Cryptocurrencies Price Prediction: Solana, Ethereum & Ripple – European Wrap 18 October

Solana Price Forecast: SOL gains 2% as community discusses Firedancer validator for better performance

Solana (SOL) price increases more than 2% on Friday, tracking the broad gains seen among the main cryptocurrencies, as its community discusses on social media the progress in the development of a new validator, Firedancer, that could boost the blockchain’s performance.

Solana is preparing for the mainnet launch of Firedancer, a high-performance validator being built by Jump Crypto, a Web3 infrastructure company. Firedancer went live on the testnet in September and the mainnet launch is expected in early 2025.

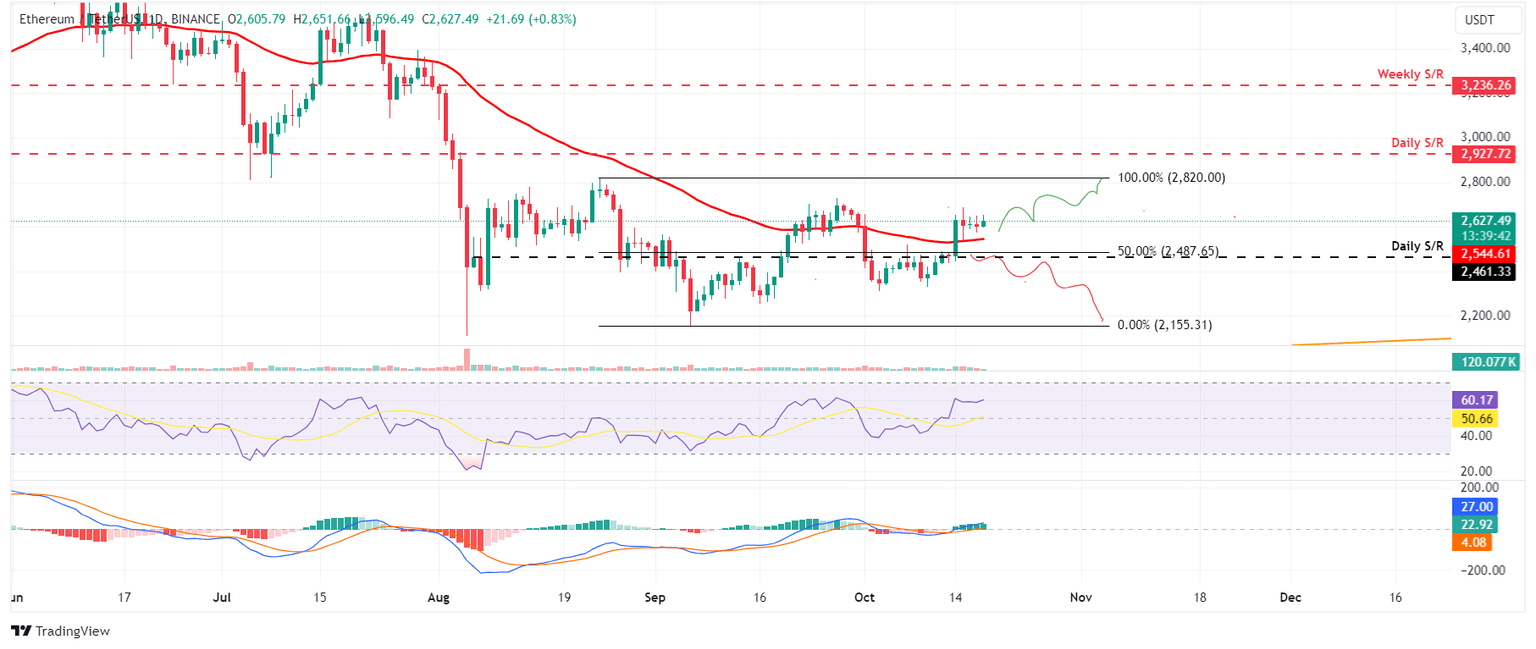

Ethereum Price Forecast: ETH demand must increase to fuel any rally

Ethereum (ETH) edges up slightly on Friday, adding to 6.5% gains so far this week after surpassing key resistance levels on Monday, bolstered by a net positive inflow of over $79 million through Thursday. Despite this influx, CryptoQuant’s Ethereum Coinbase Premium Index remains below neutral levels, indicating that demand must rise to sustain the anticipated rally.

Ethereum co-founder Vitalik Buterin said in a blog post published on Thursday that he wants the platform to process 100,000 transactions per second (tps). Ethereum’s rollup-centric roadmap, which combines Layer 2 scaling solutions, advanced data availability sampling, and data compression techniques, will achieve this 100,000 TPS goal, he said.

XRP trades above $0.55, confusion in appeals deadline could jeopardize SEC vs. Ripple lawsuit

Ripple (XRP) gains on Thursday as traders digest the uncertainty in the Securities & Exchange Commission’s (SEC) appeal in the lawsuit. A spokesperson from the US-based financial regulator has confirmed that the process has been followed and the relevant documents will be available publicly soon.

XRP traded at $0.5507 at the time of writing on Thursday. XRP has been in a downward trend since July 2023, as seen in the XRP/USDT daily chart. The altcoin could climb another 8.42% to hit its psychologically important level at $0.60. This is a key level for several XRP holders since the token has managed to break through on a few occasions since May 2024.

Author

FXStreet Team

FXStreet