- CYBER price is capitalizing on the bullishness from the past week as well as the upcoming token unlock.

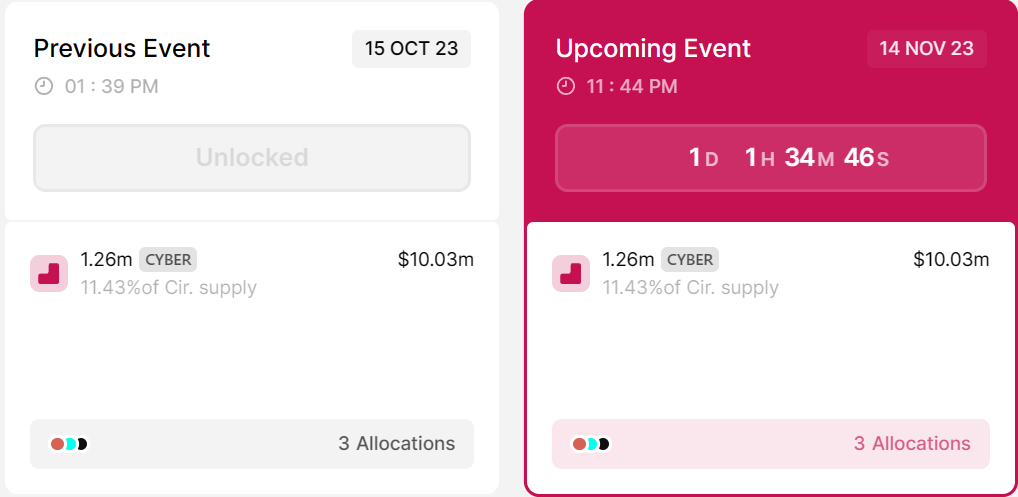

- 1.26 million CYBER tokens worth $10.03 million will be unlocked in the next 24 hours, which may result in a price decline.

- CYBER price was complacent during the previous event in October when a similar amount of CYBER was unlocked.

CYBER price’s rally emerged as a surprise for investors on Monday as the small-cap altcoin advanced against broader market cues. Apart from the rally in the past few days, a major catalyst for this increase is the upcoming token unlock, which would flush the market with more tokens, hence why investors are boosting the price.

CyberConnect token unlock is almost here

CYBER token is native to the web3 social networking platform and has noted a sudden increase in price in the past 24 hours ahead of the token unlock event set to take place in the next 24 hours. This event would see 1.23 million CYBER tokens worth over $10 million entering the market.

Token unlocks generally tend to be a bearish event, which results in a price fall. The reason behind this is the chunk of tokens that are flushed into the market, which causes a crash in the price as the demand reduces owing to increased supply.

However, the rally is likely CYBER holders boosting the price before the unlock in order to book profits before the price goes down. A similar occurrence was observed in the past when, on October 15, exactly 1.23 million CYBER tokens worth $10.03 million were unlocked.

CYBER token unlocks

The price on October 15 did not see any increase, and the following day it only rose by 2%. While the cryptocurrency falls among the small-cap category with a market capitalization of $85 million, today’s rally made it a token to watch.

CYBER price to likely decline

CYBER price trading at $7.76 is up by nearly 17% in the last 24 hours, with the intra-day trading high reaching $8.34. At the time of writing, the altcoin is close to breaching the crucial 61.8% Fibonacci Retracement of $11.63 to $4.01, marked at $7.81.

Given the upcoming token unlock, there is a possibility that not only will CYBER price fail to breach the $7.81 barrier but also will decline to test the support line marked at $6.93. Losing this support line would result in a decline to November lows of $5.80.

CYBER/USDT 1-day chart

However, if the altcoin closes above the $7.81 resistance and manages to test it as a support level, it would be able to invalidate the bearish thesis, which is generally the case when the 61.8% Fibonacci line is tested as support. This would also enable CYBER price to potentially breach the $8.00 psychological mark and reach a two-month high.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

TRUMP token leads $906 million in unlocks this week with over $330 million release

According to Tokenomist, 15 altcoins will unlock more than $5 million each in the next 7 days. Wu Blockchain data shows that the total unlocked value exceeds $906 million, of which the TRUMP token will unlock more than $330 million.

Why Mantra token’s dramatic 90% crash wiped out $5.2B market share

Mantra price hovered at $0.83 during the Asian session on Monday, following a massive 90% crash from $6.33 on Sunday. The crash wiped out $5.2 billion in the token’s market capitalization, quickly drawing comparisons to the infamous collapse of Terra LUNA and FTX in 2022.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC is on the verge of a breakout while ETH and XRP stabilize

Bitcoin price approaches its key resistance level at $85,000 on Monday; a breakout indicates a bullish trend ahead. Ethereum and Ripple found support around their key levels last week, suggesting a recovery is in the cards.

Bitcoin and crypto market sees recovery as Fed official says agency ready to stabilize market if necessary

Bitcoin rallied 5% on Friday, trading just below $84,000 following Susan Collins, head of the Boston Federal Reserve (Fed), hinting that the agency could stabilize markets with "various tools" if needed.

Bitcoin Weekly Forecast: Market uncertainty lingers, Trump’s 90-day tariff pause sparks modest recovery

Bitcoin (BTC) price extends recovery to around $82,500 on Friday after dumping to a new year-to-date low of $74,508 to start the week. Market uncertainty remains high, leading to a massive shakeout, with total liquidations hitting $2.18 billion across crypto markets.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.