Cryptocurrency News Market: Bitcoin’s diminishing chances of hitting $10,000

Here is what you need to know on Friday, June 5, 2020.

Markets:

The cryptocurrency market is mixed red and green. There was increased volatility toward the end of the trading session on Thursday. However, most digital assets encountered increased selling pressure during the Asian session on Friday. As we head into the European session, there are mixed signals for cryptocurrencies.

For instance, Bitcoin is slightly in the red after retreating from intraday highs at $9,848. Moreover, the price is dancing at $9,783 although it opened the session of the day at $9,790. Meanwhile, the existing trend is bullish amid a growing bullish momentum. On the flip side, volatility appears to be shrinking, further diminishing the chances of hitting $10,000 before the weekend session.

Ethereum has a prevailing market value of $243 after adding a minor 0.30% on its value on a daily basis. An attempt to jump to $250 once again this week hit a snag at $245. On the downside, an intraday low has formed at $241 hence defending the support at $240.

The fourth-largest crypto XRP, on the other hand, is bullish nor bearish at the time of writing. The price is balancing at the opening value of $0.2042. However, the trend is likely to lean to the bearish side in the short term. Support at $0.20 is still intact and able to keep the bearish pressure at bay and avert losses toward the next support at $0.19.

Chart of the day: BTC/USD daily

-637269370628350086.png&w=1536&q=95)

Markets:

According to a report by Bloomberg, Tether (USDT), the largest stablecoin in the cryptocurrency industry is likely to continue with the impressive growth to an extent of toppling Ethereum from the second spot. Tether already displaced Ripple from the third position by market capitalization. It has a market cap of $9.2 billion compared to Ripple’s $9.0 billion. Ethereum, on the other hand, has a market cap of $27 billion. It would be a difficult and long task for Tether to take on Ethereum, however, if demand for the stablecoin continues, its market cap could improve significantly over time.

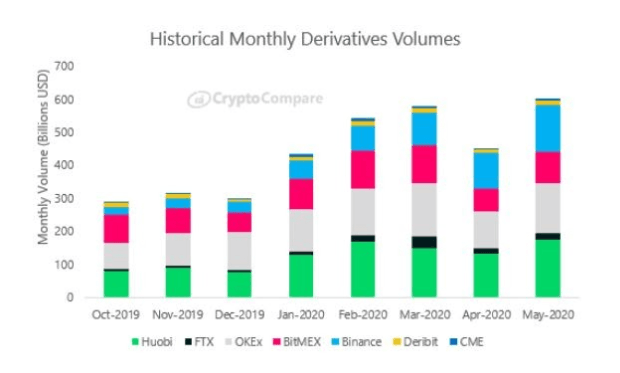

Data by aggregator platform, CryptoCompare shows that cryptocurrency derivatives monthly volume rose by one-third in May, hitting a new all-time high of $602 billion. The previous record of $600 billion was posted in March. Derivatives' growth in the industry has been impressive as they currently take up to 32% of the market, an increase from 27% in April. Binance exchange and Huobi controlled approximately 80% of May’s derivative volume. Derivatives by CME group saw a 59% growth in May to $7.2 billion which still appears like a drop in the ocean compared to the $17 billion in volume for the market leader, Huobi.

Industry:

Ethereum Classic (ETC) nodes are reported to be operating at 100% in full post-Phoenix upgrade. The upgrade was first mentioned by Ethereum Classic Labs (ETC Labs) after a consensus among stakeholders with the ETC community. The upgrade took place on June 3 to enhance EVM capabilities. Phoenix has also made Ethereum Classic “completed compatible” with Ethereum (ETH).

This upgrade demonstrates the robust development underway on Ethereum Classic, as it is the third hard fork in the last year; and reflects the strong community consensus among ETC stakeholders.

Regulation:

The Office of the Comptroller of the Currency – in charge of regulating banks in the United States is said to be seeking the public’s opinion on digital activities among national banks and federal savings associations. They also include activities related to cryptos and digital assets. A statement by the OCC reckons that cryptocurrency is:

"Part of the agency’s effort to support the evolution of the federal banking system and its ability to meet the needs of the consumers, businesses, and communities it serves." The organization added that "[c]omments received on this ANPR may inform the development of specific policy proposals or future rulemakings."

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren