Ondo price eyes 30% rally as ONDO bulls plan a breakout

Ondo (ONDO) price has been in a tight consolidative range for nearly a month and is edging closer to breaking out. A successful flip of the immediate hurdle could lead to double-digit gains for ONDO holders.

Ondo price action over the past month has produced a bullish Inverse Head-and-Shoulders setup. This technical formation contains three distinctive troughs. The central one, known as the “head”, is deeper than the other two, which are the “shoulders”.

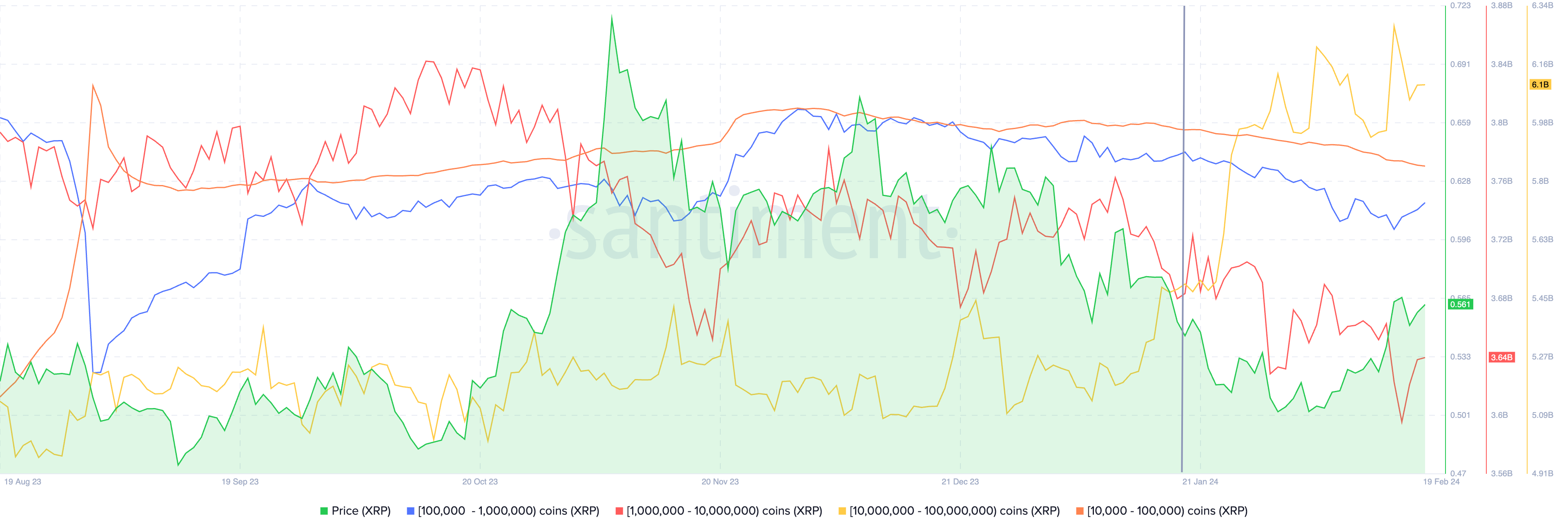

XRP price steadies above $0.56 ahead of deadline in SEC v. Ripple lawsuit

XRP price is $0.5593 on Monday, the altcoin has yielded nearly 6% weekly gains for XRP holders in the past week. The Securities and Exchange Commission (SEC) lawsuit against Ripple has a key deadline on February 20 and it will enter a new phase, with the end of remedies-related discovery, a phase in which there is formal exchange of information.

SEC v. Ripple lawsuit will see a formal end of its remedies-related discovery phase on February 20. The payment remittance firm had requested the court for a one week extension of the deadline, the initial deadline was February 12.

ARKM and WLD prices rally in double digits, Sam Altman’s AI coins on the move

Sam Altman-backed Arkham Intelligence’s ARKM token yielded double-digit gains for holders, alongside OpenAI’s project, WorldCoin’s WLD. The two Altman coins are rallying as the narrative of Artificial Intelligence (AI) tokens gathers steam.

OpenAI’s unveiling of its text to video generation tool has fueled the AI token narrative in crypto. Sora’s videos have flooded social media platforms like X and catalyzed the hype of crypto AI assets. OpenAI CEO Altman is related to the WLD and ARKM projects. While WorldCoin’s parent organization is headed by Altman, and Arkham Intelligence is backed by Sam, making the two assets, “Altman coins”, so to say.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Sui technical outlook hints at a possible double-bottom formation

Sui (SUI) price action hints at a double-bottom technical formation, which tends to be followed by a bullish move. The Coinglass long-to-short ratio for SUI stands above one and rises, indicating more traders are betting for a rally in SUI.

Bitcoin consolidation continues as market prepares for the next major move

Bitcoin (BTC) has been consolidating between $94,000 and $100,000 since February 5. Glassnode reports weakening capital inflows and declining derivatives activity, with short-term holder accumulation resembling challenging market conditions.

Stellar Price Forecast: XLM’s Total Value Locked reaches over $62 million

Stellar (XLM) price trades inside a channel pattern; a breakout indicates bullish momentum. Crypto intelligence tracker DefiLlama data shows that XLM’s TVL reaches $62 million while the technical outlook projects a target of $0.74.

XRP record gains as SEC acknowledges CoinShares, Canary and WisdomTree's XRP ETF filings

SEC accelerates the XRP ETF filing process by acknowledging CoinShares, Canary and WisdomTree's applications. The new SEC administration has yet to pause the agency's litigation against Ripple due to prioritization of cases with imminent court deadlines.

Bitcoin: BTC consolidates before a big move

Bitcoin price has been consolidating between $94,000 and $100,000 for the last ten days. US Bitcoin spot ETF data recorded a total net outflow of $650.80 million until Thursday.

The Best brokers to trade EUR/USD

SPONSORED Discover the top brokers for trading EUR/USD in 2025. Our list features brokers with competitive spreads, fast execution, and powerful platforms. Whether you're a beginner or an expert, find the right partner to navigate the dynamic Forex market.