- Altcoins wake up as Bitcoin dominance hit a wall, signaling the beginning of the ‘altcoin season.’

- Max Keiser, a prominent Bitcoin investor says $100,000 prediction for BTC is a bit conservative.

Bitcoin has been in a lull for more than two weeks apart from the brief rally that catapulted it to levels above $9,400 on Thursday. On the downside, the largest cryptocurrency has established support at $9,200. Note that in the last week of June, BTC/USD dived to levels close to $8,800 but recovered and reclaimed the ground above $9,000. Consolidation above $9,200 is expected to take place in the coming sessions.

Although Bitcoin has been confined to a drab technical picture, altcoins have performed relatively well starting with Ripple (XRP). The fourth-largest crypto corrected upwards from levels at $0.17 to highs above $0.21. XRP has since retreated and is now pivotal $0.20. The most improved altcoins include Stellar (XLM), Chainlink (LINK), Cardano (ADA) and Tezos (XTZ).

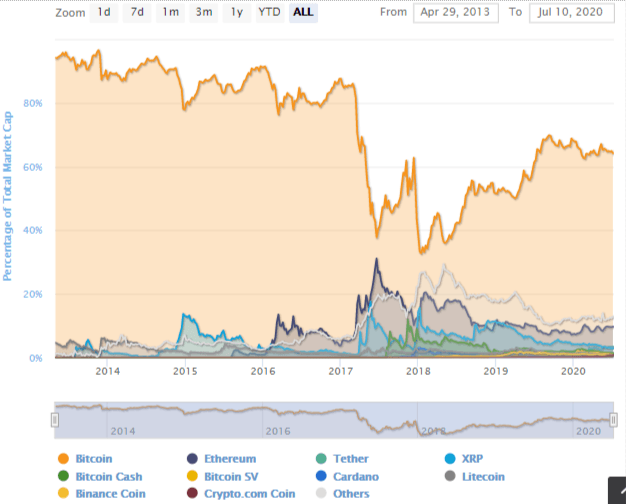

The growth of altcoins has been reflected in market dominance. Bitcoin currently has a market share of 62.8%. The metric was recently rejected at a trendline leading to a drop. On the other hand, altcoins seem to be picking up the pace with analysts predicting the beginning of the altcoin season.

Despite the positive show by the altcoins, Max Keiser believes that there is no way the cryptoassets will rally without Bitcoin. Keiser is a prominent investor in Bitcoin who also hosts the RT’s Keiser Report in collaboration with Stacy Herbert.

According to Keiser, Bitcoin will “eviscerate” all its competitors including “government subsidy-welfare bums.”

So, all these altcoin posers and government subsidy-welfare bums will be eviscerated by the one true bitcoin. It’s about time…,” besides, there is “no coin out there that can do something that BTC doesn’t do already or will be able to do shortly.

In a later comment, Keiser said that Bitcoin dominance in the market would hit 99%. In addition, the investor predicted Bitcoin trading at $100,000, representing a 900% rally from the current price level above $9,200. In another interview with Alex Jones of Inforwars, Keiser said that a $100,000 prediction was rather conservative and that Bitcoin had the potential to hit $400,000.

I am officially raising my target for BTC — and I first made this prediction when it was $1, I said this could go to $100,000 — I’m raising my official target for the first time in eight years, I’m raising it to $400,000.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple's XRP eyes massive rally following spike in key on-chain metric

Ripple's XRP trades near $2.40, up 1% on Monday following a 40% surge in its futures open interest. The surge could help the remittance-based token overcome the key resistance of a bullish pennant pattern.

Crypto Today: Bitcoin taps $100K, AI Tokens surge as Ripple CEO announces US hirings

The cryptocurrency sector valuation increased by $11 billion on Monday to reach an 18-day peak of $3.47 trillion. Bitcoin price crossed the $102,480 mark, on course to print a seventh consecutive green candle.

Solana memecoins to watch in January 2025: Pudgy Penguins, Fartcoin, Ai16z lead the way

Solana memecoins took center stage on Monday, crossing the $22 billion aggregate market cap milestone as the crypto sector's positive start to 2025 enters day six.

Bitcoin reclaims $100K as Calamos announces upcoming launch of first ever downside protection BTC ETF

Bitcoin rallied above $100,000 on Monday following asset manager Calamos' announcement of a 100% downside protection Bitcoin exchange-traded fund to help investors manage their risk.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.