Cryptocurrency Market Update: Bearish correction begins following a heavily bullish Wednesday

- The ETH/BTC daily chart has had three straight bearish sessions.

- ETH/USD fell below the $200-level in the early hours of Thursday.

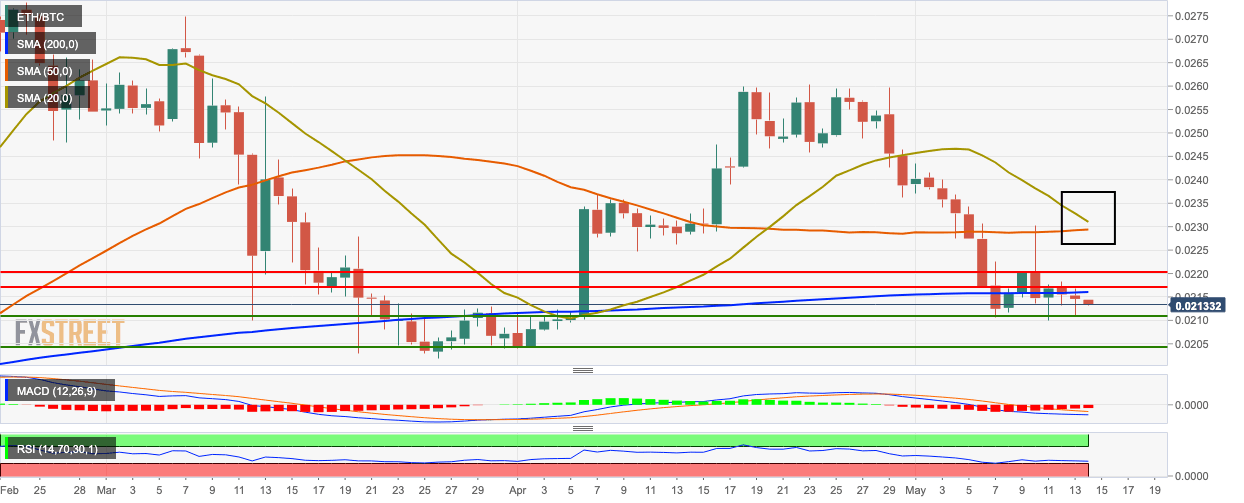

ETH/BTC daily chart

ETH/BTC dropped from 0.02145 to 0.02132 as the bears remained in control for the third straight day. The SMA 50 is looking to cross over the SMA 20 and form the bearish cross pattern. The MACD shows sustained bearish momentum, while the RSI indicator is trending horizontally next to the oversold zone.

The bears must defend support levels at 0.0211 and 0.0204. On the upside, the bulls will need to cross above resistance at SMA 200, 0.0217 and 0.0202.

BTC/USD daily chart

BTC/USD dropped a bit from $9,320 to $9,300 following a hugely bullish Wednesday. The Elliott Oscillator has had five straight red sessions, while the MACD shows sustained bearish momentum. The 20-day Bollinger jaw has narrowed, which indicates decreasing price volatility.

The price faces two resistance levels on the upside at $9,500 and $9,735. On the downside, there are two healthy support levels at $8,815.35 and $8,214.40.

ETH/USD daily chart

ETH/USD is consolidating in a triangle formation and above the red Ichimoku cloud as the price dropped from $200.10 to $198.20. The Elliott Oscillator shows 11 straight red sessions. The SMA 50 has already crossed above the SMA 200.

The bulls must defend the support levels at $187.65 and $172. On the upside, resistance lies at the SMA 20, $206.80 an $214.25

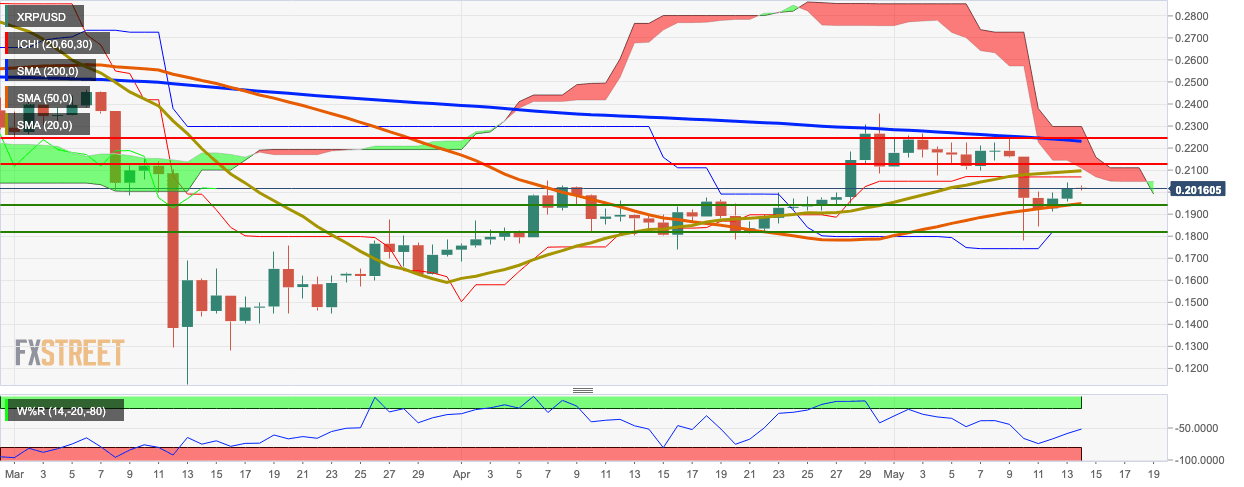

XRP/USD daily chart

XRP/USD fell from $0.2019 to $0.2007 as the red Ichimoku cloud lies ahead. The price is currently sandwiched between SMA 50 on the downside and SMA 20 on the upside. The Williams %R is trending around the neutral zone.

The price faces resistance at $0.213, SMA 200 and $0.2246. On the downside, the buyers need to defend support levels at SMA 50, $0.194 and $0.182.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.

-637250198305521785.png&w=1536&q=95)

-637250199095577885.png&w=1536&q=95)