Cryptocurrency Market Update: Bitcoin bulls hit the pause button, altcoins follow the lead

- The cryptocurrency market is mostly in red amid technical correction.

- Bitcoin regains its market share as altcoins are losing ground.

Cryptocurrency bulls need some rest after a sharp rally that took some coins to multi-months highs. Bitcoin and major altcoins have been under pressure on Thursday; however, the move can still be qualified as a natural correction from overbought levels. The cryptocurrency market capitalization decreased to $239 billion, while an average daily trading volume reduced to $130 billion from $176 billion this time on Wednesday. Bitcoin's market dominance is jumped to to 66.5%.

Bitcoin (BTC) price update

The largest cryptocurrency by market capitalization retreated from the recent high of $8,900 on Wednesday and retreated to $8,737 by press time. The coin has stayed mostly unchanged on a day-to-day basis and since the beginning of the day. Despite the retreat, BTC/USD is still trading above critical $8,500, which means that the upside momentum may be resumed after a short pause. The short-term trend remains bullish, however, the volatility is low

BTC/USD 1-hour chart

Ethereum (ETH) price update

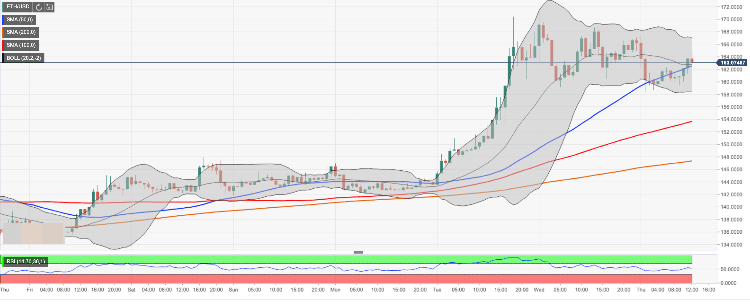

Ethereum hit $171.67 on Wednesday only to drop back to $163.00 by the time of writing. The strong downside move was caused by technical correction on the market. ETH/USD has lost about 2% since the beginning of the day. From the short-term perspective, the coin is moving within a bullish trend amid low volatility.

ETH/USD 1-hour chart

Ripple's XRP price update

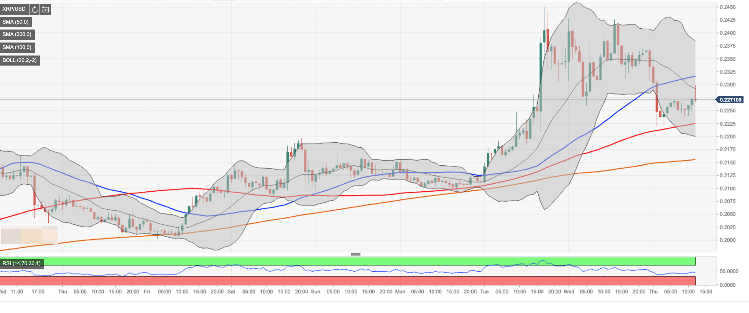

Ripple retreated to $0.2270 after a short-lived move above $0.2400. The third-largest digital asset has been losing ground after the support of $0.2300 gave way. XRRP/USD has lost over 3% since the beginning of Thursday, moving in sync with the market. The short-term trend is bullish.

XRP/USD 1-hour chart

The worst-performing altcoin out of top-20

- Bitcoin SV -11% ($326.50)

- Cosmos -6.6% ($4.39)

- Tron -5.8% ($0.0166)

Author

Tanya Abrosimova

Independent Analyst