- In the past 24 hours, XRP price dropped by more than 50%.

- The entire market lost around $50 billion as it seems XRP is dragging it down.

XRP was trading as high as $0.45 in the past 24 hours but has dropped to a low of $0.212, a massive 50% dive that seems to have no end. Initially, it seems that it had basically no effect on the market, however, in the end, Bitcoin and others did feel the dive.

Although Bitcoin is only down by 4%, other cryptocurrencies like Ethereum are down by 10% or more. Some of the worst performers include EOS, down almost 30%, and the newly listed TheGraph (GRT) which was one of the best performing coins not long ago.

Is it the beginning of a massive rally or the end?

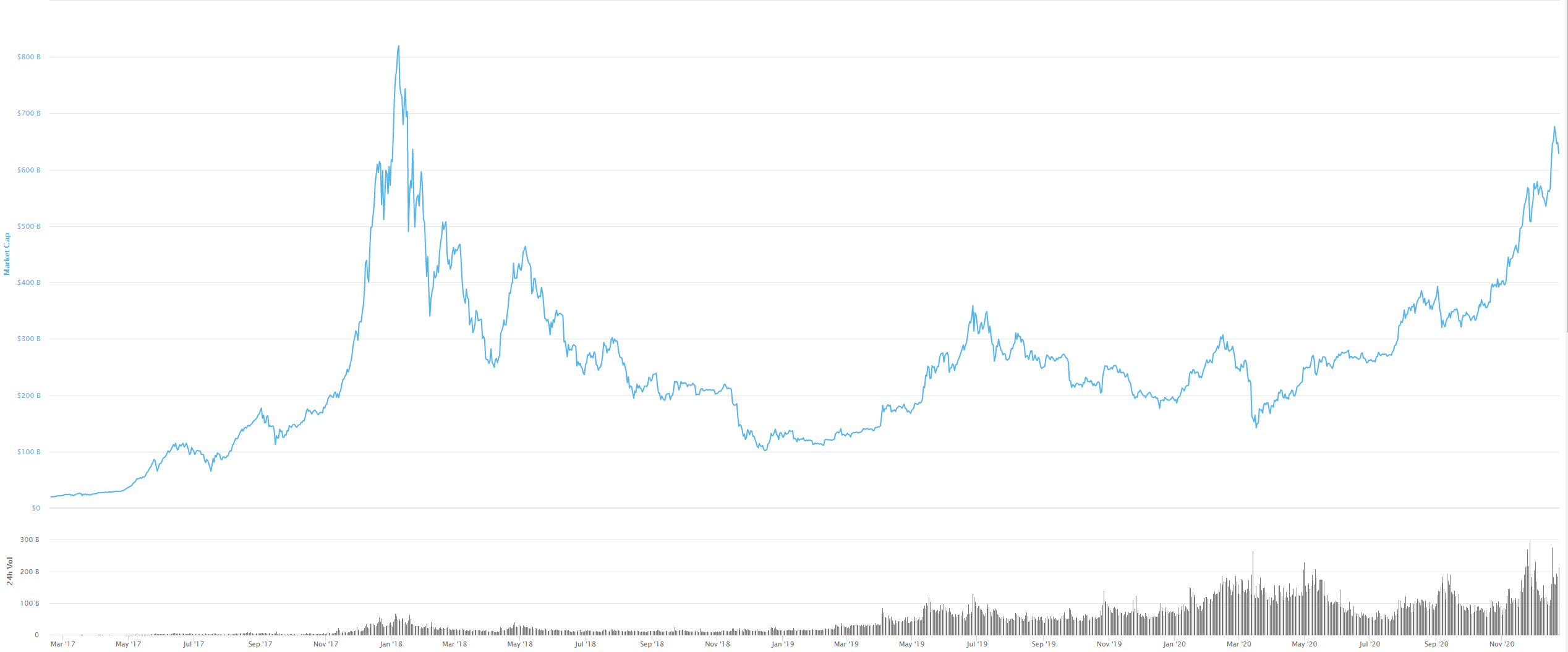

The all-time high of the total market capitalization of crypto was $811 billion on January 6, 2018. The 2020 peak was around $680 billion, despite Bitcoin hitting a new all-time high above $24,000.

