SOL worth $227M moved to centralized exchanges, clouds bullish technical outlook

A SOL market dynamic that characterized the March 2024 price top has reappeared, clouding the token's bullish technical outlook.

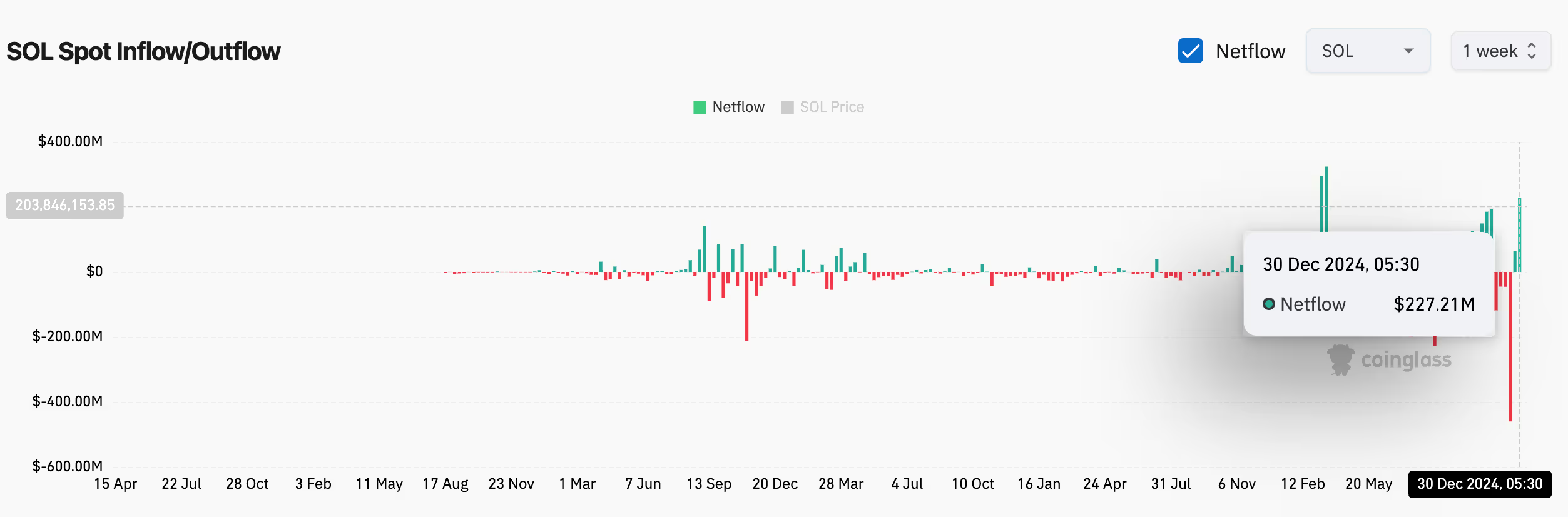

Last week, centralized exchanges recorded a hefty net inflow of $227.21 million in SOL, the token powering Solana's smart contract blockchain, marking the highest influx since the third week of March, according to Coinglass.

Bitcoin is on the verge of $100,000 again

The crypto market capitalisation has surpassed $3.5 trillion, the highest since 19 December. Short-term growth in the market is being replaced by periods of consolidation. The market seems to be probing the ground beneath its feet and moving gently upwards. The sentiment index of 76 (extreme greed) indicates a period of active buying, leaving plenty of room for growth.

Key US economic data this week could shake crypto markets

Key US economic reports this week, including jobs data and Fed insights, could drive volatility in crypto markets, shaping Bitcoin's short-term outlook.

This week, key US economic data reports are set to influence crypto markets, with Bitcoin still struggling below the $100,000 mark. Traders and investors are watching closely as job reports, Federal Reserve insights, and consumer sentiment data could trigger market volatility. Economic indicators will help shape investor confidence and guide trading strategies in the coming days.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Price Forecast: BTC holds above $100K following Fed’s Michael Barr resignation

Bitcoin edges slightly down to around $101,300 on Tuesday after rallying almost 4% the previous day. The announcement of Michael S. Barr’s resignation as Fed Vice Chair for Supervision on Monday has pushed BTC above the $100K mark.

Injective Price Prediction: INJ 3.0 upgrade reduces the token supply

Injective price extends its gains for the seventh day in a row, trading above $26 on Tuesday after rallying more than 25% the previous week. The announcement of the INJ 3.0 upgrade on Sunday, which focuses on significantly decreasing the token supply, could further fuel the ongoing rally.

Solana Price Forecast: Open Interest reaches an all-time high of $6.48 billion

Solana price trades slightly down on Tuesday after rallying more than 12% in the previous week. On-chain data paints a bullish picture as SOL’s open interest reaches a new all-time high of $6.48 billion on Tuesday.

Ripple's XRP eyes rally to new all-time high after 40% spike in open interest

XRP open interest surged by 40% in the past 24 hours. Buying pressure across exchanges and investment products helped XRP to maintain a bullish outlook. XRP could be on the verge of a massive breakout after testing the resistance of a bullish pennant.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot ETFs in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.