- Bitcoin price falls in deep slumber unable to escape range resistance.

- Ethereum defends the support at $120: Upside still laced with tough hurdles.

A look at the market on Friday shows that cryptocurrencies will close the week in the red. The trading this week has been uneventful as digital assets showed a high level of stability. The same cannot be said for last week’s trading which faced a waterfall drop on Thursday where Bitcoin tanked below $3,500. The market opened the week at $124 billion but it is likely to close it at the current $122 billion. Bitcoin dominance is still more than half the market share, precisely at 52.4%.

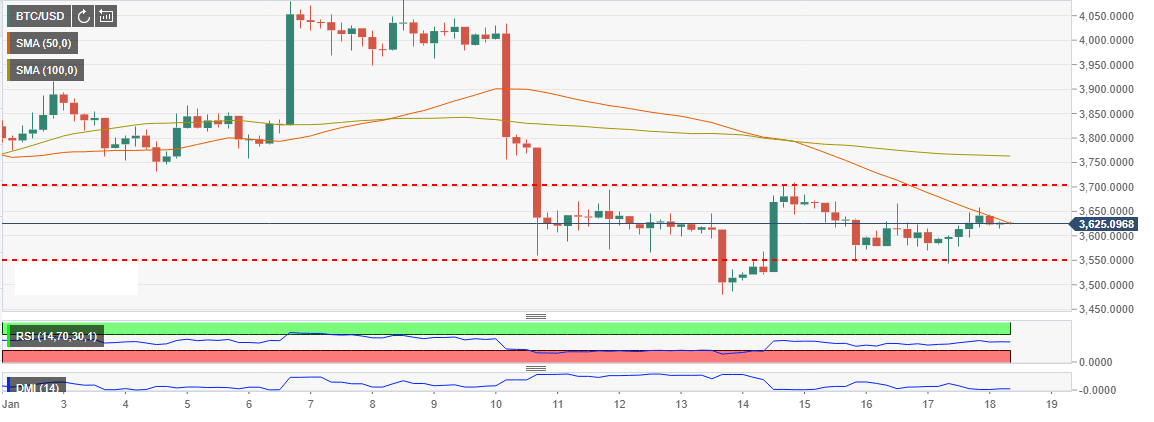

Bitcoin price technical picture

Following the sharp drop last week, Bitcoin price has fallen in deep slumber. It seems the bulls have taken a nap leaving just enough momentum to prevent the price from sliding below the range support at $3,550. The attempts made to push the price above the range resistance at $3,700 have been thwarted by selling pressure. Besides, the price is trading below both the 50-day and the 100-day Simple Moving Average (SMA). The 50-SMA is limiting the gains slightly above the current BTC value ($3,627). The gap between the Moving Averages is widening to show that bear pressure will continue in the coming sessions ahead of the weekend.

BTC/USD 4-hour chart

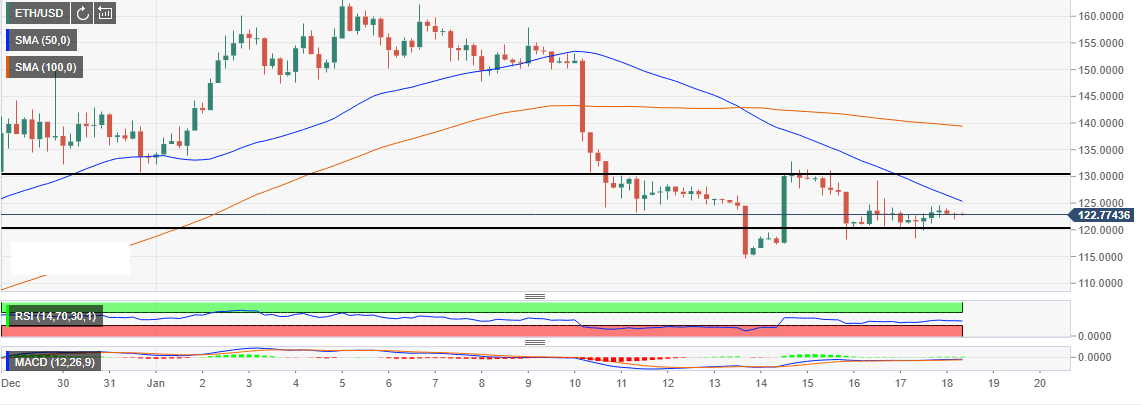

Ethereum price technical picture

Ethereum, on the other hand, is also stuck in a range with the upside capped at $130. ETH is valued at $112.92 at press time and it is likely that it will continue trading in the same range for a few days. However, a break past the range resistance will open the road for a correction towards $140 (key resistance). On the flip side, support is established at $120 and $115 respectively.

ETH/USD 4-hour chart

Read more:

Bitcoin and all major coins ignore positive fundamentals

Get 24/7 Crypto updates in our social media channels: Give us a follow at @FXSCrypto and our FXStreet Crypto Trading Telegram channel

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Top gainers Virtuals Protocol, Floki, Hyperliquid: Altcoins extend gains alongside Bitcoin

The cryptocurrency market sustains a market-wide bullish outlook at the time of writing on Tuesday, led by Bitcoin (BTC) and select altcoins, including Virtuals Protocol (VIRTUAL), Floki, and Hyperliquid (HYPE).

Token unlocks over $625 million this week across major projects SUI, OP, SOL, AVAX and DOGE

According to Wu Blockchain, 11 altcoins with one-time tokens unlock more than $5 million each in the next seven days. The total value of cliff and linear unlocked tokens exceeds $625 million.

TRUMP meme coin on-chain activity surged following dinner announcement: Kaiko

Kaiko Research published a report on Monday highlighting the significant impact of TRUMP's team dinner announcement on the meme coin sector. The announcement triggered a surge in on-chain activity and trading volumes, with TRUMP accounting for nearly 50% of all meme coin trading volume.

Coinbase launches new Bitcoin Yield Fund, offering investors 4–8% annual returns

Coinbase has launched a Bitcoin Yield Fund, aiming to offer non-U.S. investors sustainable 4–8% returns paid directly in Bitcoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.