Here is what you need to know on Wednesday, June 3, 2020.

Markets:

Bitcoin price is in shambles after the unsuccessful attempt to hold above $10,000. As reported on Tuesday, BTC/USD traded above this key resistance zone for the first time since the first week of May. It is, however, clear that the breakout to $10,410 was not fundamentally nor technically supported. Due to that, a reversal under $9,000 occurred during the American session on Tuesday. BTC/USD is trading at $9,446 following a 1.3% loss on the day. The ongoing retracement is likely to continue if support at $9,400 fails to hold.

Ethereum, on the other hand, has retreated from highs above $240 but managed to hold above $230. The price is teetering at $236 after sinking 0.45% on the day. With the trend being bullish, it shows that buying pressure is still present. The shrinking volatility talks of dwindling trading volume, which means that rapid price movement to the north is unlikely.

Ripple has surprisingly held above $0.20 despite the general retracement in the market. A loss of 0.14% has been encountered on the day. XRP is trading at $0.2029 at the time of writing. On the upside, an intraday high has been reached at $0.2034 while the focus is still on sustaining gains above $0.21 and $0.22.

Bitcoin may seem to be the most affected cryptocurrency in the market by the ongoing bearish wave but some of the worst-hit coins among the top 100 include Nexo (-22.74%), MadiSafeCoin (-10.83), Loopring (-5.39%), HyperCash (-5.49%), and IOST (-7.35%).

Chart of the day: BTC/USD daily

Market:

According to one of the most significant cryptocurrency pioneers in the world, Blockstream’s Adam Back, Bitcoin is set to explode into massive gains backed by the ongoing financial disaster. In his opinion, the ongoing printing of paper money for economic stimulation will push retail investors to Bitcoin. For this reason, Bitcoin is pointing towards $300,000 in the next five years.

It might not require additional institutional adoption because the current environment is causing more individuals to think about hedging,” Back said. “And retaining value when there’s a lot of money printing in the world.

Industry:

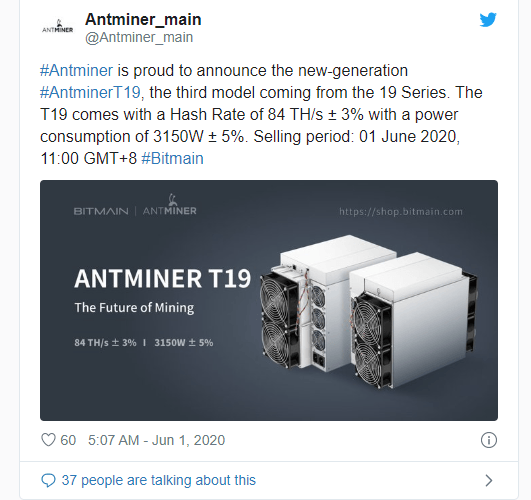

Bitmain, a leading cryptocurrency mining equipment manufacturer has this week launched a new T19 mining rig. The new rig boasts of improved software and efficiency. The move is as though to counter the negative publicity when miners claimed in May that the company was producing defective rigs with malfunctioning hardware. Miners said that the defective rigs were leading to great losses and negative user experience. The new Antiminer T19 started selling on June 21 while delivery will be made between now and early July.

Regulation:

Regulation experts are envisioning tougher times ahead for Bitcoin ATMs. The strict measures are likely to come into effect in a bid to eradicate money laundering. A report published by CipherTrace found that over 74% of Bitcoin ATM transactions from the United States made it to overseas cryptocurrency exchanges. The volume of these transactions has grown immensely since 2017. CipherTrace’s CTO John Jeffries while in an interview with Law360 said that tougher regulations will call for uniform regulatory requirements across countries.

Quote of the day:

“Bitcoin itself is primarily a financial tool. Ethereum is explicitly less financial in nature, but even there it remains a fact that a large fraction of applications that a blockchain legitimately makes better involve handling coins/tokens/money of some form.”(Ethereum co-founder Vitalik Buterin).

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Ripple update: XRP shows resilience in recent crypto market sell-off

Ripple's XRP is up 6% on Tuesday following a series of on-chain metrics, which reveals investors in the remittance-based token held onto their assets despite the wider crypto market sell-off last week.

Floki DAO floats liquidity provisioning for a Floki ETP in Europe

Floki DAO — the organization that manages the memecoin Floki — has proposed allocating a portion of its treasury to an asset manager in a bid to launch an exchange-traded product (ETP) in Europe, allowing institutional investors to gain exposure to the memecoin.

Six Bitcoin mutual funds to debut in Israel next week: Report

Six mutual funds tracking the price of bitcoin (BTC) will debut in Israel next week after the Israel Securities Authority (ISA) granted permission for the products, Calcalist reported on Wednesday.

Crypto Today: BTC hits new Trump-era low as Chainlink, HBAR and AAVE lead market recovery

The global cryptocurrency market cap shrank by $500 billion after the Federal Reserve's hawkish statements on December 17. Amid the market crash, Bitcoin price declined 7.2% last week, recording its first weekly timeframe loss since Donald Trump’s re-election.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637267641184466764.png)