Cryptocurrency Market News: India is looking to ban Bitcoin yet again

Here is what you need to know on Thursday 6, August.

BTC/USD has awakened and it’s trading at $11,667 after a 4% breakout above the previous resistance levels on August 4 and 3. The next resistance level to beat is $12,000 psychological and $12,123, the high of 2020.

ETH/USD is on the verge of climbing above $400, however, bulls already got rejected once but ETH saw no bearish continuation.

XRP/USD is fighting to stay above $0.30 after creating a clear daily bull flag. Daily EMAs are still far behind the current price.

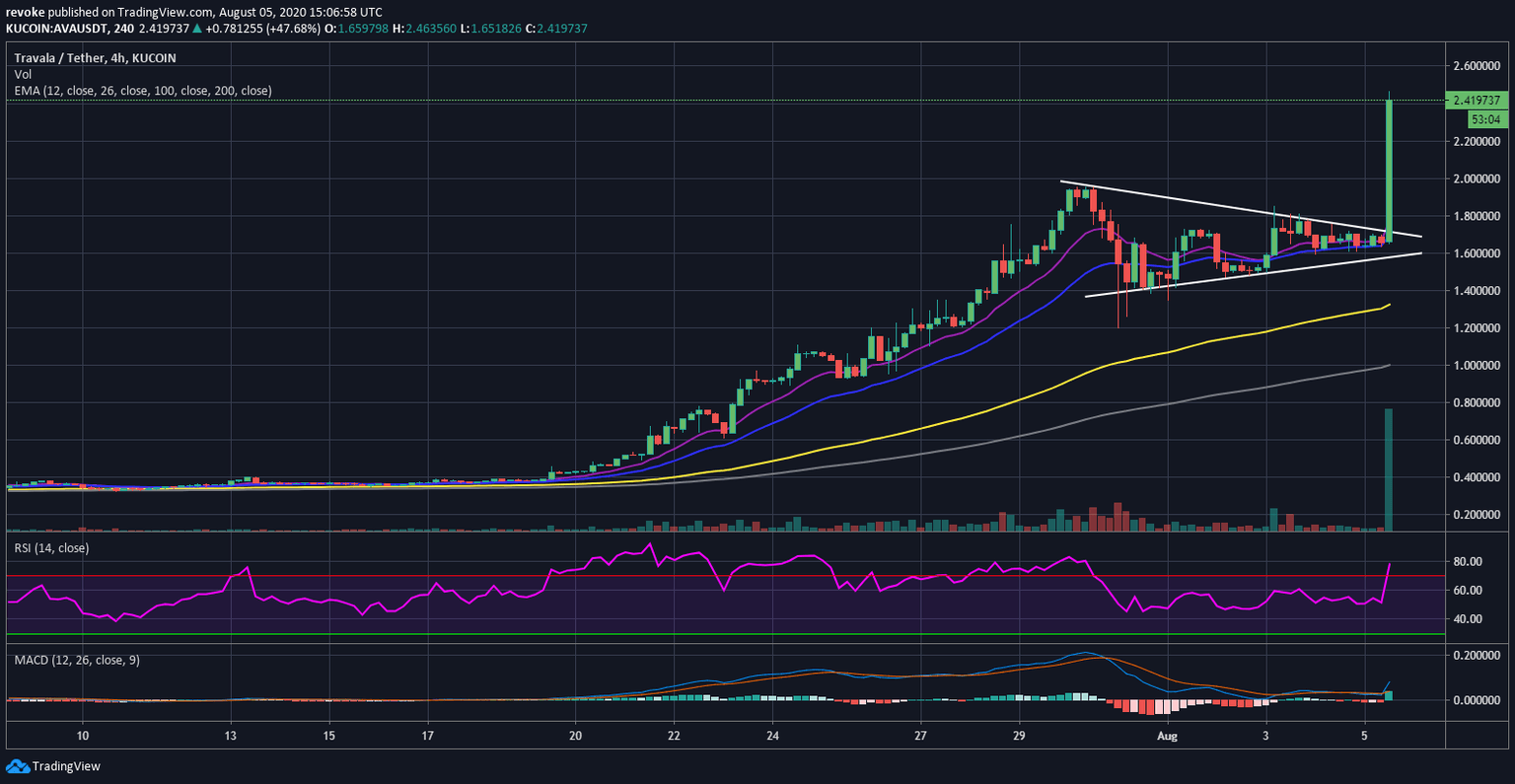

Travala.com is the biggest winner today after getting listed on Binance. The digital asset had a massive 50% price boost with increasing trading volume. Akropolis is also a huge gainer today with a 53% increase in value hitting $0.033. BORA, Aurora, and Bancor are other winners.

Chart of the day: AVA/USD 4-hour chart

Market

What first started as a rumor, it is now basically real. Indian courts lifted a ban on crypto recently, however, the government of India has been considering another law. According to a news article from MoneyControl, the government is planning to bring in a new law to ban the trade of cryptocurrencies.

There was a view in the government that banning it through a law would be more binding. It will clearly define the illegality of the trade. We have forwarded a note to related ministries for inter-ministerial discussions, a government official told Moneycontrol on condition of anonymity.

Industry

The cryptocurrency exchange INX is trying to launch an Initial Public Offering (IPO) in the U.S. The platform has already filed an F-1 Form, a securities registration for non-U.S. issuers. The offering is expected to launch before the end of 2020 with a price of $0.90 per token valuing the entire company at $117 million. If the sale is successful, INX would become the largest IPO of digital assets.

Investors will be able to buy the tokens using cryptocurrencies but also U.S. dollars. Either way, customers interested in the purchase of the token will need an Ethereum wallet address to participate.

Quote of the day

The long-standing arguments on whether to, or not to, enforce a crypto taxation laws or capital gains tax on cryptocurrency trading and transactions is glaringly coming to an end. It is believed that in order to legalize cryptocurrency as a legal tender, there would be need for documented cryptocurrency taxation by the government.

― Olawale Daniel

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.