Cryptocurrency Market Update: Bitcoin locked in a range after volatile week

- The cryptocurrency market is directionless during early Asian hours on Sunday.

- Bitcoin and all major altcoins are trapped in tight ranges.

The cryptocurrency market has been moving sideways with bullish bias during early Asian hours on Sunday. Saturday's sell-off did not yield into a big move and several altcoins reversed from support levels and attempted recovery. The cryptocurrency market capitalization edged to $230 billion, while an average daily trading volume dropped to $72 billion. Bitcoin's market dominance settled at 66.1%.

Read also:

Bitcoin may be ready for recovery as the Chinese New Year is behind us

Bitcoin (BTC) price update

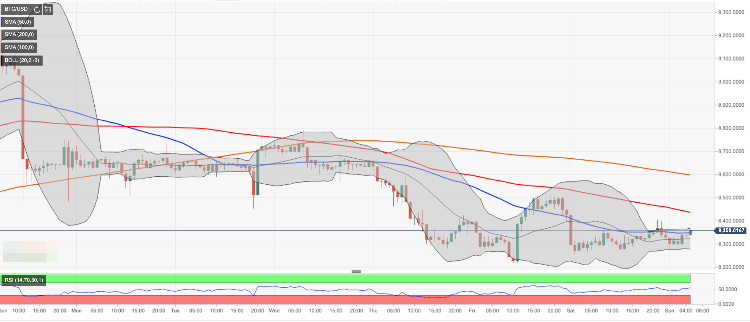

The largest cryptocurrency by market capitalization has settled above $8,300 after a short-lived sell-off to $8,217 On January 24. At the time of writing, BTC/USD is changing hands at $8,350, mostly unchanged since the beginning of the day. We will need to see a sustainable move above $8,450 created by SMA100 1-hour and 50% Fibo retracement for the upside move from December 2018 low to July 2019 high for the upside to gain traction.

BTC/USD 1-hour chart

Ethereum (ETH) price update

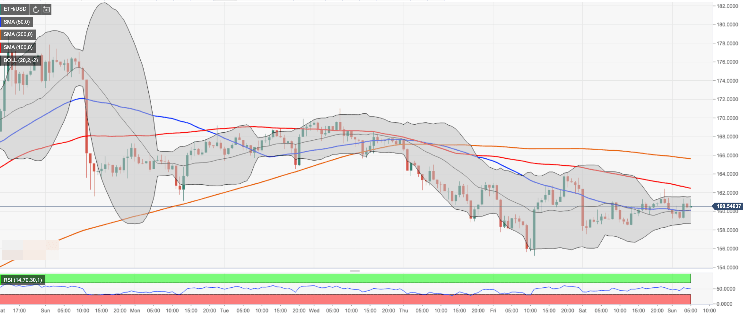

Ethereum settled above to $160.00 during early Asian hours after a move tot $159.22 during early Asian hours. The second-largest coin with the current market value of $17.4 billion is moving within the short-term bearish trend amid expanding volatility. ETH/USD has gained about 1.0% on a day-to-day basis and stayed unchanged since the beginning of Sunday. The local resistance is created by SMA100 1-hour at $162.40.

ETH/USD 1-hour chart

Ripple's XRP price update

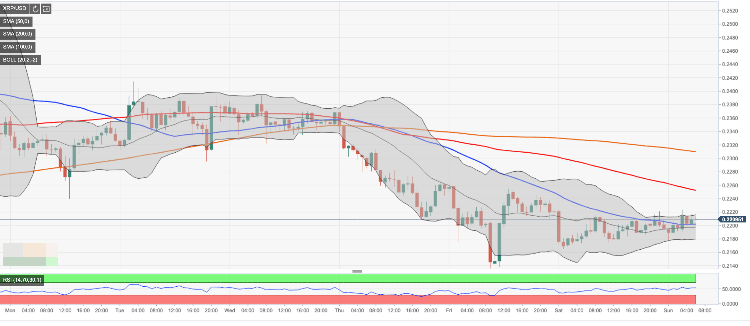

Ripple settled at $0.2206 after a move to $0.2136 on January 24. XRP/USD is locked in a tight range, moving with short-term bearish bias. The critical support is located at $0.2200. recovery may be limited by SMA50 1-hour at $0.2235.

Read also:

Ripple CEO: Bitcoin a store of value, not suitable for transactions

XRP/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst