Cryptocurrencies Price Prediction: Chainlink, Bitcoin & Solana – European Wrap 28 April

Chainlink price heads for low-hanging fruit of 5% gain as bulls try to overcome price cap

Chainlink (LINK) price sees bulls performing a big squeeze against bears since the rejection against $7.50 on Thursday. Later in that session bulls performed a bear trap and are dragging price action back up toward the current price cap. The squeeze is set to break higher as bears are bound to snap under pressure and will need to buy in the market in order to cover their loss. This should lead to a 5% jump in LINK price later on Friday.

Chainlink price is drawing a perfect squeeze on the chart since bears tried to run price action into the ground in early Thursday trading. Bulls kept their calm, bought the dip and are in the process of hitting bears where it hurts: in their trading balance. With continuous higher lows, bulls are squeezing bears out of their positions until they snap.

Bitcoin Weekly Forecast: Fed’s interest decision will be key to BTC directional bias

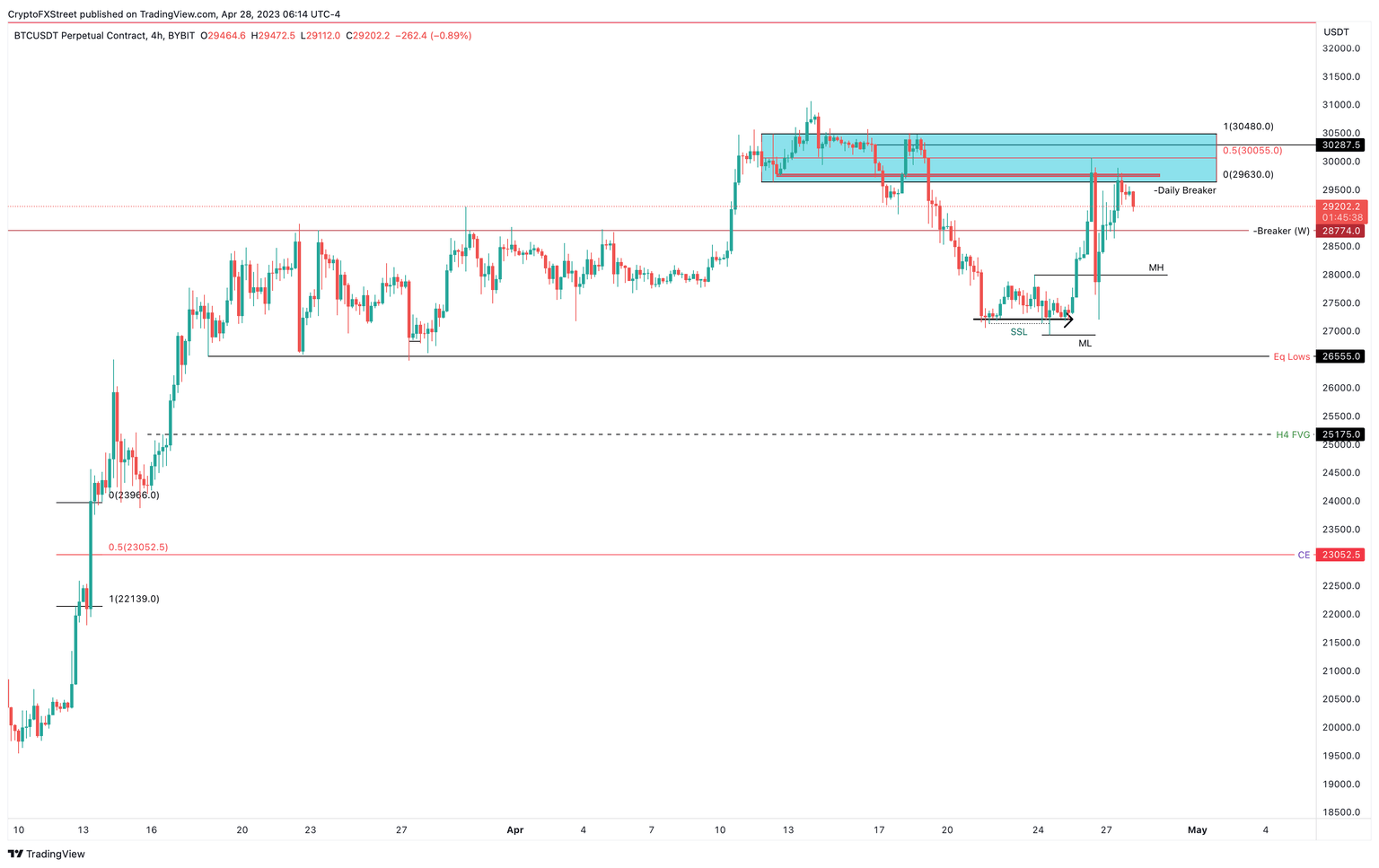

Bitcoin price shows no signs of bullish momentum as it hovers below a critical psychological level. This lack of buying pressure could be a result of exhaustion after BTC’s impressive rally in Q1 of 2023. With two major macroeconomic events on the horizon, traders are likely going to position themselves in the direction of the most probable outcome.

