Cryptocurrencies turning up, bouncing off supports

Cryptocurrencies are in a positive mood today with Ethereum (+3.1%) surpassing the $175 key level and Bitcoin (+1.99%) moving above $7,900. The leaders today areTezos(+6.62%), Monero (+6.81%), DASH(+5.81%) and Z-Cash(+5.53%). The Ethereum-based tokens are also up, with LINK( +4.34$) leading the advances of top cap projects, and BHT(+17%), DATA(+19%) and UCT (30%) presenting strong gains.

Fig 1 - 24H Crypto Sector HeatMap

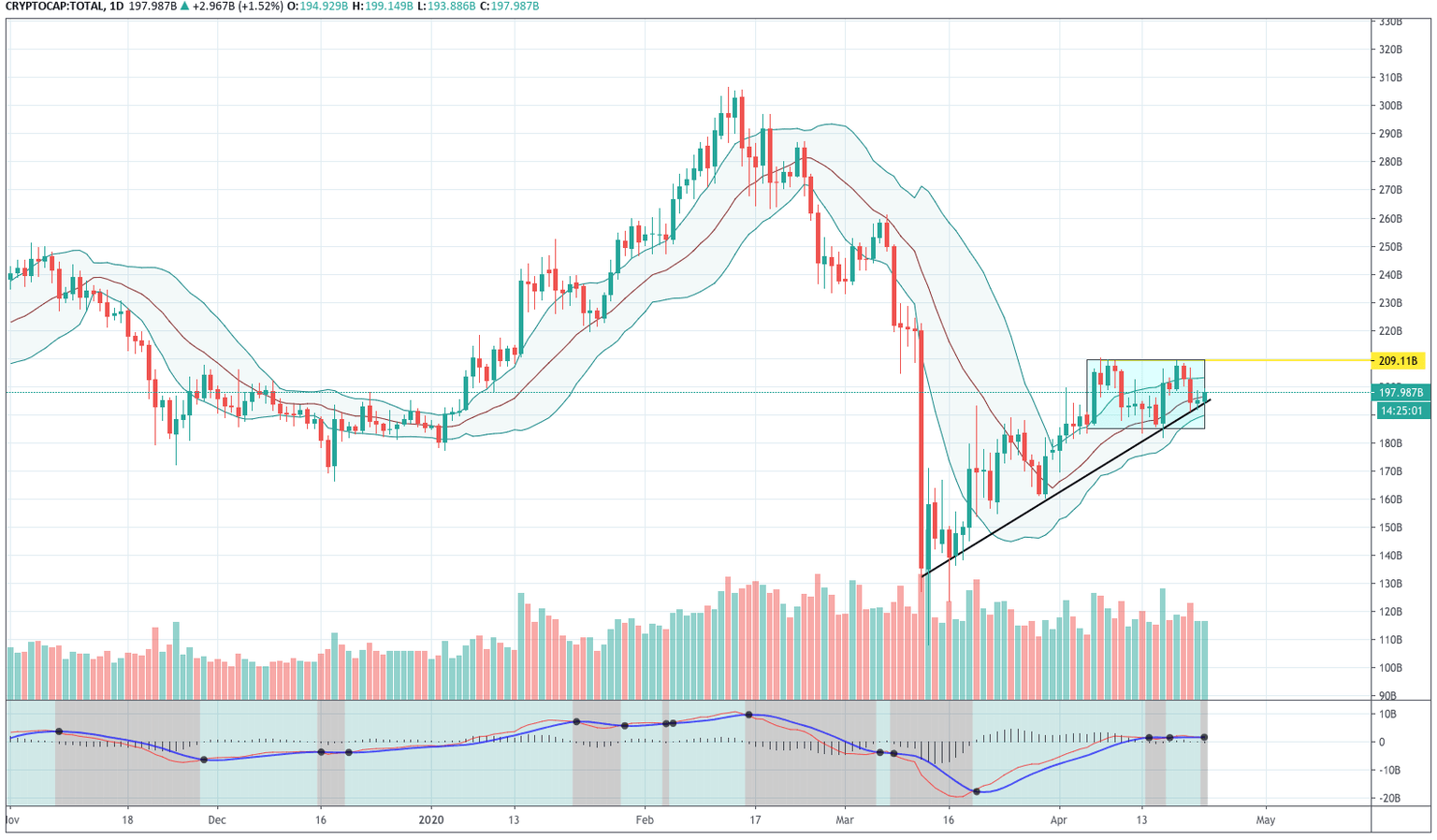

The total market curve shows the crypto sector still is respecting the upward trendline that began just after the massive March's selloff. The last action has created a double top, but as long as the trendline is kept, it may evolve as an ascending triangle.

The current market cap value is $197.98 billion, $2.967 billion (+1.52%) higher than yesterday's value. The traded volume dropped by 26.53 percent and was $34 billion, as the dominance of Bitcoin is relatively stable at 63.77 percent.

Fig 2 - Crypto Total Market Daily Chart

Hot News

China began the trials for its Sovereign Digital Yuan. Digital Currency Research Institute of the People's Bank of China, the team in charge of developing the digital yuan, has confirmed that the pilot plan has been approved in four cities. According to the South China Morning Post, the first look at the digital currency emerged on Wednesday with a glimpse of a screenshot that was leaked online. For now, the trials will take place in closed environments, and with no impact ontheinvolvedinstitutions.

The Dutch Central Bank is eager to play a key role in the development of a CDBC Euro. In anarticleposted on Tuesday, the bank states that the use of physical money is declining in the Netherlands, so people are using less physical currency to buy goods. Thus, they conclude that maybe the central banks should provide " a new type of money that is better attuned to the needs of citizens and firms." They also stated that if the ECB were to decide a test of such a monetary system, they would be "ready to play a leading role."

