Cryptocurrencies Price Prediction: Cronos, Ethereum & AVAX – European Wrap 05 May

Cronos price action gears up for bullish breakout on back of US job numbers this Friday

Cronos (CRO) price is gearing up for a bullish breakout. Although pressure is building on the bottom line at $0.070, bulls keep underpinning the price action. For a third day in a row, bulls are defending the level and keep pushing price action back up as bearish pressure mounts. With the US job numbers expected later this Friday, a catalyst is nearby that could pour oil on the fire, leading toa breakout toward the next big cap nearby for a 10% gain.

Cronos's price has bulls getting ready for a jump higher with the US job numbers this Friday as a catalyst that would set fire to the fuse. For nearly the whole week, bulls have been preparing for the event by supporting the 55-day Simple Moving Average (SMA) around $0.070. By doing so, some stacking positions have been built. Once the cap on the topside is broken, the road looks wide open for a stretch up to $0.075.

Ethereum active deposits explode, wiping out decline from the FTX collapse

Ethereum network’s active deposits have exploded, hitting an eight-month high, the highest level since the blockchain’s transition from Proof-of-Work to Proof-of-Stake. ETH deposits climbed to the highest level since Merge and wiped out the decline from FTX exchange’s collapse.

The volume of active deposits on the second-largest blockchain exploded, hitting an eight-month high. Deposits to ETH’s Beacon Chain contract hit an eight-month peak. Experts at crypto intelligence tracker Santiment are investigating the cause of the peak, and conclude that the spike in deposits could shadow the volatility in Ethereum price.

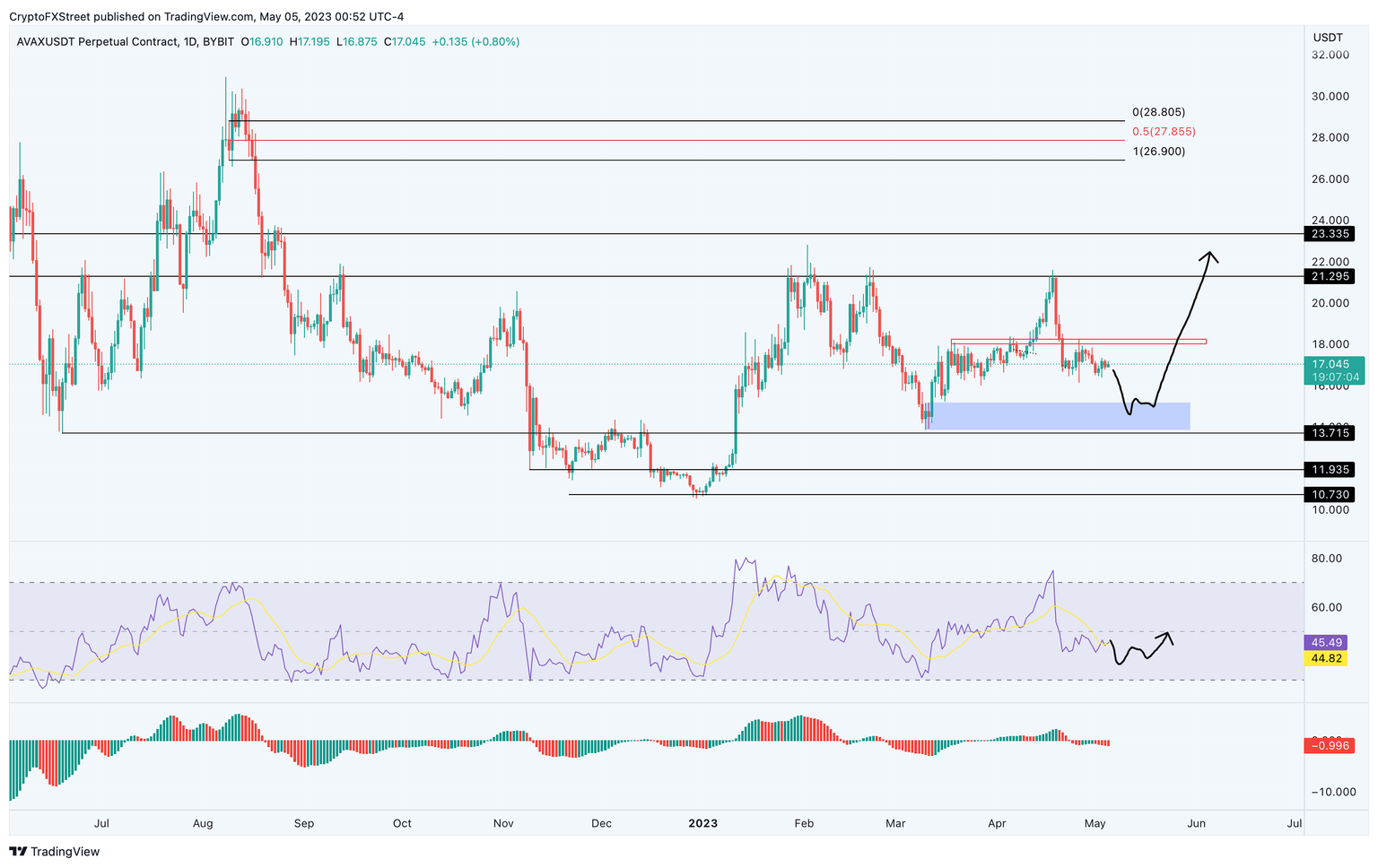

AVAX price to target 55% rally under these conditions

AVAX price has been on a tight leash ever since the altcoin breached a crucial support structure on August 26, 2022. This move has kept the Avalanche from moving higher. Changing winds in the crypto sphere could set the stage for an explosive move soon.

AVAX price slid below the $21.29 support level on August 26, 2022, and crashed 55%. Since then, the altcoin has attempted to recover above the aforementioned level five times but failed each time. The recent rejection on April 18 caused Avalanche bulls to disappear, making the altcoin nosedive 21%.

Author

FXStreet Team

FXStreet