Here is what you need to know on Tuesday 11, August

BTC/USD is currently trading at $11,870 after climbing above $12,000 again and experiencing a $500 flash crash. Bitcoin has recovered quickly and it’s eying up $12K again.

ETH/USD continues fighting for the $400 level and consolidating on the daily chart. Bulls are happy to trade sideways even for another week.

XRP/USD has unfortunately lost the $0.30 level and is seeing a more pronounced consolidation.

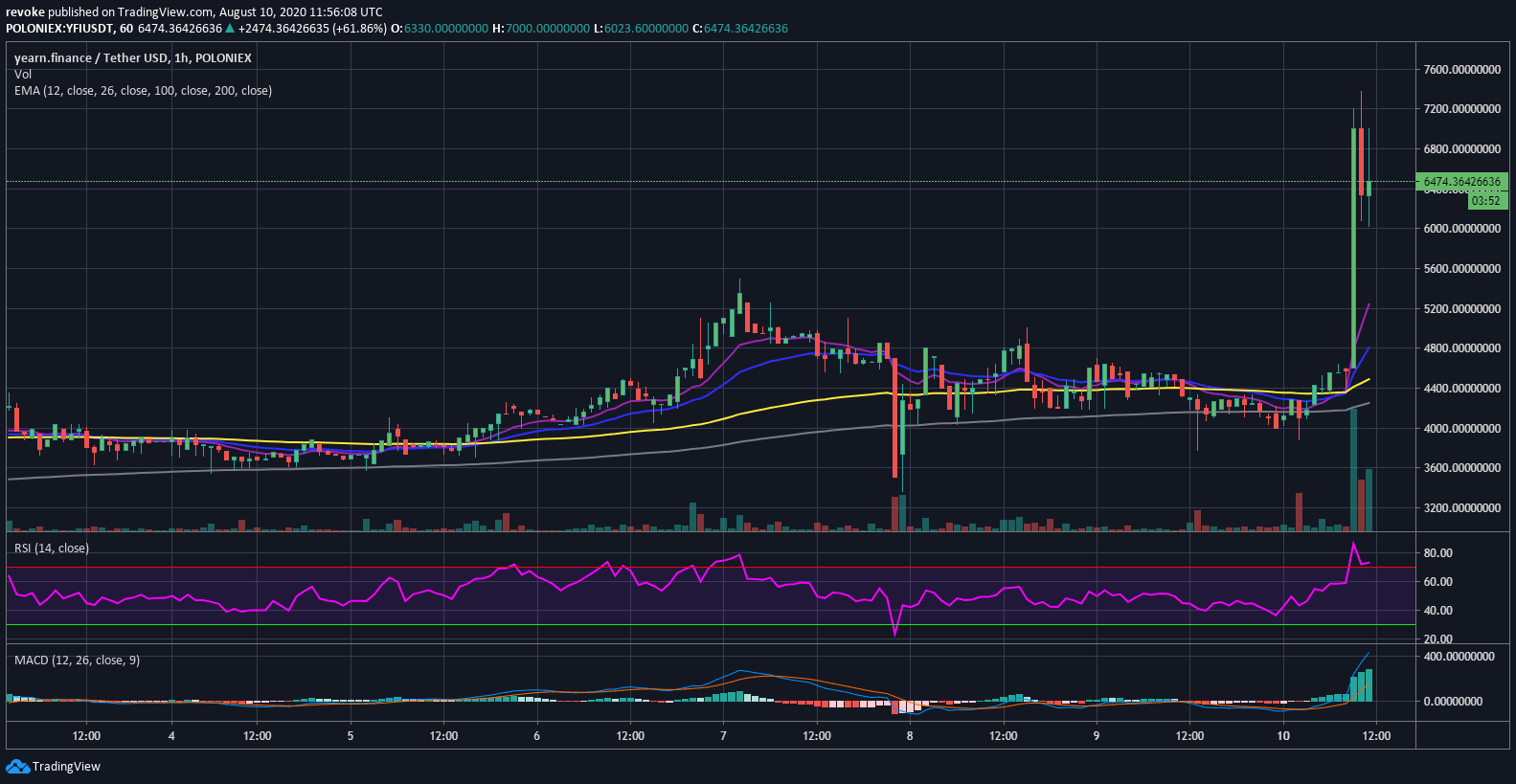

The biggest gainers today were Ankr with a 54% increase and Yearn.Finance with a 60% price surge after Binance announced it would list the digital asset. MainFrame, JUST, and IRISnet also had massive pumps today.

Chart of the day: Yearn.Finance 1-hour chart

Market

Bitcoin tested the $12,000 level again and had another flash crash, dropping $500 within seconds triggering bots to sell and longs to liquidate. The MACD is now close to a bearish cross on the daily chart while the positive sentiment is slowly slipping away.

Grayscale, the biggest Bitcoin trust fund has bought massive amounts of Bitcoin since the beginning of 2020. Today, the fund has released ads for the American national TV, although they didn’t mention anything about Bitcoin. Unfortunately, the ad has received a lot of criticism as it seems to be of bad quality and doesn’t clearly convey any message.

Our new commercial debuts TODAY... Trust us: AUDIO ON! #GoGrayscale pic.twitter.com/hPhUgp7HiY

— Grayscale (@Grayscale) August 10, 2020

Industry

According to a blog post, KB Kookmin, one of the biggest banks in South Korea, might be planning to launch crypto custody services that include Bitcoin. Jin Kang, the legal and compliance officer at hashed said:

On August 6, 2020, Hashed formed a strategic partnership with KB Kookmin Bank, Haechi Labs and Cumberland Korea to advance the emerging market for digital assets in South Korea. Their cooperation around fundamental technologies such as blockchain will entail managing and storing digital assets, advocating for optimal regulatory developments, and transforming the traditional financial sector.

Quote of the day

As the value goes up, heads start to swivel and skeptics begin to soften. Starting a new currency is easy, anyone can do it. The trick is getting people to accept it because it is their use that gives the “money” value.

– Adam B. Levine

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Cardano Price Forecast: Sign of robust bullish reversal emerges despite dwindling DeFi TVL volume

Cardano rebounds to test resistance at $0.69 as technical indicator flashes a buy signal. A minor increase in the derivative Open Interest to $831 million suggests growing trader interest in ADA.

Crypto Today: Bitcoin's downside risks escalate as BTC spot ETF outflows extend

The cryptocurrency market is consolidating losses after starting the week amid high volatility. Bitcoin attempted to steady the uptrend above $106,000 but lost steam, resulting in a reversal to $105,204 at the time of writing on Tuesday.

Bitcoin falls below $106,000 as risk-off sentiment persists

Bitcoin price faces rejection around its $106,406 resistance level on Tuesday, hinting at a potential correction ahead. Market sentiment sours as growing Israel-Gaza tensions weigh on riskier assets, such as BTC.

Coinbase asset roadmap adds Ethena, ENA targets $0.34 breakout before listing

Ethena records its fourth consecutive positive day, signaling increased bullish momentum. Coinbase announces the addition of Ethena to the asset roadmap, making it tradable on the platform soon.

Bitcoin: BTC dips as profit-taking surges, but institutional demand holds strong

Bitcoin (BTC) is stabilizing around $106,000 on Friday, following three consecutive days of correction that have resulted in a near 3% decline so far this week. The correction in BTC prices was further supported by the profit-taking activity of its holders, which has reached a three-month high.