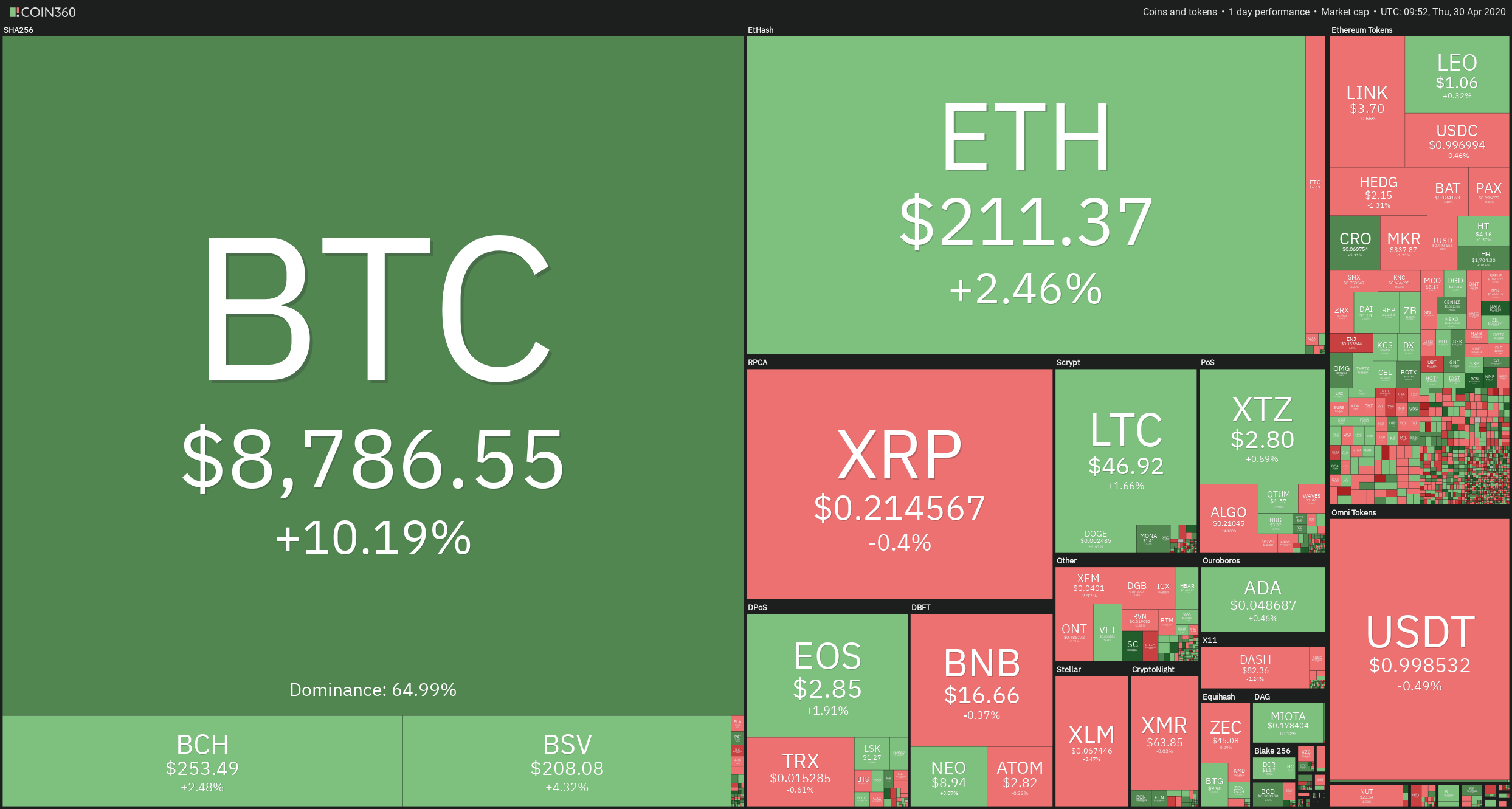

Cryptocurrencies are finally retracing in the last hours, after a strong rally led by Bitcoin (+10.2%) that made a 20 percent move at its top, which led it to achieve the $9,450 level. Also, Ethereum(+2.64%), Bitcoin Cash (+2.48%), Bitcoin SV 8+4.32%), Ripple (-0.4%), and Litecoin (+1.66%) followed the movement, although right now are suffering the selling action of profit-takers. In the Ethereum token sector, OMG (+11%) THR( +10.02%) and CRO (+5.21%) lead the gains among the main tokens.

Fig 1 - 24H Crypto Sector Heat Map

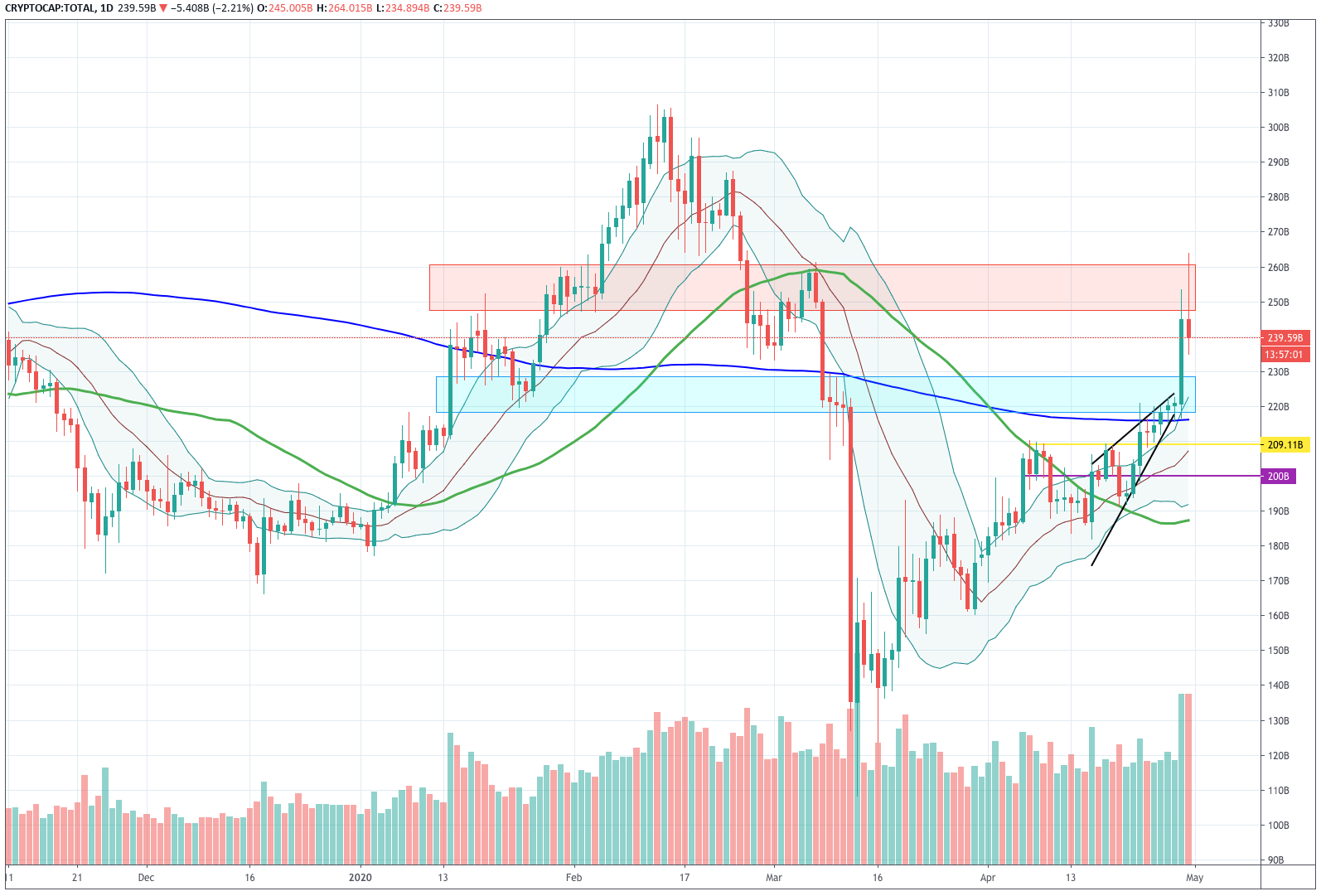

After this bullish move, the total market cap went as high as $264 billion, although, currently, it is at $241 billion, as it tries to consolidate after the bounce off the topping area. The traded volume in the last 24 hours was quite high, at $85.540 billion, a 145% increment from the previous 24H figure. The Bitcoin dominance went up almost one point and currently is 64.99%.

Fig 2 - 24H Crypto Total Market Daily Chart

Hot News

-

These are the headlines of the current news related to the sector.

-

Federal Reserve Chair Says "We Won't Run Out of Money," as Bitcoin gains 20% in 24 Hours.

-

Bitcoin Doubles Gold's YTD Rate of Return in 1 Day as Gains Top 27%.

-

Italian Town Creates New Currency to Cope With COVID-19.

-

Alibaba Patents Blockchain System That Spots Music Copycats.

-

Telegram delays the launch of its blockchain by one more year and is ready to return investor's money.

-

160 Million USDT Tokens were Minted During Bitcoin's Rise to $9K.

-

Swiss-based Capital Markets and Technology Association Issues New Common Standards for Crypto Custody.

-

CZ: Charity and Stablecoins Drive Meaningful Crypto Adoption.

-

BTC Tops $9,000, Recovery Leaves Stock Market in the Dust.

-

Chinese tech-giant Tencent launches blockchain accelerator.

Technical Analysis - Bitcoin

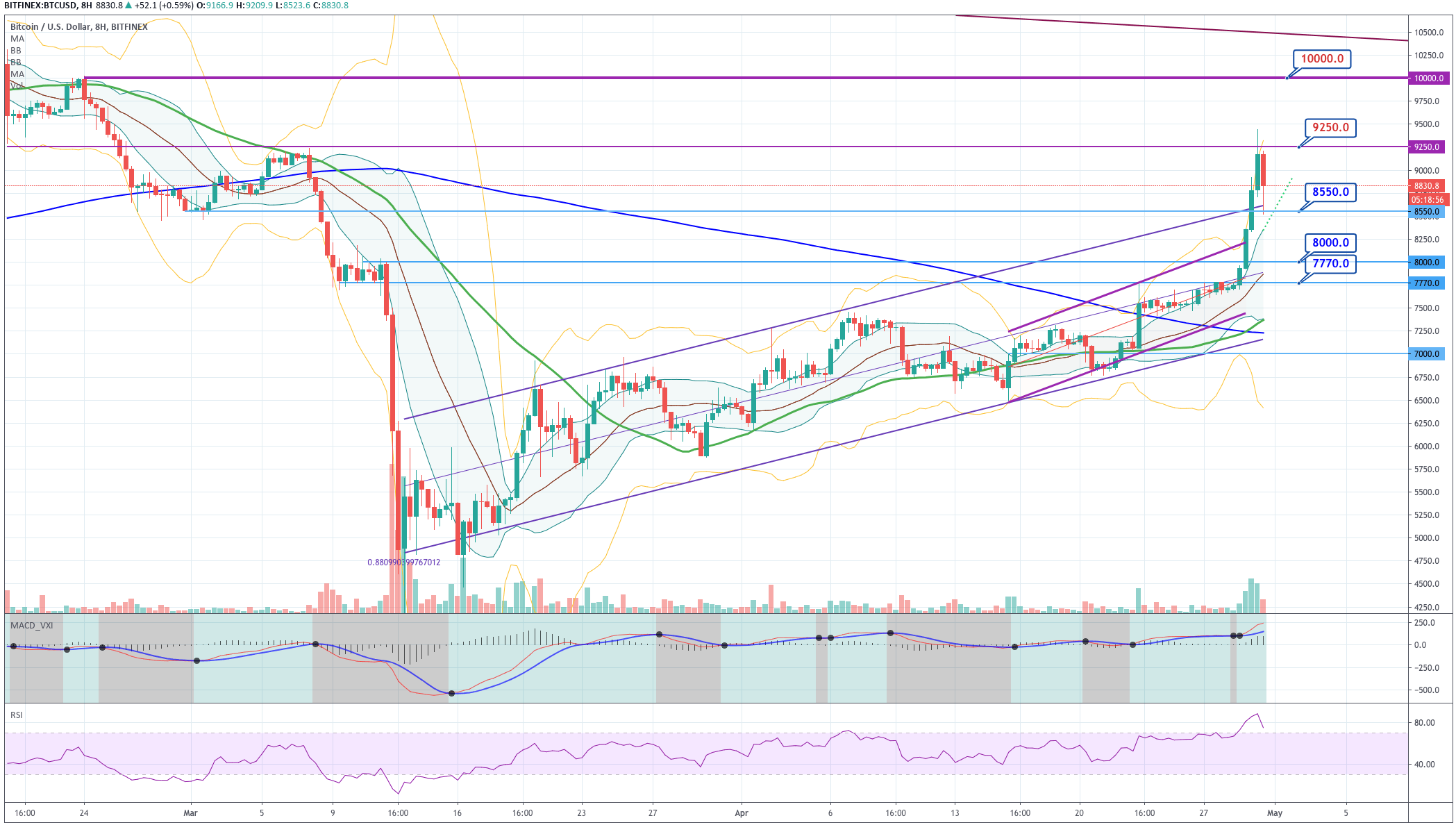

Fig 3 - Bitcoin 8H Chart

Bitcoin's bullishness created a 24H 20% movement that brought the digital asset to its top at $9,442, its best top since February 25. After this incredible move, the sellers and profit takers came in and drove the price below the 9k. On the technical side, we see on the chart that the price moved past its +3 SD Bollinger line (amber) before retreating. Now, it is about two standard deviations from the Bollinger mean. We also see the RSI descending from the 90 level, but still in the overbought area. We conclude that the trend is bullish, but the asset is making a consolidation move before continuing its ascent.

Standard Pivot Levels

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

7,052 |

7,410 |

8,060 |

|

6,405 |

8,420 |

|

|

6,040 |

9,065 |

Ethereum

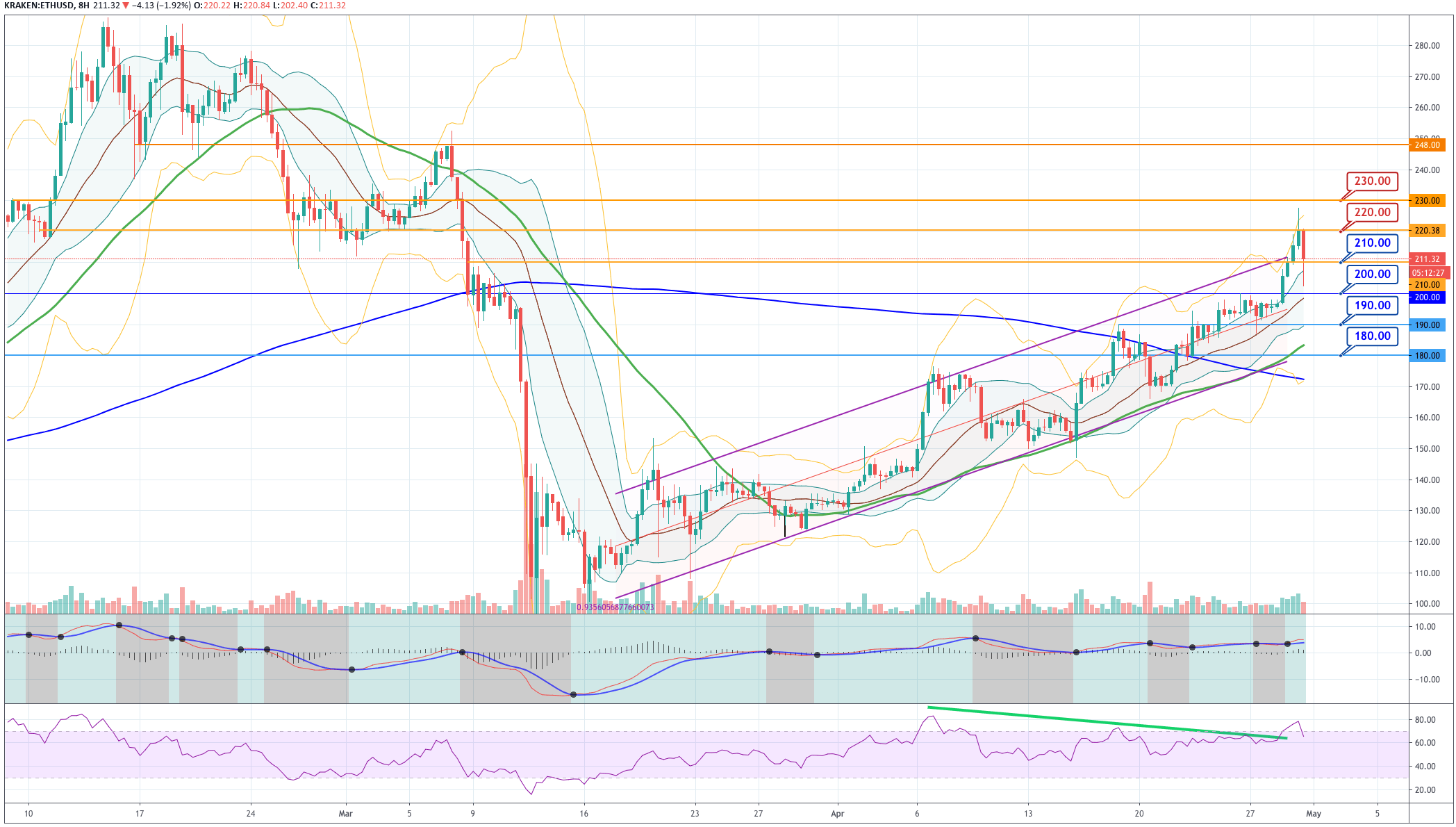

Fig 4 - Ethereum 8H Chart

Ethereum also made a strong upward movement that carried its price beyond the +2 standard deviation edge of its linear regression channel in which it was advancing. The price was halted near the $227 level, as the RSI went into overbought territory, and the price exceeded the +3SD line ( amber). As is the case of Bitcoin, Ethereum's underlying trend continues to be bullish, but this overextended move needs to be digested by investors and traders. Thus, profit-taking and short position orders tend to create a consolidation leg. A break above $220 will surely attract more buyers, and we see also that near $ 200 buyers came in and push the price upwards.

Standard Pivot Levels

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

176.5 |

188 |

210 |

|

155 |

222 |

|

|

143 |

243 |

Ripple

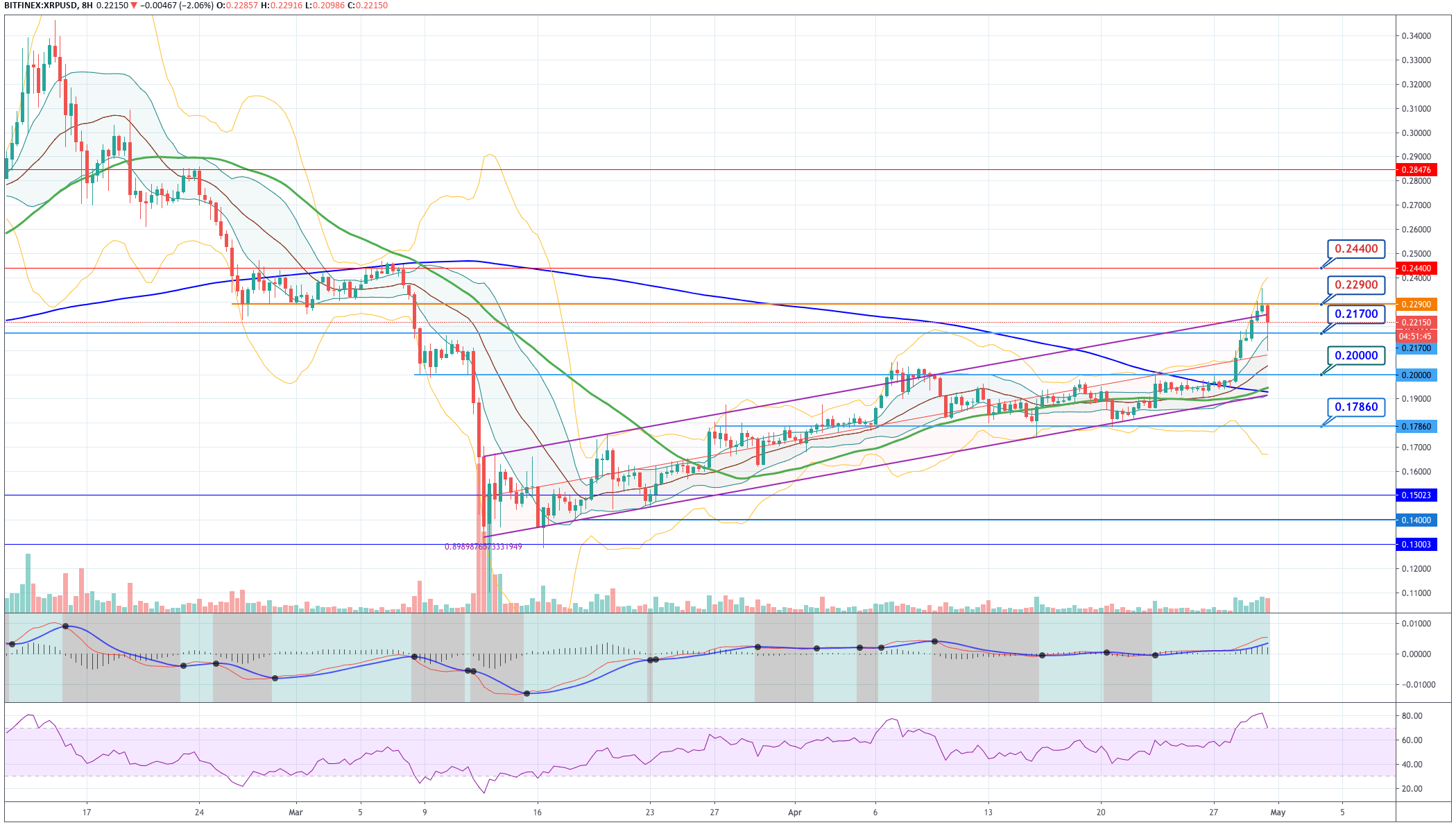

Fig 5 - Ripple 8H Chart

Ripple was the first to call this rally, but in the last 24 hours was the weakest of the top 3 cryptos. The asset found sellers after moving above 0.235 and created a large bearish candle that went to the middle of the linear regression channel, where it found buyers to move its price above the +1SD Bollinger line. We see on the chart that the RSI is curving down and is close to getting out of the overbought zone. Thus, even though this asset is much weaker than the other two top assets, the technical indicators point to a bullish trend that is consolidating its last upward move. The price seems tom find support at $0.21, if the asset moves back to near that level and makes a reversal bar, it can be a right place for entering long trades. Also, a move above 0.23 is a good spot to open long positions.

Standard Pivot Levels

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

0.1830 |

0.1915 |

0.2050 |

|

0.1695 |

0.2134 |

|

|

0.1610 |

0.2270 |

Try Secure Leveraged Trading with EagleFX!

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Bulls target $100,000 BTC, $2,000 ETH, and $3 XRP

Bitcoin (BTC) is stabilizing around $95,000 at the time of writing on Wednesday, and a breakout suggests gains toward $100,000. Ethereum (ETH) and Ripple (XRP) followed BTC’s footsteps and hovered around their key levels.

Tether mints 3 billion USDT on Ethereum and TRON as markets stabilize

Tether ramps up its minting activity amid surging demand for stablecoins, often signaling heightened trading and liquidity needs. The issuer of the leading stablecoin by market capitalization has minted 2 billion USDT on Ethereum and an additional 1 billion USDT on the TRON network.

SEC delays decision on Franklin Templeton’s spot XRP ETF to June 2025

The Securities and Exchange Commission (SEC) has postponed its decision on Franklin Templeton’s spot XRP ETF, extending the review period to June 17, 2025. XRP traded at approximately $2.24 at press time, rising 7% over the past week, according to CoinGecko.

Trump Media announces new token launch and native crypto wallet in latest Shareholder letter

Trump Media unveils plans to launch a utility token and crypto wallet to monetize Truth Social and expand its streaming services. Markets react with a 10% drawdown on the Solana-hosted official TRUMP memecoin.

Bitcoin Weekly Forecast: BTC consolidates after posting over 10% weekly surge

Bitcoin (BTC) price is consolidating around $94,000 at the time of writing on Friday, holding onto the recent 10% increase seen earlier this week.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.