Technical Analysis - Bitcoin

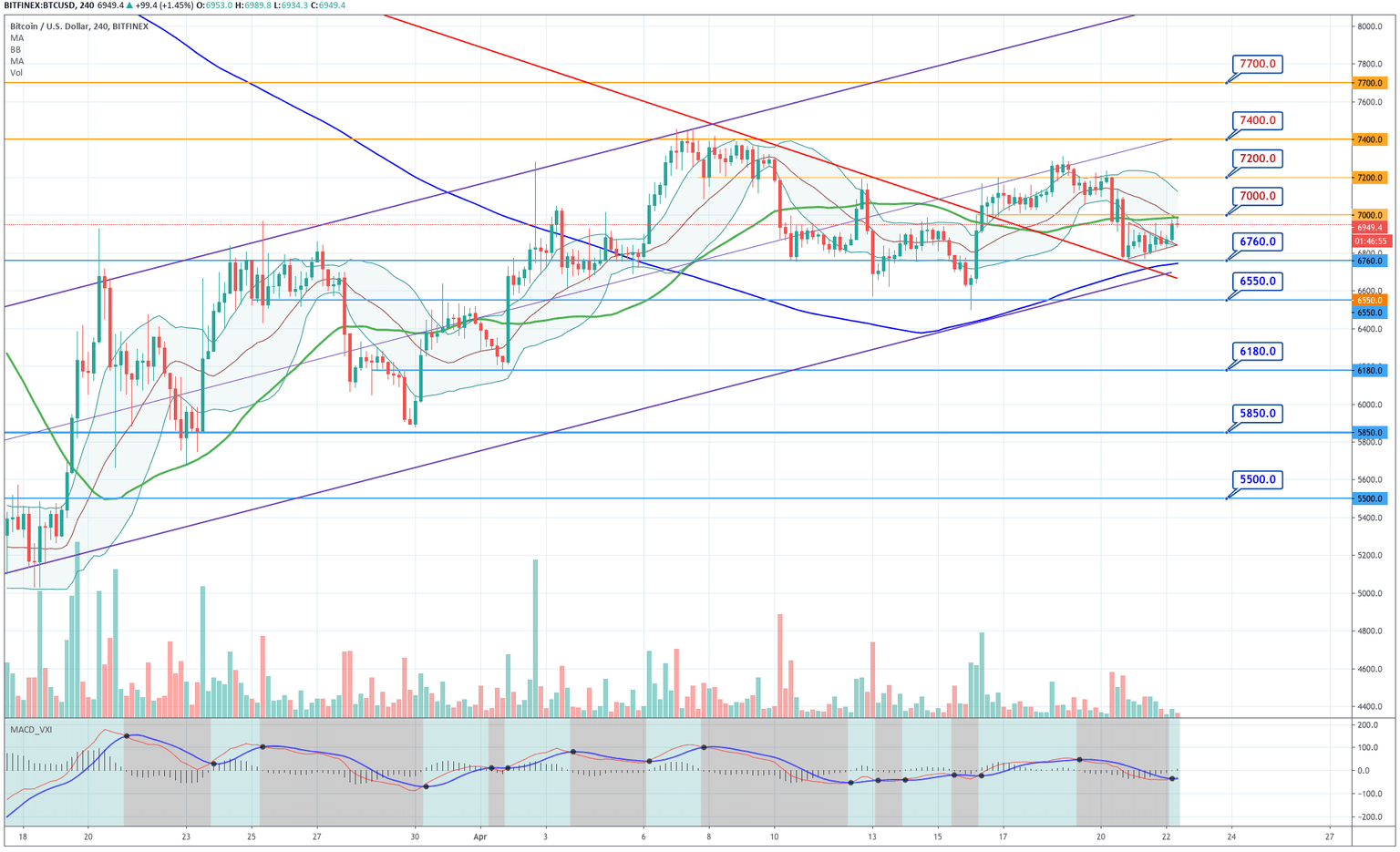

Fig 3 - Bitcoin 4H Chart

Bitcoin has broken the triangular consolidation zone to the upside, as the MACD has made a bullish crossover. The price has moved to touch the confluence of 50- and 20-period SMA. The price is still on the lower side of the Bollinger Bands; so, we need a confirmation of this potential bullish reversal. A close above $7,000 would be a good confirmation, as it will cross over both 20- and 50-SMA levels as well, and drive the price to the upper side of the bands.

Standard Pivot Levels

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

6,653 |

6,982 |

7,462 |

|

6,173 |

7,790 | |

|

5,844 |

8,270 |

Ethereum

Fig 4 - Ethereum 4H Chart

Ethereum has also crossed the triangular consolidation structure to the upside. The price also pierced and closed above the $175 level. We see also that the 50-SMA curve has held the price. Also, the MACD is close to making a bullish crossover. We see that ETH is moving inside an upward channel, and the recent move has made a higher low. If this reversal is confirmed by a break of the recent high ($176), bulls may get in as the $195 target offers a good reward-to-risk factor. A break below $170 would deny the reversal.

Standard Pivot Levels

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

155.00 |

172.00 |

197 |

|

131.00 |

214 | |

|

114.00 |

239 |

Ripple

Fig 5 - Ripple 4H Chart

Ripple has been retracing from the bottom of the slightly descending linear regression channel, and it has stopped near the mid-Bollinger line, close to the $0.187 level, and also to the 50-period SMA (green curve). At the same time, the MACD made a bullish crossover. Thus, thetechnicalhints are mixed. But taking into account that Ripple is moving in an almost horizontal channel, we consider that this is a reversal. So that the price could be making a new leg up to the top of this channel at about $0.195.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

0.1761 |

0.1868 |

0.1998 |

|

0.1630 |

0.2104 | |

|

0.1524 |

0.2235 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and