Cryptocurrencies retracing as Volume Dries up

2019 Crypto Currency Gainers and Losers

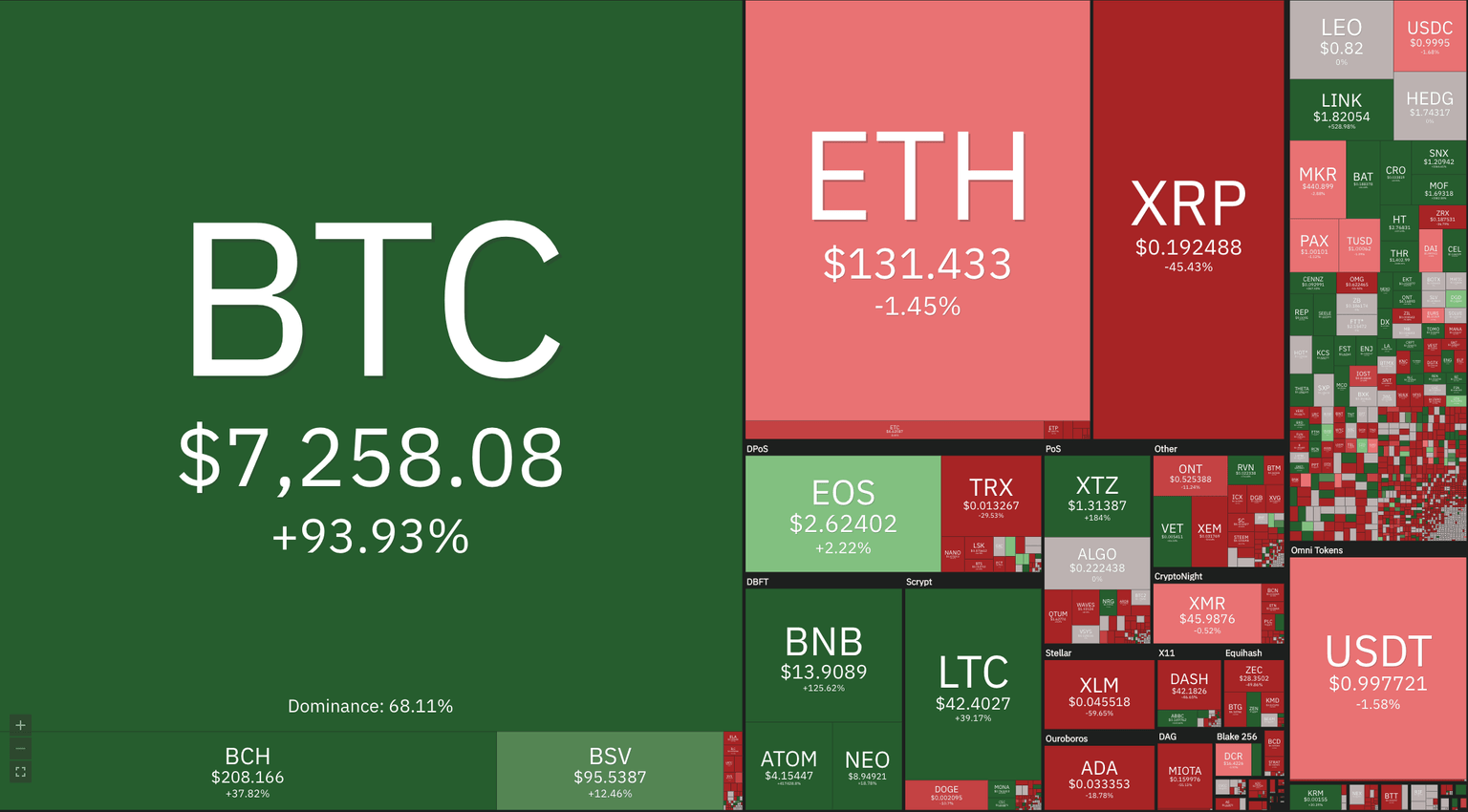

The year is over, and by analyzing what happened, we get a mixture of successes and not so much. Along with Bitcoin (+93.93%), the most highly valued were Binance Coin (+126%), Tezos (+184%), and the star of the year: Atom (41,728.8%).

