- The holiday mood seems to have taken a toll on the market as it is painted red everywhere.

- Bitcoin defends $5,200 support following rejection at $5,300.

- Ripple and Ethereum hold tight to key support levels as bears take advantage of Easter Holiday.

The crypto market is strongly bearish in the morning of Good Friday. The holiday mood seems to have taken a toll on the market as traders take a minute to relax after four months of trading in 2019. The total market capitalization is currently sliding lower from the weekly high at $180 billion recorded on Thursday 18. The market cap stands at $178 billion with Bitcoin taking up the bigger chunk at $92 billion. Bitcoin dominance on the market is rising, besides it stands at $52% at press time.

Bitcoin price update

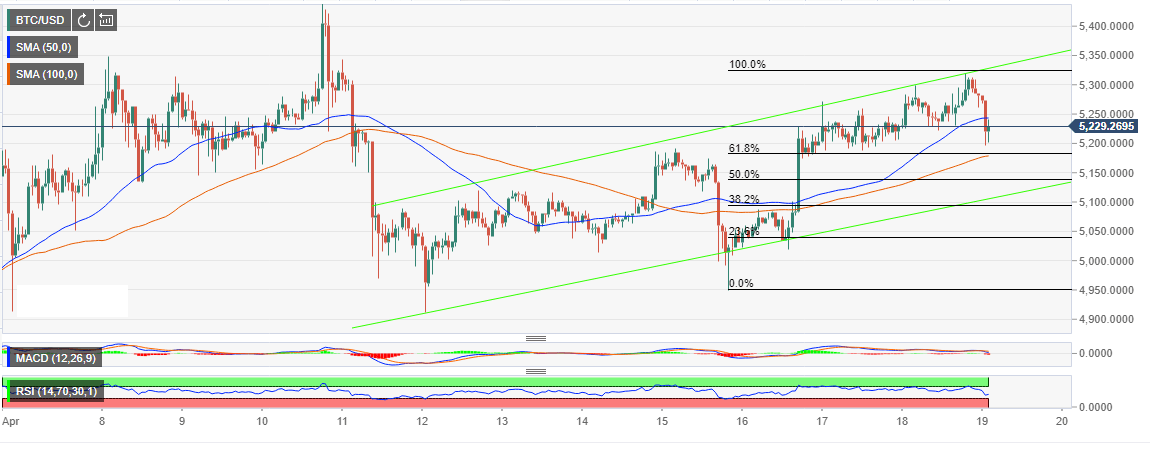

Bitcoin has throughout this week, been trending upwards within a rising channel. The bulls keep pushing the limits on the upside, although it has been capped slightly past $5,300. An attempt to make headway above this level was futile moments before the end of Thursday’s session. A lower correction tanked below 50 SMA but the support at $5,200 is still in place. BTC/USD is trading at $5,231 while facing resistance at the 50 SMA.

Ethereum and Ripple price update

Both Ripple and Ethereum are in the red at press time. Ethereum is down 1.85% to trade at $171.40 while Ripple is in the red with losses of 2.18% and changing hands at $0.3306. Both the assets are hanging in the balance slightly above key support areas. Ethereum, for example is right in the middle of the bullish zone we explored in the price prediction on Thursday. Ripple, on the other hand, is barely holding on to the resistance turned support at $0.3300. The rest of the top twenty cryptocurrencies are in the red with losses between 0.5% and 3%.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Lukas Enzersdorfer-Konrad, Bitpanda deputy CEO: “Crypto needs Gary Gensler gone”

Lukas Enzersdorfer-Konrad is the deputy CEO at Bitpanda, a broker based in Europe with more than five million users. At the European Blockchain Convention held in Barcelona, the executive shared with FXStreet his views on the current state of the crypto industry and its regulation.

Bitcoin still consolidates despite positive spot ETFs demand

Bitcoin (BTC) trades slightly up, around $64,000 on Thursday, following a rejection from the upper consolidation level of $64,700 the previous day. BTC’s price has been consolidating between $62,000 and $64,700 for the past week.

Why is ONDO’s price outlook bullish?

DefiLlama data shows that Ondo TVL reached a new ATH of $613.75 million. Ondo’s Supply Distribution metric shows whale accumulation. On-chain data shows that ONDO’s daily trading volume is rising, and the supply of exchanges is decreasing.

Maker price eyes a rally on technicals and on-chain metrics

Maker trades above $1,500 on Thursday, suggesting a potential rally as technical indicators show bullish divergence. This positive outlook is reinforced by MKR’s Exchange Flow Balance, which shows a negative spike, indicating growing investor confidence in the platform.

Bitcoin: Fed-led rally could have legs towards $65,000

Bitcoin is poised for a second consecutive week of gains, supported by the recent 50-basis-point cut in interest rates by the Federal Reserve. Bitcoin broke above several key technical resistances this week, signaling a rally continuation.

Five best Forex brokers in 2024

VERIFIED Choosing the best Forex broker in 2024 requires careful consideration of certain essential factors. With the wide array of options available, it is crucial to find a broker that aligns with your trading style, experience level, and financial goals.