Bitcoin price has failed to sustain its uptrend after its recent plummet from $30,000 to $27,200. Although bulls tried to run BTC back up, they faced a lot of selling pressure around the bearish breaker, extending from $29,630 to $30,480. After two failed attempts, the big crypto is currently hovering around $29,200.

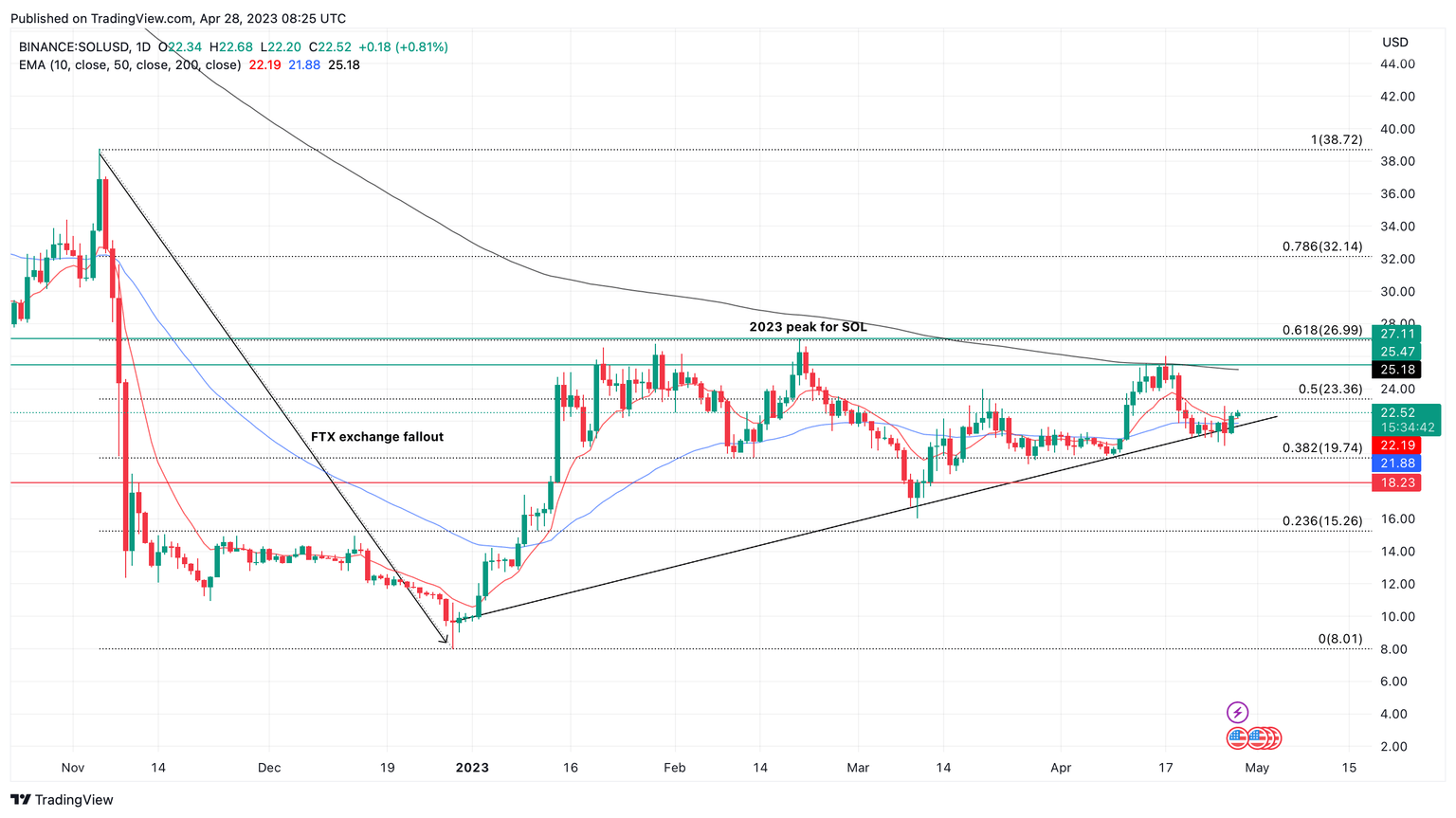

Solana outperforms Bitcoin despite taking massive hit after FTX crash

Solana, an Ethereum-alternative project, has more than doubled in price in 2023. The token outpaced Bitcoin, the largest asset by market capitalization, in its year-till-date returns. Interestingly, SOL price has wiped out most of its losses from the 2022 FTX exchange collapse.

The Ethereum-killer token, Solana, has yielded 125.88% gains for holders in 2023. The altcoin outpaced Bitcoin and several large market capitalization assets as its price more than doubled since the beginning of 2023.

Author

FXStreet Team

FXStreet