Cryptocurrency Market News: Is another Bitcoin massacre brewing?

Here is what you need to know on Wednesday, June 17, 2020.

Markets:

The battle between the bulls and the bears is far from over, at least for this week’s trading. Digital assets in the market are back to swimming in the red waters after taking a breather on Tuesday. Profit-taking is likely the reason behind the lock-step trading across the board.

As for Bitcoin, the recovery above $9,500 hit a wall under $9,600. This paved the way for sellers to increase activity, forcing Bitcoin closer to the support at $9,400. An intraday low has been traded at $9,416.18, however, the prevailing bearish trend means that the selling activity is far from over. Besides, with the volatility on the roof, a downtrend could easily refresh the levels around $9,000. For now, defending $9,400 support is key for the next recovery move towards $10,000.

Read more: Bitcoin Price Prediction: BTC/USD reversal to $9,000 could confirm rally to $10,000

Ethereum is not very different from Bitcoin. In fact, it is among the biggest losers of the day after correcting from $235.39 (opening value) to $232 (prevailing value). The path of least resistance is downwards which means that if buyers do not defend $230 support, further declines to $225, and $220 could come into the picture.

Ripple is also dealing with an increase in the number of sellers especially after failing to break above the resistance at $0.1950. On the downside, support has been formed at $0.1900; an area that remains very vital to XRP’s recovery. The crypto asset is trading at $0.1915 after losing about 0.45% of its value on the day.

As aforementioned, the entire market is in the red. Among the top 100, the most affected cryptoassets include DigiByte (-8.55%), Zilliqa (-6.81%), and Horizen (-3.18%) among others. The cryptoassets that managed to outdo the selling pressure are ABBC Coin (23.98%), Unibright (9.61%), Divi (15.75%), NEXO (16.71%), Swingborg (16.71%), Flexacoin (27.97%) and Verge (11.58%).

Chart of the day: BTC/USD daily

-637279733516369325.png&w=1536&q=95)

Markets:

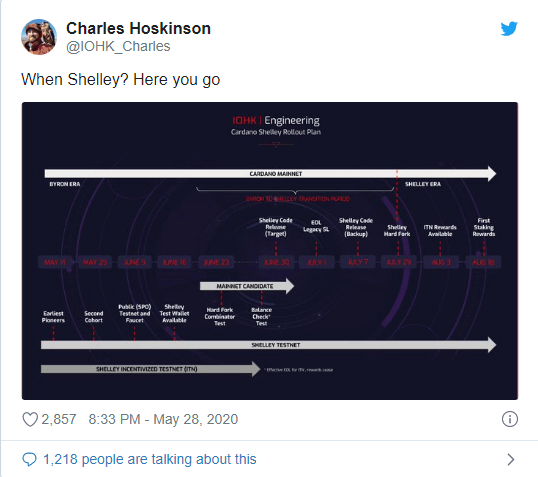

Cardano has continued to perform incredibly well in the last four weeks after the announcement that the long-awaited Shelly network upgrade was due in July. With the upgrade only two weeks from now, investors are positioning themselves for a possible rally above $0.1. Over the last four weeks, ADA has surged from $0.55 to $0.89 (June high). The weekend trading did not auger well for Cardano, resulting in losses to $0.70. However, recovery has been forthcoming with ADA/USD trading at $0.78 at the time of writing. The Shelly upgrade is set to commence on June 30 and will set the framework for ADA staking set to begin on August 18.

Industry:

A New York-based city asset manager, WisdomTree Trust is reported to have filed an exchange-traded fund (ETF) that would see it put up to 5% of its entire asset holdings into CME Group Bitcoin futures contracts. The information regarding the filing was found in documents belonging to the Securities and Exchange Commission (SEC) in the United States.

The SEC has in the past thwarted all attempts by various companies to launch a Bitcoin ETF. The regulator cites the size of the Bitcoin market, risks of market manipulation, custody of Bitcoin as well as lack of oversight as the reason behind the many rejections. However, if approved, the “WisdomTree Enhanced Commodity Strategy Fund” could get Bitcoin the recognition of a normalized investment. The crypto could also get exposure among the Wall Street giants as well as the commodity markets.

Regulation:

The firms working in crypto-related businesses in India are confident that a new ban on ownership, trading, and other crypto-related activities is unlikely. Their message comes after rumors erupted earlier this week that the country is working on anti-crypto regulations. Indian crypto-related businesses are still recovering after a two-year ban imposed against banks extending banking services to cryptocurrency firms.

The Economics Times was the first to publish an article citing an unnamed government official who said that a bill that was proposed back in July 2019 could be revived. The bill had proposed the outlawing of cryptocurrency ownership including jail times and fines for those found in violation. Firms such as WazirX say that such rumors are “overblown’ and “highly unlikely.”

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren