Cryptocurrencies surged, Bitcoin Above $6K

The crypto sector soared yesterday with strength after breaking their resistance levels. Bitcoin(+15%), Etherem(+17%), and, particularly, Bitcoin SV(+34%) moved extremely bullish, but most of the sector shrug off the past losses and finally buyers came in to push them up in a wave of optimism. Also, Ethereum-based tokens behaved as the rest of the crypto market, with LINK(+15.94%), MKR(+24.69%), and HEDG(+36.47%) leading the sector.

This move is reflected in the sector's market cap, with an increment in the capitalization of 15.93 percent that puts it at $175.614 billion. That was achieved with a 50.5 percent volume increment, as 59.756 billion was traded in the last 24 hours. The dominance of Bitcoin is virtually unchanged at 64.89 percent.

Hot News

Kozo Yamamoto, Member of the House of Representatives and former official at the Japanese Ministry of Finance, is strongly arguing in favor of a Digital Yen. He contends that a future without a digital yen could mean people would use other digital currencies and forget the yen; thus, Japan would lose its monetary sovereignty.

In an official statement, the European Central bank announced its $750 billion Pandemic Emergency Purchase Programme (PEPP). It is aimed at the public and private sector to counter the economic effects of the pandemic. The purchases will take place until the end of 2020.

Institutional traders created Bitcoin's price drop. That is the conclusion of a chainlink analysis that stated that about seventy percent of the traded volume on exchanges during the dip due to institutional traders.

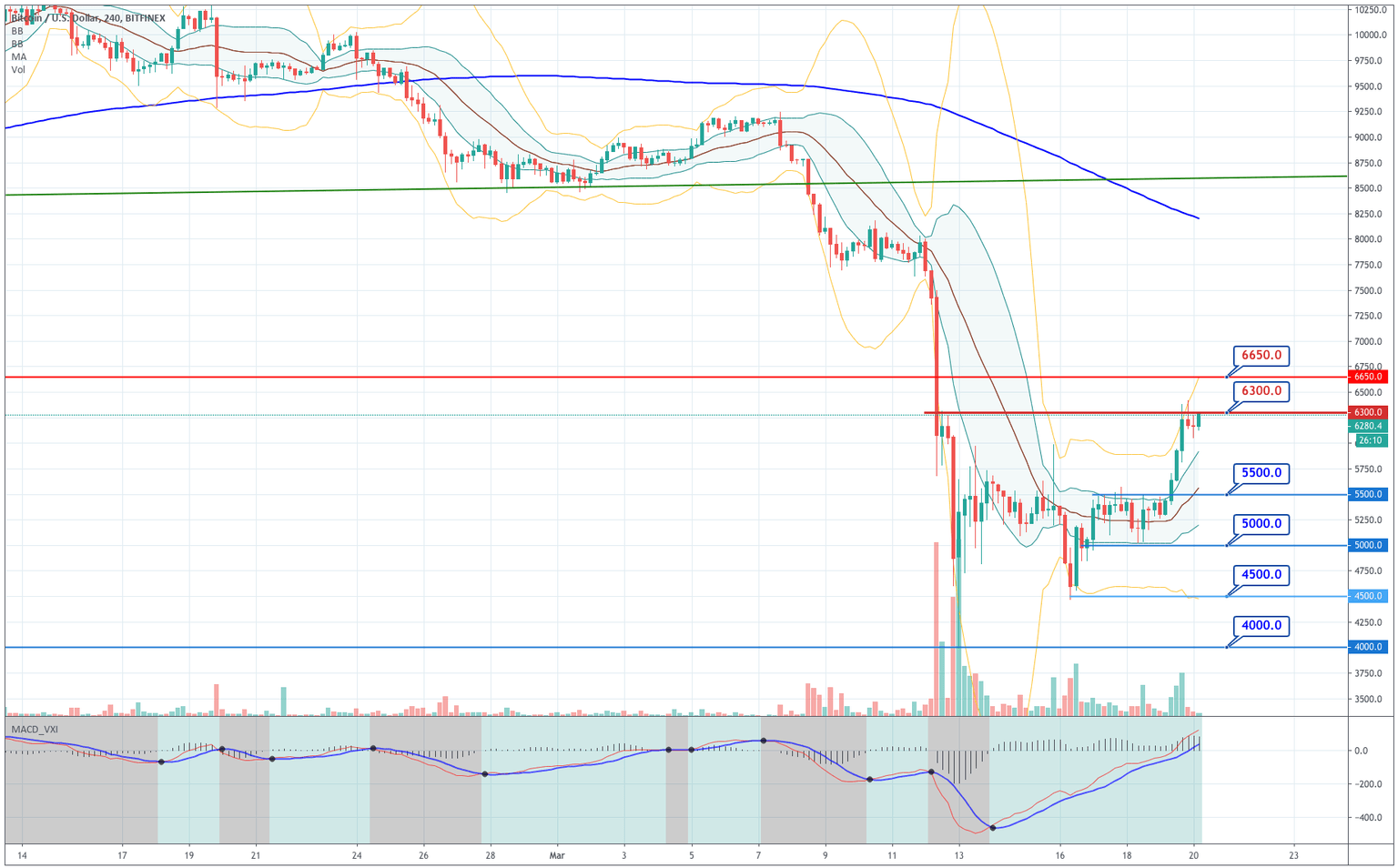

Technical Analysis: Bitcoin

Bitcoin moved decisively up after breaking the $5,500 resistance level. Bitcoin's price moved with increasing volume past its +1SD Bollinger line and continue ascending to finally touch its +2SD line. That shows the strength of the bullish move. Currently is moving near our yesterday's target of $6,300 and is making a consolidation figure, its price stepping out of oversold levels. The current bias is bullish, and a continuation to $6,650 is likely.

|

Support |

Pivot Point |

Resistance |

|

5,500 |

5,860

|

6,300 |

|

5,000 |

6,650 | |

|

4,500 |

7,000 |

Ethereum

Ethereum reached our target of $136 and is still moving actively. The price is above its +1SD Bollinger line as the MACD continues showing upward bias. The price has just broken the $136 level and seems headed towards $150.

|

Support |

Pivot Point |

Resistance |

|

123 |

136

|

149 |

|

110 |

158 | |

|

100 |

169 |

Ripple

Ripple is following the crypto market flow, although with less volume and strength. XRP's price has broken de descending trendline and the $0.15 resistance level to move up to the 0.17 level, the suggested target in our yesterday's market brief. The price has been rejected there and is not in its second attempt to break it. The price moves above its +1SD line, and the MACD is also moving bullishly. Therefore, as the overall market is filled with optimism, it is likely this asset continues ascending to its next target of 0.186.

|

Support |

Pivot Point |

Resistance |

|

0.1500 |

0.1600

|

0.1700 |

|

0.0140 |

0.1860 | |

|

0.1300 |

0.3000 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and