Curve DAO token jumps as institutional capital flows in

- Curve DAO price has posted double-digit gains, 12% on Wednesday, in response to rising institutional demand.

- Abra, a financial services company, purchased $13.46 million worth of CRV tokens, revealing institutional capital inflow in crypto.

- Analysts are bullish on the CRV price rally as Curve DAO token eyes a $3 target.

Curve Finance DAO’s CRV token recently witnessed a massive breakout with the rise in institutional capital inflow. The token’s price increased 12% on Wednesday in response to news of Abra’s purchase of $13.46 million worth of CRV.

CRV price breaks out amid rising institutional interest

Curve Finance DAO, an Ethereum-based exchange liquidity pool, recently witnessed a massive spike in the price of its CRV token. Proponents have identified one key reason for the rise in CRV price.

Abra, a financial services company that runs a cryptocurrency wallet service, acquired $13.46 million in CRV tokens at $2.33 each. The purchase is representative of institutional interest in CRV.

Typically, institutional interest in an asset fuels a bullish sentiment among investors. CRV price posted 12% gains on Wednesday in response to the move by institutional investors and the rising capital inflow.

Abra purchased 5.78 million CRV tokens. The purchase pulled out 90% of Curve Finance DAO’s tokens on the FTX exchange. A reduction in CRV’s circulating supply and exchange reserves positively impacted the asset’s price.

FTX exchange had limited liquidity of 575,000 CRV left on their platform. Curve Finance DAO has focused on developing liquidity and opened new pools consistently. The most recent one is the Citadel DAO.

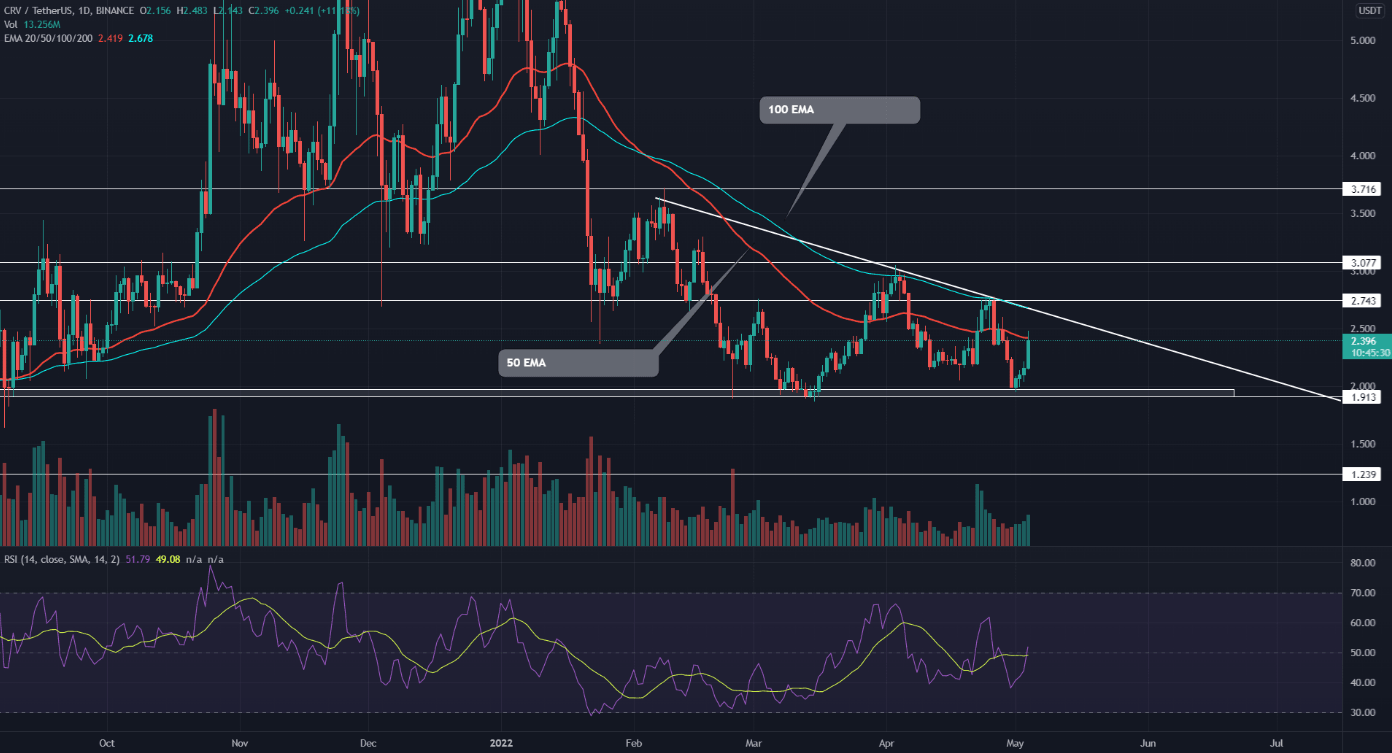

Analysts have evaluated the Curve Finance DAO price trend and identified a descending triangle pattern in the token’s chat. CRV price has wobbled in the bullish pattern with the next key resistance at its 100-day Exponential Moving Average above $2.50. At the same time, CRV’s on-chain activity witnessed a 92% gain in its intraday trade volume, exceeding $307.5 million.

CRVUSDT chart

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.