Cryptocurrencies Price Prediction: Solana, Polygon & Litecoin – European Wrap 13 July

Solana price eyes 15% nosedive after recent development in FTX bankruptcy case

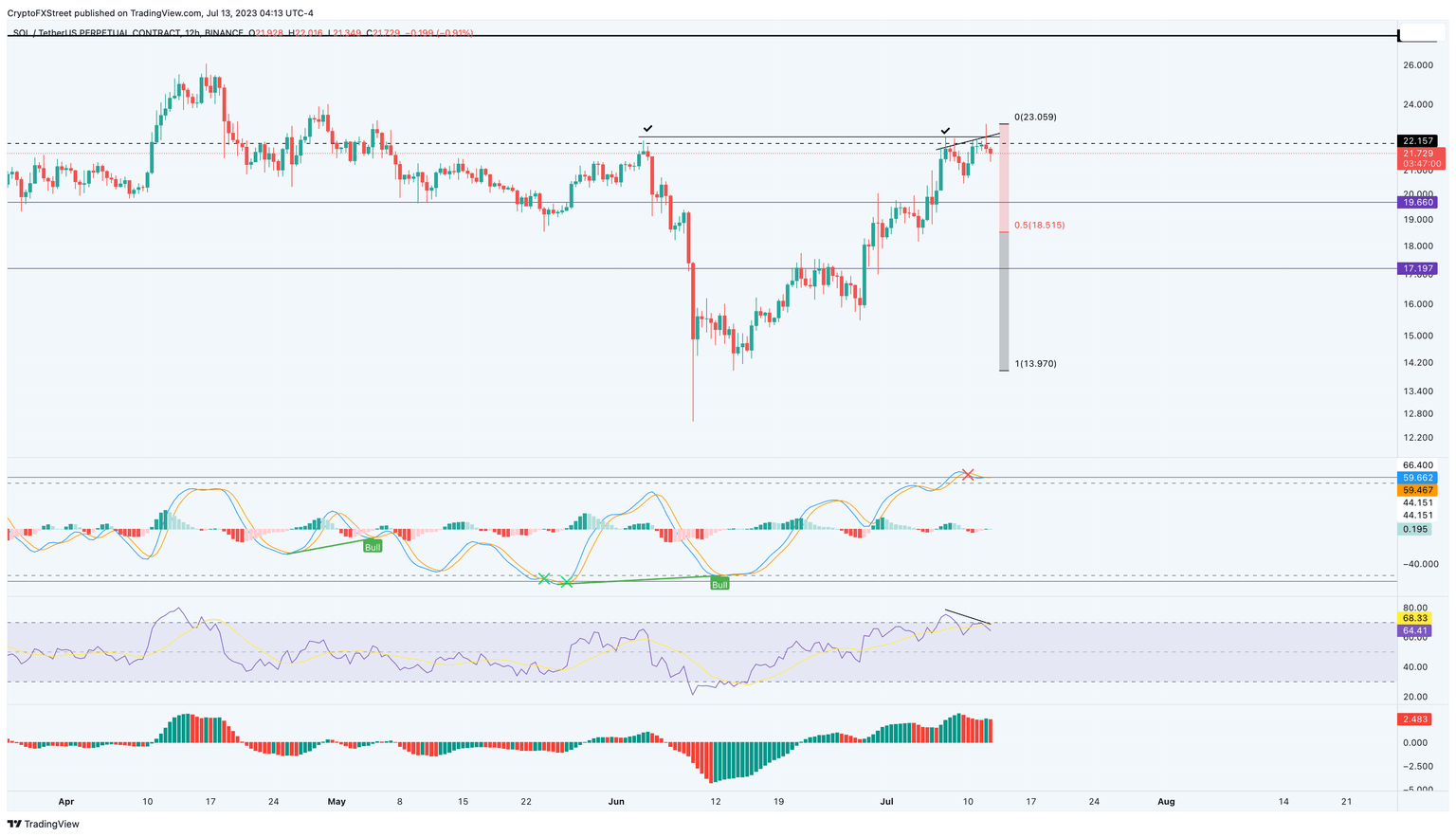

Solana price has been on an uptrend for nearly a month, clocking in nearly 65% in gains. While the ascent is impressive, SOL holders need to be aware of a sudden shift in trend due to declining momentum. Additionally, the FTX bankruptcy case has new development that requires the now-defunct crypto exchange to pay up to $325 million to its European creditors.