The big losers of the year were Tron(-29.53%), Ripple (-45.43%), DASH (-46.65%), Iota ( -55.13%), and Stellar (-59.65%).

In the Ethereum token section, there were huge performers, such as LINK (+628.98%), SNX(+3,067%), MOF (+3,582%), ThoreCoin (THR,+3,498%) and SEELE (+3,343%). Overall the token section has provided excellent returns for most of the investors with very few risks. Among the top capitalized, only ZRX was a lousy performer with a 36.8% drop, while the average gain is above 300%.

Fig 1 - 1Year Crypto Heat Map

The last 24 Hours

The last 24 hours Cruptos were retracing part of the gains acquired during the weekend. The drops were between 2 and 4 percent, with Tron (-4.12%) and Litecoin (-3.91%) being the worst performers, whereas Waves generated a nice 6% gain.

The market cap dropped by $3.78 billion (-1.92%) and now is $193.32 billion. That came with a traded volume of $23.554 billion in the last 24 hours. The Dominance of the bitcoin did not change and still is 68.08%.

Fig 2 24H Crypto Market Cap and Traded Volume

Hot News

The Daily Hodl reports that the International Monetary Fund (IMF) sees that central banks are divided as to the future of digital currencies and can be classified into three groups:

First Group:

-

Run pilot programs to explore the concept

-

Increases the resources devoted to CDBC and fintech

-

Review legislation to support digital currency

-

Study possible competing currencies and their implications

Secondgroup:

-

Increase resources devoted to CBDC and payment systems

-

Limitedtesting of thetechnology

-

Explore alternatives to Blockchain

Thirdgroup:

-

No immediateinterest in CBDC

-

Allocate resources to improve existing payment systems

-

Strengthenregulation.

An article by Cointelegraph points out that even when the Blockchain adoption is rising, the number of new startups are drying up. The news piece states that after a total investment of $5.5 billion of raised capital in 2018, the present year saw a sharp drop with less than $3 billion moving into the crypto sector.

Bitcoin is the best performer among commodities in 2019 with close to 100% increase, followed by Palladium (+57%), Gasoline (+34%), Coffee(+30%), Lumber(+27%), Platinum (+19%), Gold (+18%), Silver (+15%), Sugar (+13%) and Wheat (+11%).

Technical Analysis

Bitcoin

Chart 1 - Bitcoin 4H Chart

After the last leg down, Bitcoin is moving inside a support region. $7,200 seems to hold the price. The MACD shows a corrective phase, and the price is below the -1SD line of the Bollinger bands. Since this is the last day of the year, we expect a drop in the traded volume and a sideways movement between $7,200 and $7,300.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

7,200 |

7,300 |

7,390 |

|

7,125 |

7,525 | |

|

7,070 |

7,680 |

Ripple

Chart 2 - Ripple 4H Chart

Ripple continues its movement inside a channel between 0.186 and 0.20. Currently, the price is making a tight sideways movement, product of lack of liquidity. We think the movement will keep tight, and every move away from the mean of the Bollinger bands will be faded.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

0.1950 |

0.1950 |

0.1970 |

|

0.1900 |

0.2000 | |

|

0.1860 |

0.2030 |

Ethereum

Chart 3 - Ethereum 4H Chart

Ethereum, although it has retraced, it seems more bullish than its peers. ETH price it is still moving on the upper side of the Bollinger Bands and making higher highs and lows. That said today, being Dec 31 will most likely experience a lack of traded volume, so beware of fake movements, since most probably they will be faded away.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

130.00 |

132.00 |

135.00 |

|

127.00 |

138.00 | |

|

123.00 |

140.00 |

Litecoin

Chart 4 - Litecoin 4H Chart

Litecoin's movement is similar to Ethereum in bullishness. The asset is making higher highs and lows, although the last drop has put the price on the lower side of the Bollinger Bands, which is a bit bearish. The MACD also points to a period of choppy movements. Our recommendation regarding trading on Dec 31 applies, as well. Caution is due when the traded volume dries up.

|

SUPPORT |

PIVOT POINT |

RESISTANCE |

|

41.60 |

42.80 |

43.80 |

|

40.00 |

45.00 | |

|

39.00 |

46.30 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and