Cryptocurrencies Price Prediction: Chainlink, Uniswap & Ethereum — Asian Wrap 31 May

Here’s why Chainlink price could crash 15% despite spike in social volume

Chainlink (LINK) price has flashed multiple sell signals after its recent climb, hinting at a short-term correction. This signal comes despite a double-digit growth in its social volume. LINK bulls need to exercise caution as this forecast is backed by on-chain metrics.

Uniswap founder hopes SEC doesn't pursue enforcement as on-chain data shows price spike is on the horizon

Uniswap (UNI) gained nearly 3% on Thursday as its founder revealed the decentralized exchange (DEX) has responded to the Securities & Exchange Commission's (SEC) Wells notice. Meanwhile, UNI's on-chain data also suggests a price spike may be on the horizon.

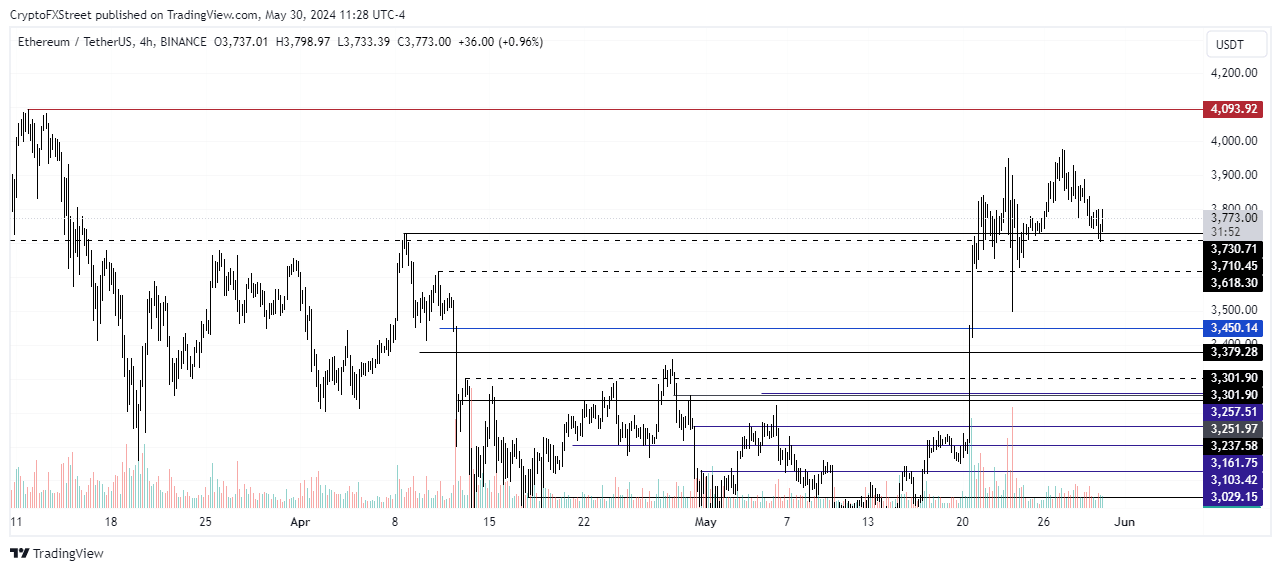

Ethereum price lags, investors potentially reallocating capital after BlackRock's updated S-1 filing

Ethereum (ETH) price shows neutrality despite positive updates of BlackRock's spot ETH ETF updated S-1 application and the Securities & Exchange Commission’s (SEC) engagement with issuers. A key reason for the price lag may be a potential capital reallocation from investors to DeFi tokens in hopes of a larger upside if the launch of spot ETH ETFs spurs a rally.

Author

FXStreet Team

FXStreet

%2520%5B23.39.11%2C%252030%2520May%2C%25202024%5D-638527083384283606-638527219977875616.png&w=1536&q=95)