Solana price kick-started its ascent on June 14 and set up a local top at $23.05 after rallying 65% in less than a month. This expansive move seems to be running on fumes now as sell signals emerge while SOL trades at $21.72.

MATIC price explodes as Polygon announces proposal to upgrade to POL token

Polygon, Ethereum’s largest Layer 2 scaling solution, announced an upgrade to its native token MATIC. Developers proposed an upgrade from MATIC to utility token POL for utility in dApps built on the network’s blockchain.

In response to the development, MATIC price rallied nearly 5%, as seen on Binance. Polygon Network’s token MATIC suffered regulatory crackdown as the Securities and Exchange Commission (SEC) labeled the asset as a “security.” In response to the SEC’s actions, MATIC price witnessed a decline.

Proud to unveil POL, the proposed upgrade to MATIC!

— Mihailo Bjelic (@MihailoBjelic) July 13, 2023

POL is a next gen, multi-utility token, designed to secure, align and grow the Polygon ecosystem.

We’re excited to discuss the proposal with the community. Only together we can build the Value Layer of the Internet! https://t.co/si2LcnT1wC

Litecoin holders await bullish trend reversal 20 days before the halving

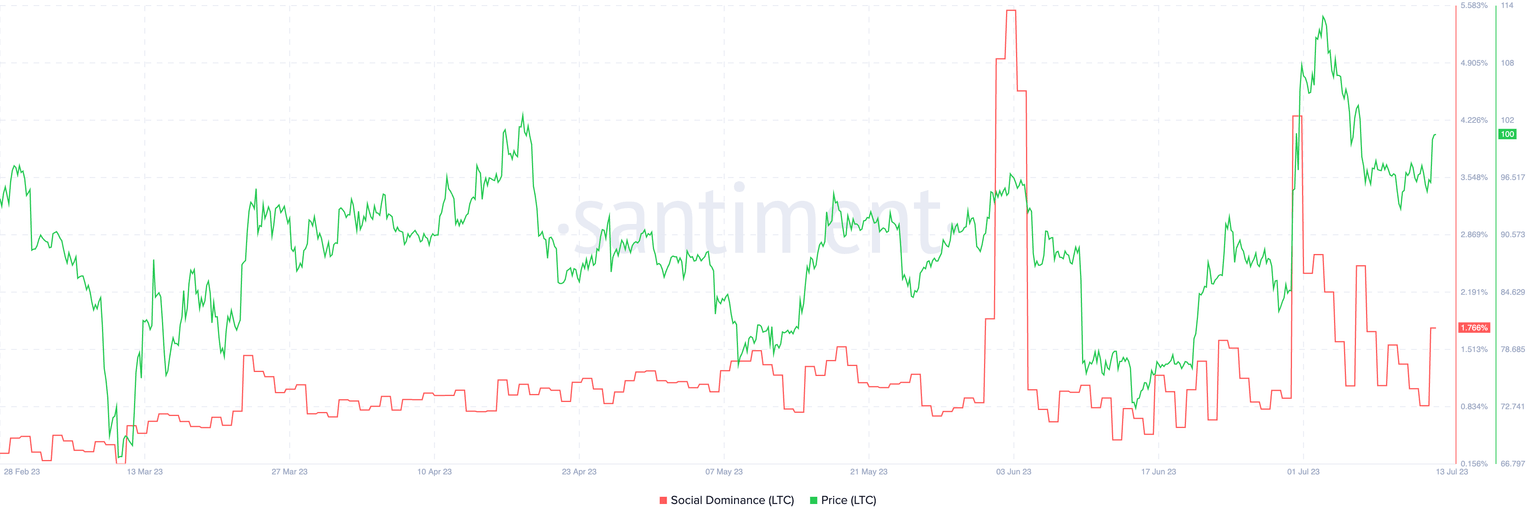

Litecoin halving, a key event where reward for mining LTC will be slashed from 12.5 LTC to 6.25, is 20 days away. LTC holders are awaiting a bullish trend reversal in the token as price sustains above the key psychological level of $100 close to the halving.

Litecoin, one of the largest altcoins in the crypto ecosystem, is closer to a halving event. According to data from crypto intelligence tracker Santiment, there is a spike in social dominance of Litecoin. Previous increases in this metric coincided with a price correction in LTC. Therefore, this on-chain indicator paints a bearish picture for Litecoin price trend in the short term.

Author

FXStreet Team

FXStreet