Total Market Capitalization chart

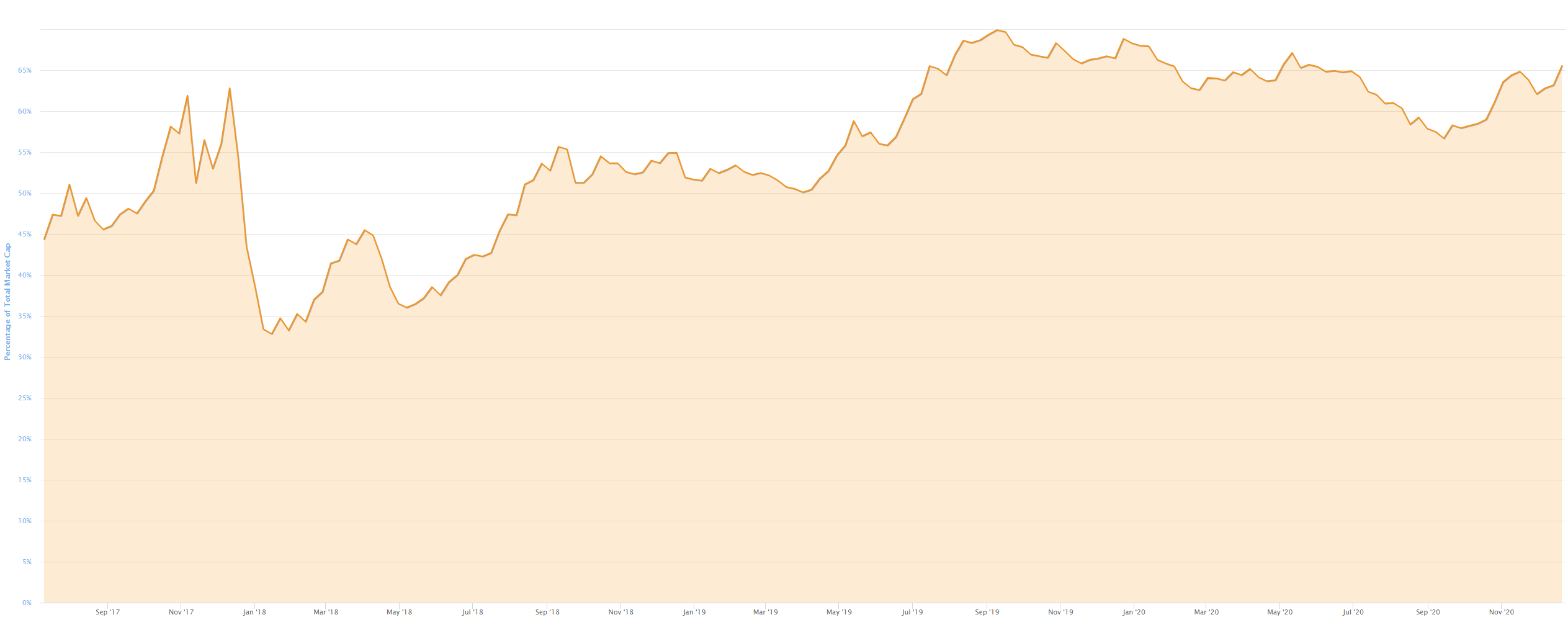

This begs the question, is this the beginning of the altcoin rally? In 2017, Bitcoin had a massive rally towards $20,000 gaining a lot of market dominance like it’s doing now, sitting at 69%. It was only after Bitcoin started consolidating that altcoins began to rally. At one point, Ethereum was significantly close to beat BTC in terms of market capitalization.

Bitcoin Dominance chart

Bitcoin’s dominance is actually higher than it was at its peak in December 2017 at 62.8%. As long as Bitcoin remains in control, altcoins will most likely not see any significant gains

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

Cardano Price Forecast: ADA bulls target double-digit gains as bullish bets increase among traders

Cardano (ADA) price hovers around $0.74 at the time of writing on Thursday after a recovery of over 4% so far this week. On-chain data hints at a bullish picture as ADA’s stablecoin market cap rises while its bullish bets increase among traders.

GameStop's plan to issue $1.3 billion convertible notes to buy Bitcoin could boost crypto market and meme coins

Video game retailer GameStop announced on Wednesday that it plans to issue senior convertible note offerings worth $1.3 billion. The company aims to use part of the proceeds from the offerings to buy Bitcoin.

Stablecoin mania kicks off as Wyoming and Fidelity join the race

According to Governor Mark Gordon, the state of Wyoming has joined the race for a stablecoin, following plans to launch WYST, a US Dollar-backed token in July.

Toncoin traders target $10B valuation as Elon Musk integrates Grok AI into Telegram

Toncoin price rose 3% on Wednesday despite crypto market inflows subsiding after a two-day rally.

Bitcoin: BTC stabilizes around $84,000 despite US SEC regularity clarity and Fed rate stability

Bitcoin price stabilizes around $84,000 at the time of writing on Friday after recovering nearly 2% so far this week. The recent announcement by the US SEC that Proof-of-Work mining rewards are not securities could boost BTC investors' confidence.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.