCard, Bitcoin, Monero and Dash.

- Dash ignores selling pressure to add 2% on the day.

The Dash network recently celebrated the crypto’s 5th birthday. To market the celebration, the team offered the network free hosting for 100 Dashpay Masternodes for a period of six months. In the wake of the celebrations, Dash announced that its token, DASH had landed support from more than 200 mobile phone provider spanning 145 countries.

The support has been made possible by Mobile Topup in Thailand. The platform is supported by various payment providers including VISA, MasterCard, Alipay, PromptPay, Bitcoin, Monero and now Dash. The platform offers its customers “faster and cheaper than multi-country topup” services.

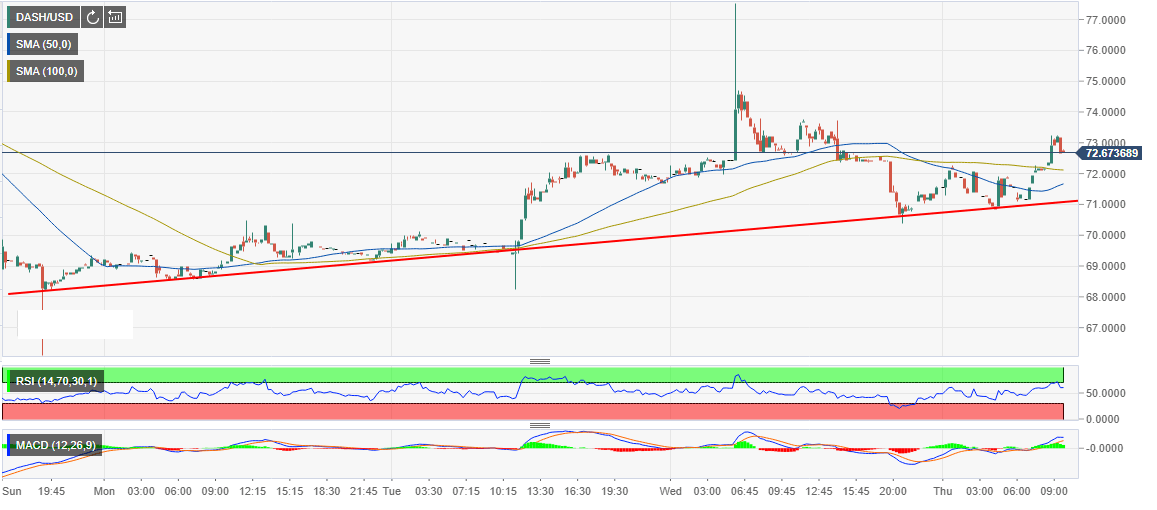

Dash price technical picture

Dash is the bull among the bears on Thursday. The crypto is trading in the green ignoring the negative pressure that is languishing most of the assets like Bitcoin Cash which has corrected lower 3.27% on the day. On the contrary, Dash is gaining traction and is already recording gains of over 2%.

The crypto has been gaining traction amid the lock-step trading since the declines last Sunday that formed lows at $68.22. Dash not only managed to reclaim the position above $70.00, but it also formed highs around $75.00. There has been a lower retracement with the price testing the support at $70.00.

The rising trendline has been in position, working as a bouncing wall for the price. DASH/USD is currently trading at $72.67 above both the 100-day Simple Moving Average (SMA) and the 50-day SMA, both of which are offering support at $72.14 and $71.66 in that order. More support areas are highlighted at $70.00 and the recent lows at $68.22.

More:

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ethereum records another day of heavy liquidations as Mt. Gox bearish pressure persists

Ethereum (ETH) is down nearly 5% on Friday following the Mt. Gox BTC repayment, sparking more than $108 million in ETH liquidations. The repayment's supply strengthened the bearish momentum on Bitcoin, which spiraled into altcoins like ETH.

APT, XAI, and IMX: Could these three token unlocks lead to further decline?

$161 million worth of APT, XAI, and IMX are set to flood the market this week. Their prices may decline further following the unlock, as all the tokens are down over 5% in the past 24 hours. DYDX, NTRN, FORT and HNT are other tokens that will unlock new supplies.

WIF and BONK post gains amid wider market drawdown

WIF is up more than 7% as Solana bulls appear to have returned to the meme coin. BONK joined WIF in defiling the bearish trend, posting a 2% gain in the past 24 hours. Meme coins may suffer major hits if the crypto market's bearish pressure persists.

Gold bug Peter Schiff predicts Bitcoin sell-off will intensify when price drops under $38,000

Peter Schiff, American stockbroker and financial commentator, shared his views on where Bitcoin is headed in a recent tweet on X. Bitcoin slips under key support at $54,000 early on Friday.

Bitcoin: BTC sinks under $55,000 as Mt Gox prepares payment to creditors

Bitcoin (BTC) price is having its worst week of the year, influenced by selling activity among BTC miners and heavy transfers of Bitcoins to exchanges by Mt Gox and the German Government.