CyberConnect price could fall 10% as $9.65 million worth of CYBER tokens due to flood markets in cliff unlock

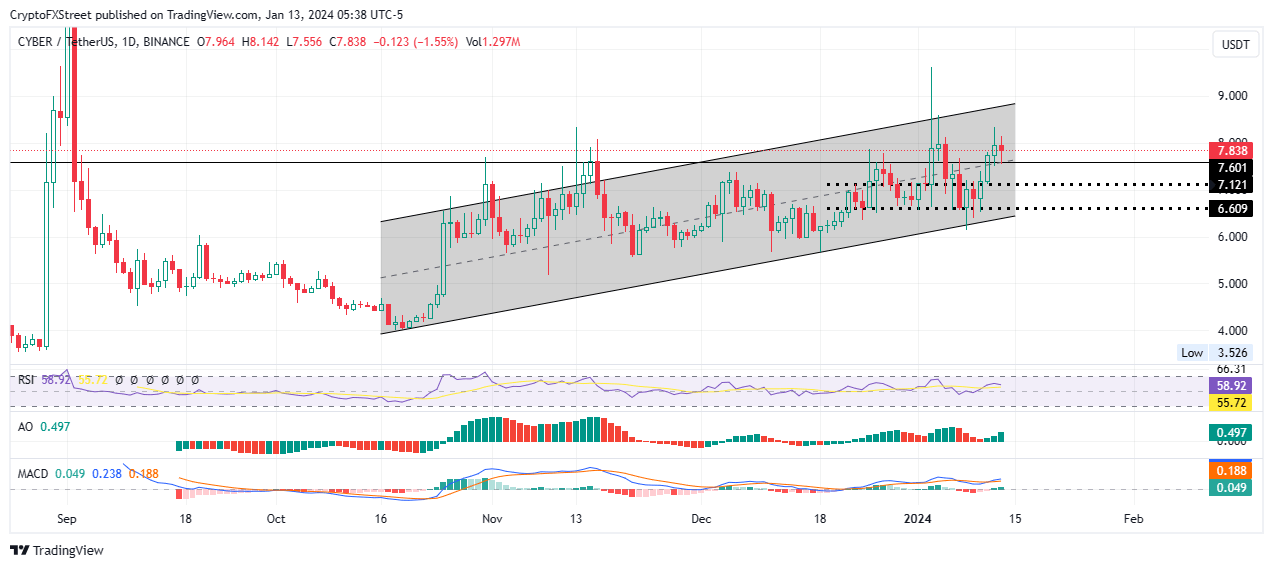

- CyberConnect price has consolidated along an ascending parallel channel, with a recent correction testing the lower boundary on January 8.

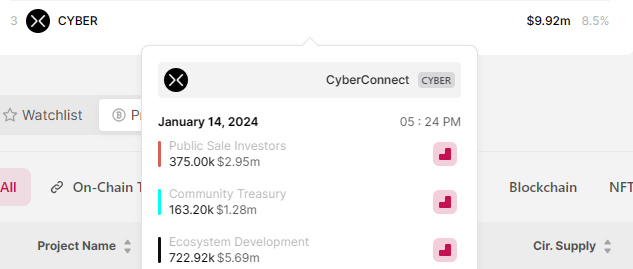

- The network has a cliff token unlock on Sunday, with 1.26 million CYBER tokens worth $9.65 million to be unleashed.

- CYBER could fall 10% to $7.121, with the risk of extending the fall to the subsequent support at $6.609.

- The bearish thesis will be invalidated if the altcoins confirms a breakout above the channel beyond the $9.00 psychological level.

CyberConnect (CYBER) price is trading with a bullish bias, consolidating within an ascending parallel channel since October when the broader market turned bullish. However, this bullishness could be tested soon as the network has a bearish catalyst on the calendar on Sunday, January 14.

Also Read: CYBER price jumps nearly 17% ahead of $10 million token unlock

CYBER Network to unlock 1.26 million tokens

CyberConnect (CYBER) price could be coiling up for a dump, as the network has a cliff token unlocks event tomorrow. According to the TokenUnlocks app, the network will be flooding 1.26 million CYBER tokens worth approximately $9.65 million. The volume of the unlocks represents nearly 8.5% of the asset’s supply.

The tokens will be allocated to community treasury, ecosystem development, and public sale investors. While the first two may not be looking to sell, investors are likely to cash in for quick gains. The ensuing selling momentum could weigh heavy on CYBER price.

In principle, crypto token unlocks are typically considered bearish events for asset prices. Unlocked tokens enter circulation, increasing the selling pressure on the asset across cryptocurrency exchange platforms.

CYBER Token Unlocks

CyberConnect price outlook

CyberConnect price remains bullish, but this position could be tested soon in the wake of the expected profit booking. If the bears have their way, CYBER price could drop below the $7.601 support level, or lower, to test the $7.121 support.

A break and close below the aforementioned level, constituting a 10% dump, would push CyberConnect price over a cliff, potentially going as low as the $6.609 support level.

The Relative Strength Index (RSI) appears subdued, edging south to show momentum is falling. If the trajectory of the RSI sustains, it could soon cross below the signal line (yellow band), a crossover that is interpreted as a sell signal. Traders heeding this call would reinvigorate the selling pressure.

CYBER/USDT 1-day chart

Conversely, if the bulls fasten their grip on CyberConnect price, it could push north, extending to break above the upper boundary of the channel. This could see CYBER price tag the $9.000 psychological level. In a highly bullish case, the gains could extend for the altcoin to reclaim the $9.696 range high, levels last tested on January 3.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.