Cryptocurrency Market News: Bitcoin bears still trampling over the bulls

Here is what you need to know on Friday, June 19, 2020.

Markets:

Cryptocurrencies are likely to usher in the weekend session with declines if the current picture in the market does not change in the course of the sessions on Friday. The majority of cryptos are swimming in rough red waters. The Asian session was characterized by the same bearish sentiment especially for Bitcoin, Ethereum and Ripple.

BTC/USD spiraled further after $9,400 (Thursday’s support) was shattered. Attempts to keep the price above $9,300 failed miserably as the bearish leg was extended to $9,230.66 (intraday low). Support at $9,200 is expected to be significant enough to enact a change in the trend. Besides, Bitcoin is already trading above $9,300 after a minor recovery. Gains towards $10,000 will depend on one, the ability of the buyers to sustain gains above $9,400, and two, the volume supporting gains above the weekly resistance at $9,300.

Related content: Bitcoin Price Prediction: BTC/USD inverse H&S pattern, is a rally to $10,000 imminent? – Confluence Detector

Ethereum is trading 1.41% lower on the day following a rejection at $235. The price slipped under $230, testing support at $225. Ether is valued at $228 at the time of writing amid a building bearish momentum. Support at $225 is expected to continue being vital to the price and will be the stepping stone for price action above $230. It is essential that buyers realize that as long as ETH/USD remains under $240, selling activity will continue to force it towards $200. Therefore, the best move is to overcome the hurdle at $240 and focus on $250 and $280.

Related reading: Ethereum Price Forecast: ETH/USD slips under $230, will $225 hold?

Ripple price is also trading below the recent support at $0.19. The good thing is that weekly support at $0.1850 is still intact. XRP/USD currently exchanges hands at $0.1887 after suffering a 0.56% loss on the day. Buyers are now keen on reclaiming the position above $0.19 as it gives them a fighting chance for levels above $0.20.

While the losses are widespread across the market, there are selected digital assets that have managed to defy the selling pressure. For example, Nexo (up 11.20%), Flexacoin (up 24.72%), Hyperion (up 11.89%), Aave (up 23.78%) and Augur (up 7.09%). The coins that are doing badly in the last 24 hours include Verge (-9.43%), Seele-N (-17.67%), and Unibright (-7.33%).

Chart of the day: BTC/USD hourly

-637281450930354354.png&w=1536&q=95)

Market:

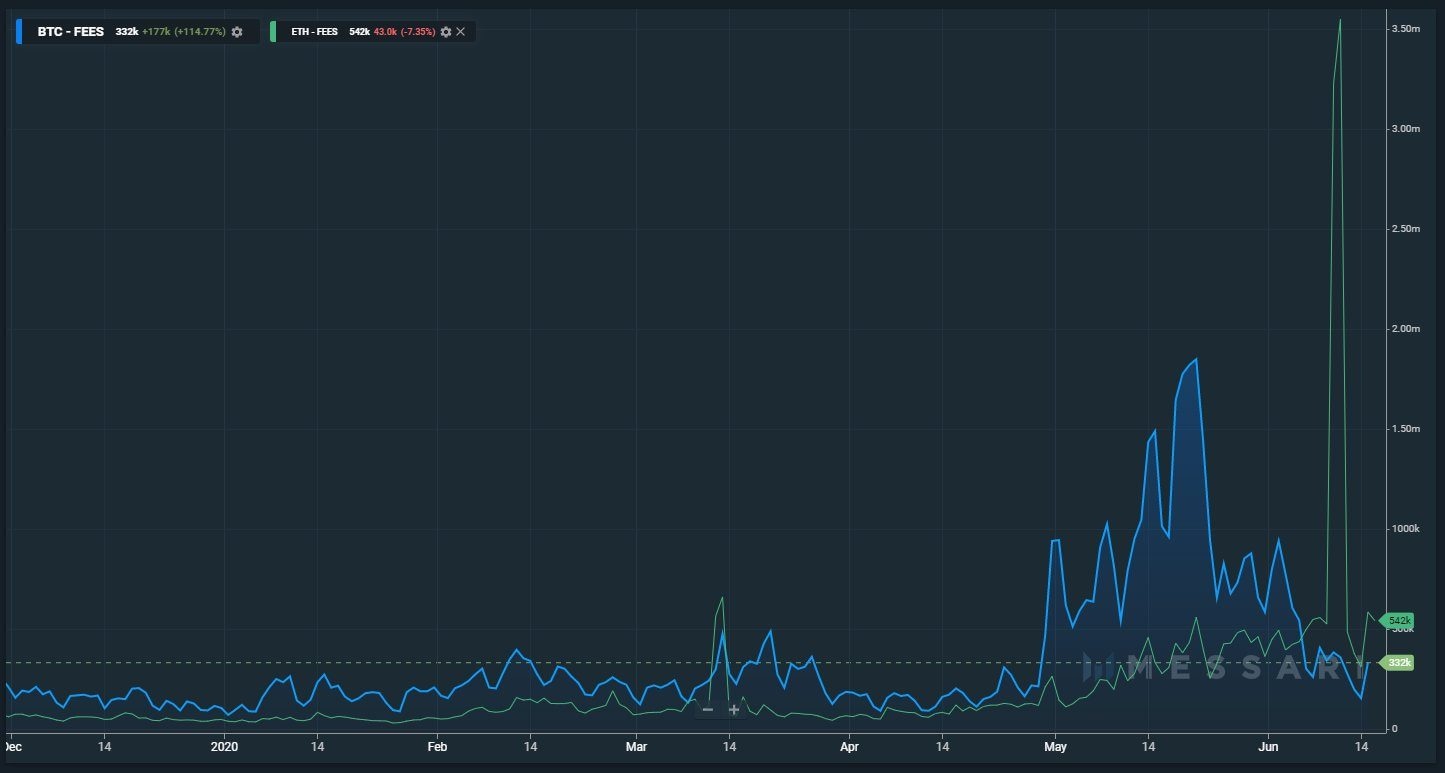

Ethereum transaction fees continue to surge, even surpassing those of the leading cryptocurrency, Bitcoin. According to Ryan Watkins, a Research Analyst at MessariCrypto, the “last time this happened was during mid-2018 when the controversial and now-defunct exchange, Fcoin, was clogging Ethereum block space.” Watkins reckons that the difference between then and now is that “today’s fee pressure is much more fundamentally driven.” In other words, there is “real economic activity” going on within the Ethereum network.

Industry:

Ripple, Brave and Huobi, alongside other 40 firms, are reported to have entered into a coalition referred to as the Open Payment Coalition. The organization is expected to develop and release an instant payment network PayID across the world. It is projected that the new payment platform will reach over 100 million consumers, giving them an opportunity to send and receive funds from anywhere in the world.

Like PayPal, users will only need to have an email address or even a phone number that has been linked to their bank accounts to send and receive money instantly, voiding the use of bank account numbers, fund transfer codes and SWIFT IDs. According to Caroline Bowler, the CEO of BTC Markets:

PayID is a crucial next-step in infrastructure that will bring ease of payments to an international audience.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren