Cryptocurrency Market Update: Bitcoin and major altcoins attempt a recovery

- The cryptocurrency market has recovered from the recent lows.

- The short-term momentum remains bearish as the coins are moving inside recent ranges.

The cryptocurrency market has been flashing red colors during early Asian hours with Bitcoin and all major altcoins nursing small losses within the current ranges. The cryptocurrency market capitalization settled at $229 billion, while an average daily trading volume recovered to $89 billion. Bitcoin's market dominance settled at 66.2%.

Read also:

Chainalysis: Increase in exchange attacks but reduced stolen crypto funds

Missing QuadrigaCX funds linked to shadow bank Crypto Capital?

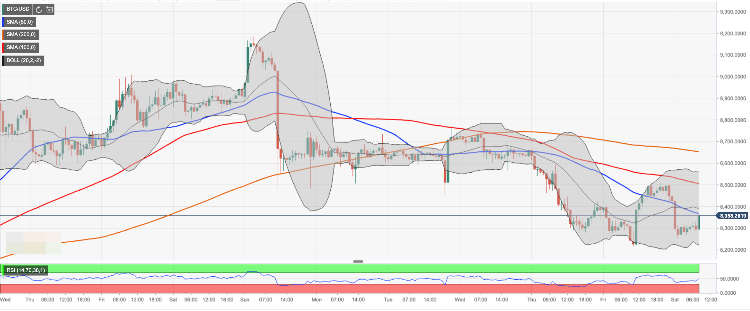

Bitcoin (BTC) price update

The largest cryptocurrency by market capitalization recovered above $8,300 after a short-lived sell-off to the intraday low of $8,217. However, the further upside may be limited by the local resistance created by SMA50 1-hour at $8,370. At the time of writing, BTC/USD is changing hands at at $8,360, down nearly 1% since the beginning of the day.

BTC/USD 1-hour chart

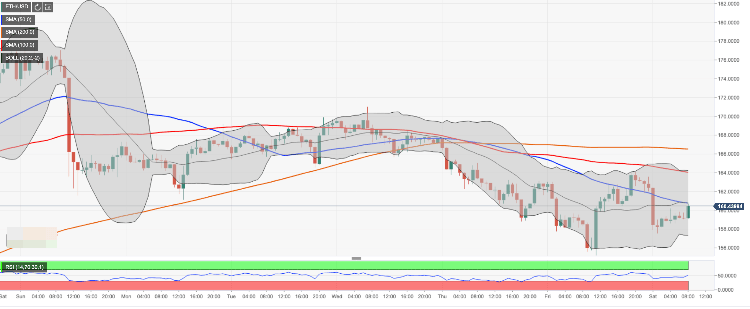

Ethereum (ETH) price update

Ethereum dropped to $157.22 during early Asian hours. The second-largest is changing hands at $160.30, amid short-term recovery. ETH/USD has lost about 1.2% since the beginning of the day. From the short-term perspective, the coin is moving within a strong bearish trend tend amid expanding low. The nearest support is created at $164.00 (SMA100 1-hour and the upper line of 1-hour Bollinger Band).

ETH/USD 1-hour chart

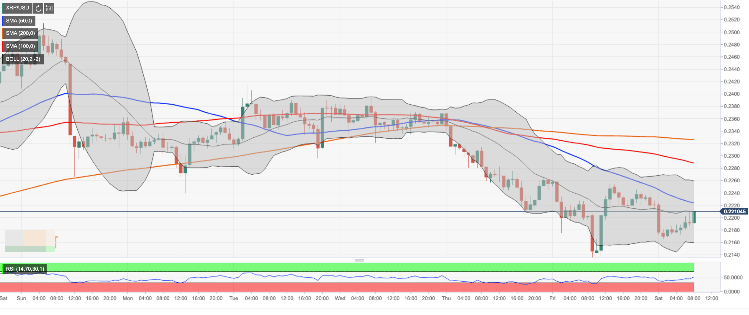

Ripple's XRP price update

Ripple retreated to $0.2206 after a move to $0.2136 on Friday. XRP/USD's short-term recovery may be limited by SMA50 1-hour at $0.2235 The short-term trend is bearish.

Read also:

Ripple CEO: Bitcoin a store of value, not suitable for transactions

XRP/USD 1-hour chart

Author

Tanya Abrosimova

Independent Analyst