Cryptocurrencies Price Prediction: Ethereum, Bitcoin & Bonk – European Wrap 15 July

Crypto Today: Bitcoin, Ethereum, XRP trim gains amid declining ETF inflows and profit-taking

The cryptocurrency market is experiencing a sudden spike in volatility on Tuesday following a robust bullish wave the previous day. Bitcoin (BTC) is trading at $116,918, down over 2% in the day as investors book profits ahead of the release of the United States (US) Consumer Price Index (CPI) data for June.

Altcoins have also run into heightened volatility, led by Ethereum's (ETH) drop below the pivotal $3,000 level and Ripple's (XRP) pullback below Monday's highs of around $3.02.

Bitcoin Price Forecast: BTC edges below $117,000 ahead of US CPI data

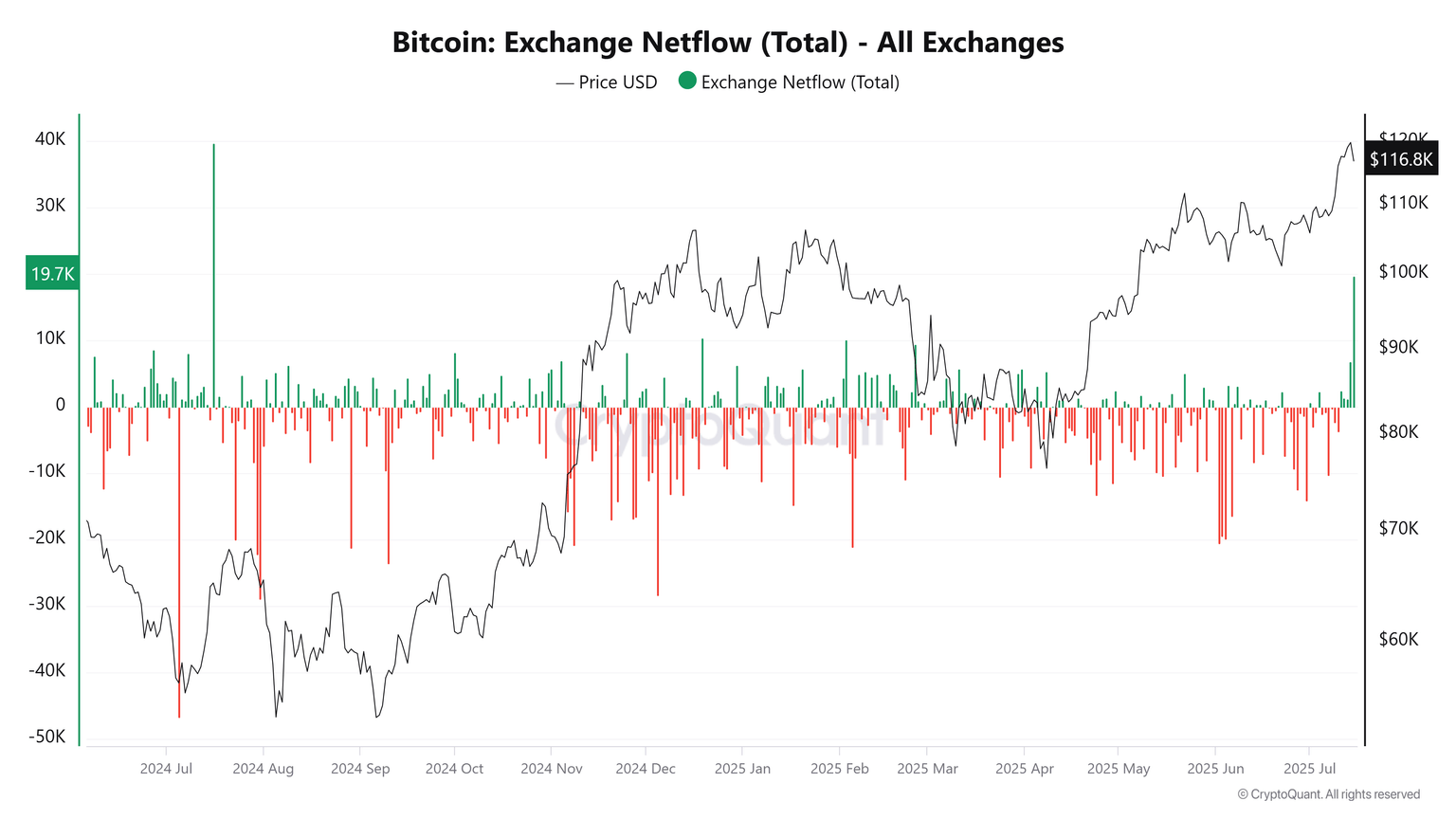

Bitcoin (BTC) price is facing a correction, trading below $117,000 at the time of writing on Tuesday after hitting a new all-time high of $123,218 the previous day. The pullback comes as on-chain data shows increased selling pressure, with both long-term holders and dormant wallets moving BTC to exchanges. Market participants are taking a cautious stance ahead of the US Consumer Price Index (CPI) data release for June, as it could influence the Federal Reserve’s (Fed) interest rate cut decision and bring volatility and direction to riskier assets, such as Bitcoin.

Bitcoin price soared to a new all-time high of $123,218 at the start of this week on Monday. This surge in BTC price flipped its market capitalization to $2.38 trillion, reaching the fifth-largest asset in the world and surpassing both silver and Amazon in terms of market valuation.

Meme Coins Price Prediction: Solana-based BONK, PENGU, WIF could lead the next market bull run

Meme coins such as Bonk (BONK), Pudgy Penguins (PENGU), and Dogwifhat (WIF) recorded double-digit gains last week, driven by uplifted sentiments in the crypto market. The Solana-based BONK and WIF meme coins eye further gains as the uptrend holds momentum, while the launch of a multiplayer game could extend the PENGU rally.

Bonk, the largest Solana-based meme coin by market capitalization of $2.29 billion, extends the nearly 20% surge from last week. At the time of writing, BONK appreciates over 6% on the day, printing its fourth consecutive bullish candle.

Author

FXStreet Team

FXStreet