Cryptocurrency Market News: Bitcoin decoupling from the S&P 500

Here is what you need to know on Thursday, July 16, 2020.

Markets:

Bitcoin is teetering slightly under $9,200 after correcting from $9,214.27 (intraday high). For several weeks, BTC/USD has stayed in consolidation. Analysts across the board believe that Bitcoin is on verge of a breakdown following the consolidation period. The price is trading above the 50-day EMA and is likely to lose ground, testing $8,500. BTC/USD could even extend the lower leg to $7,200 before a bounce occurs.

The Ethereum market is just as lethargic as the Bitcoin market. The price has even lost ground under $240 and is now trading at $237. As reported earlier, ETH/USD is facing strong resistance at $239. A breakout is expected to bring a rally into the picture owing to the positive sentiments within the Ethereum network.

Ripple continues to lose ground under the former pivotal level at $0.20. Support at $0.1950 has already been tested. The longer Ripple stays under $0.20, the stronger the bears become. On the downside, $0.19 is the rendezvous for the bears in the near term.

Although the market is gloomy and mainly painted in red, some cryptocurrencies are choosing to remain in the green such as Elrond as reported during the Asian session. SwissBorg has also corrected upwards by 12.48% in the last 24 hours. Another crypto among the top 100 doing relatively well is Reserve Rights.

Chart of the day: ETH/USD daily

Market:

Bitcoin price is likely to have decoupled from the stock market as its price continues to trade sideways. One factor that is becoming a topic of great interest is the emerging decentralized finance (DeFi) ecosystem. The ecosystem includes assets such as derivatives, payments as well as lending services. Over the last three months, prices of tokens in DeFi have rallied massively highlighting the possibility of traders shifting their attention from Bitcoin to the emerging market.

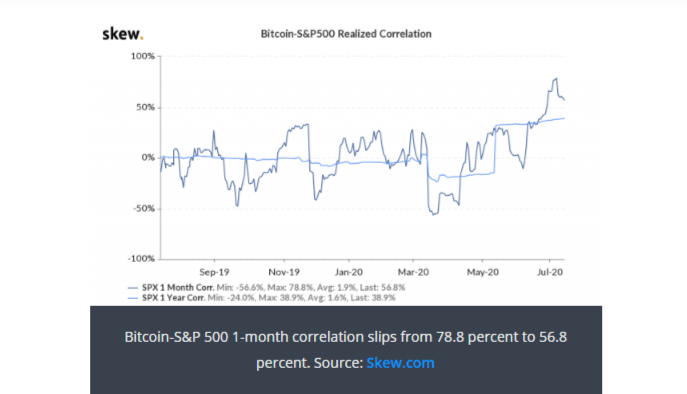

According to the correlation level between Bitcoin and S&P 500 in the last thirty days, the largest cryptocurrency is returning to its default nature (as a hedging asset). The chart below by the crypto analytic platform Skew shows the correlation tanking from 78.8% to 56.8%.

Industry:

A recent release from Samsung, one of the leading smartphone manufacturers, says that Stellar (XLM) would soon be part of its Blockchain Keystore. The Stellar Development Foundation confirmed the announcement. The users of Samsung Galaxy devices will now be able to store their Stellar wallet private keys on their phones. Moreover, developers within the Stellar network will be able to come up with applications designed for Galaxy users. According to the CEO of SDF, Denelle Dixon:

Stellar’s integration into the Samsung Blockchain Keystore is a significant step for our network and the incredible ecosystem of applications built on this platform. Samsung provides a key management solution that is user-friendly and drives greater adoption of blockchain technology. With this integration, we’ve opened up to a new network of users that can benefit from the combined innovation of Stellar and Samsung.

Regulation:

The Bank of Japan (BoJ), according to a local newspaper, Nikkei is seriously considering the adoption of a central bank digital currency (CBDC). The government is likely to include the CBDC in its 2020’s policy framework. Once included, the CBDC will become official government policy. The move comes after the BoJ decided it’s time to respond to the growing domestic need for electronic payments.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20(60)-637304781525825297.png&w=1536&q=95)