Here's what you need to know on Friday

Markets:

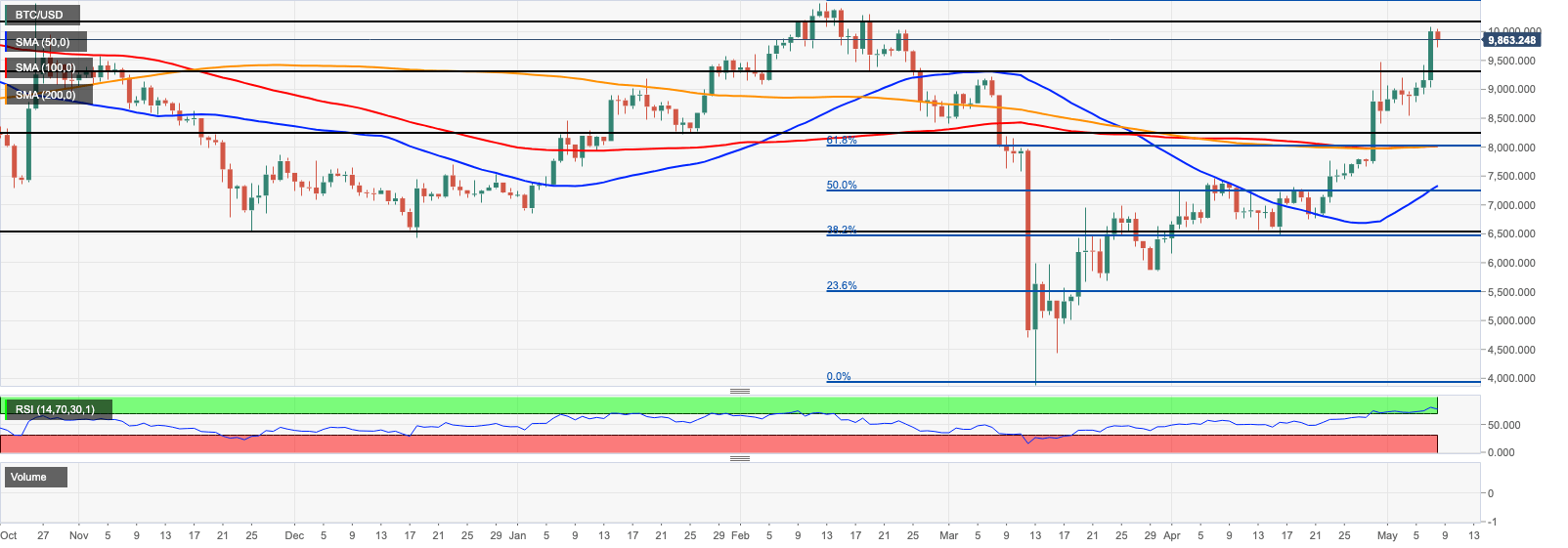

BTC/USD is changing hands at $9,880, having retreated from the intraday high of $10,047. The coin has lost 2% since the start of the day, though it is still 5% higher on a day-to-day basis. Now Bitcoin is trading within the strong short-term bullish bias amid high volatility.

At the time of writing, ETH/USD is changing hands at $208.80. The price tested a high of $216.93 during early Asian hours but reversed to the downside. The second-largest coin has lost 2% since the start of the day and gained 2% in the recent 24 hours. Now ETH is moving within a short-term bullish trend. The volatility is expanding.

XRP/USD is hovering at $0.2153, unchanged on a day-to-day basis and down 1.5% since the beginning of Friday. XRP’s recovery is still blocked by $0.2200. A sustainable move above this area is needed for the upside to gain traction. XRP/USD is trading within a bearish trend amid expanding volatility.

Among the 100 most important cryptocurrencies, Crypterium (CRPT) $0.6307 (+65%), ABBC Coin (ABBC) $0.1665 (+27.8%), and 0x (ZRX) $0.3120 (+24.3%)

The day's losers are, Numeraire (NMR) $29.70 (-8.9%), Chiliz (CHZ) $0.0099 (-8.3%), Nexo (NEXO) $0.1059 (-6.2%).

Chart of the day:

BTC/USD, daily chart

Market

The volatility is back on the market. Bitcoin jumped above $10,000 ahead of a technical event that is supposed to trigger a long-term rally. However, the digital asset is driven mostly by speculative sentiments and agitation, which may lead to a downside correction after the halving. Jehan Chu, a managing partner with blockchain investment and advisory firm Kenetic Capital, said:

Bitcoin trades sentiment-driven at its peaks and valleys, and the post-halving hangover is part of the normal price ebbs and flows on top of Bitcoin’s fundamental value.

Macro investor Paul Tudor Jones explained while he was buying Bitcoin. He said that he used cryptocurrency as a hedge against inflation amid excessive money-printing by global central banks. He also added that Bitcoin reminded him of the role gold played in the 1970s.

The best profit-maximizing strategy is to own the fastest horse. If I am forced to forecast, my bet is it will be Bitcoin.

Industry

Bitcoin is still way more popular in the darknet than a privacy-focused cryptocurrency Zcash, according to the research performed by Rand Corporation for Electric Coin Company. The researchers did not found evidence that Zcash was less popular among criminals than Bitcoin or Monero. They pointed out that users engaged in illicit activities might not understand the Zcash privacy features, that’s why they choose other coins.

Regulation

The Bank of Netherlands (De Nederlandsche Bank, DNB) said that all cryptocurrency service providers should be registered with the regulatory by May 18. The Dutch Senate voted the Implementation Act amending European Union’s fourth Anti-Money Laundering Directive (ALMD) on April 21. Now all companies that offer fiat-crypto conversion services or cryptocurrency custody services have two weeks to register with the DNB.

Telegram agreed to disclose the communications between the company and the participants of the ICO in 2018. The company filed an order of consent agreeing to submit the documentation requested by the Securities and Exchange Commission (SEC). The documents in question are related to communications about the distribution of Gram tokens during the initial coin offering (ICO) in 2018 and the related purchase agreements.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.