Cryptocurrency Market Update: Freefall in DeFi screams bubble busting

- The DeFi craze is taking a breather amid massive losses for individual tokens.

- The total value locked in DeFi plunged from $13.25 billion (September highs) to the prevailing $9.42 billion.

- Aave and Yearn.finance fall by more than 40% from their all-time highs.

It has been an exciting year so far in the cryptocurrency industry. First, the market crashed excessively following the COVID-19-triggered selloff in March. Then, investors diversified their attention from Bitcoin and other major cryptocurrencies to decentralize finance (DeFi) tokens.

Projects in the new ecosystem allow investors to borrow and provide liquidity on digital platforms. These assets rallied to new highs, popularizing the DeFi craze. However, the last four weeks have not been kind to the same tokens, with some of them posting monthly losses of more than 40%.

The biggest questions remain, is the DeFi bubble about to burst? Or has it done it already?

DeFi market cap falls below $10 billion

The entire DeFi ecosystem has total value locked of $9.42 billion. The figure might seem high considering how young the sector is but note the drop from September highs of $13.25 billion. A chart provided by DeFi Pulse highlights that recovery seems to be underway from the monthly low of $6.30 billion.

At the time of writing, UniSwap is the biggest DeFi project. It has a total value locked of $1.91 billion, which represents dominance of 20.27%. Over the last 24 hours, UniSwap lost 1.45% of the funds locked.

Maker trails UniSwap with a total value locked of $1.27 billion. Its fund has grown by 1.79% over the last 24 hours. Curve Finance comes in the third position with a total value locked of $1.23 billion, following a 1.83% loss in 24 hours.

Yearn.finance DeFi darling spirals to $20,000

The meteoric rise of Yearn-finance (YFI) left many dumbfounded. Never before had cryptocurrency enthusiasts imagined an altcoin surpassing Bitcoin (BTC) to become the most expensive digital asset in the world. However, YFI rallied within weeks of its launching, becoming the most costly crypto and the DeFi darling.

Yearn.finance is an Ethereum-based platform that provides investors with access to other DeFi projects to take advantage of the changing interest rates on the platforms to increase their earnings. The platform also launched Yearn Vaults, which “follow unique strategies that are designed to maximize the yield of the deposited asset and minimize risks.” Investors are also provided with a discount on gas to combat the rocketing transaction fees within the Ethereum network. Yearn.finance also launched an insurance cover in collaboration with Nexus Mutual to ensure the risk of loss is minimized.

Yearn.finance market update

After trading at all-time highs of $44,000 on September 12, YFI commenced a gain-trimming exercise which has seen it explore levels towards $20,000. On Monday, 21 September 2020, Yearn.finance traded at weekly lows of $21,621 before resuming the ongoing week reversal. From its all-time high, YFI has lost over 40% in less than two weeks. Such a massive loss in a short period raises questions of where YFI is headed. Can it resume the uptrend, or should investors anticipate more losses soon?

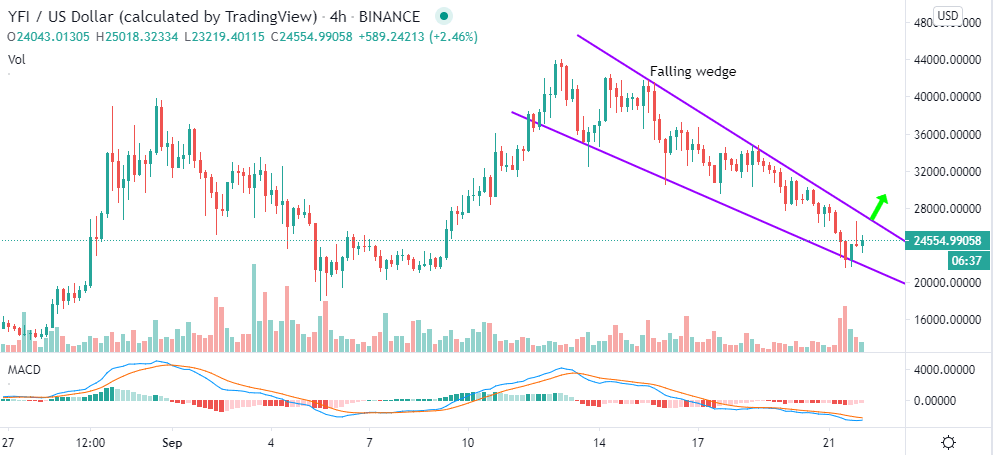

YFI/USD 4-hour chart

The chart highlights the formation of a descending wedge pattern, which, if confirmed, could eventually lead to a breakout eying $30,000. The Moving Average Convergence Divergence (MACD) seems to be taking a hiatus from the slump in the last two weeks. If consolidation comes into play, the bulls can use the time to forge the next mission to $30,000.

Meanwhile, IntoTheBlock data shows that YFI has a clear path to levels above $27,000. However, it is essential to realize that the resistance between $27,169 and $27,893 is extreme, perhaps due to the supply created by the 555 addresses that previously bought 656,410 YFI around those levels. On the downside, it is essential to keep in mind that if the support between $23,510 and $24,234 is shattered, then YFI will spiral to test the next support range at $22,064 and $22,787.

Yearn.finance IOMAP chart

-637363499064754833.png&w=1536&q=95)

Aave explores lows towards $0.40

Aave (LEND) has had an impressive 2020, particularly in the period between April and August. From barely holding above $0.01 at the beginning of the year, LEND sprung to stardom in the DeFi spectrum. The meteoric rise saw the crypto aim for $1.00, but it stalled an all-time high of $0.9090 in August. Unfortunately, LEND also started to trim gains, and at the time of writing, the token is valued at $0.48 (representing over a 40% drop from the all-time high).

Aave is a DeFi protocol that is open source yet non-custodial. The platform works to create money markets by presenting opportunities where users can earn interest on deposits while, at the same time, they are able to borrow other digital assets.

LEND/USD 4-hour chart

The 4-hour chart shows the formation of a double-bottom pattern that could eventually catapult Aave to highs above $0.65. It is essential to wait for a confirmed breakout because the MACD is still pointing downwards, suggesting that selling influence is also present. If the breakout materializes, the 50 Moving Average (MA) and the 100 MA in the 4-hour range will hinder growth towards $0.65. Generally, LEND appears to be getting ready for a breakout that could retake some of the levels towards $1.00.

Aave holder distribution

A glance at the large investors’ activity can help provide a general idea where LEND is going. As the prices dipped in the last two weeks, whales rushed to reduce their holdings. Santiment’s holder distribution chart highlights buying pressure has been on the rise since September 17 despite the falling prices. Addresses holding 1 million to 10 million LEND rose from 42 to 45 on September 22, representing a 6.6% increase within such a short period. Subsequently, holders with more than 10 million LEND increased from 12 to 14 in the same period, representing a 14.28% increase.

Aave holder distribution

%20%5B07.58.48%2C%2022%20Sep%2C%202020%5D-637363577896786856.png&w=1536&q=95)

The increase in large volume investors may seem insignificant at the moment, especially with LEND still nursing bruises. However, the volume moved by these whales can put immense buying pressure on Aave, leading to a breakout. Moreover, if the buying spree progresses, LEND may finally get the boost it desires above $1.00.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren