Cryptocurrencies Price Prediction: Cardano, Tezos, Chainlink — Asian Wrap 29 June

Cardano Price Prediction: ADA anticipates bullish breakout

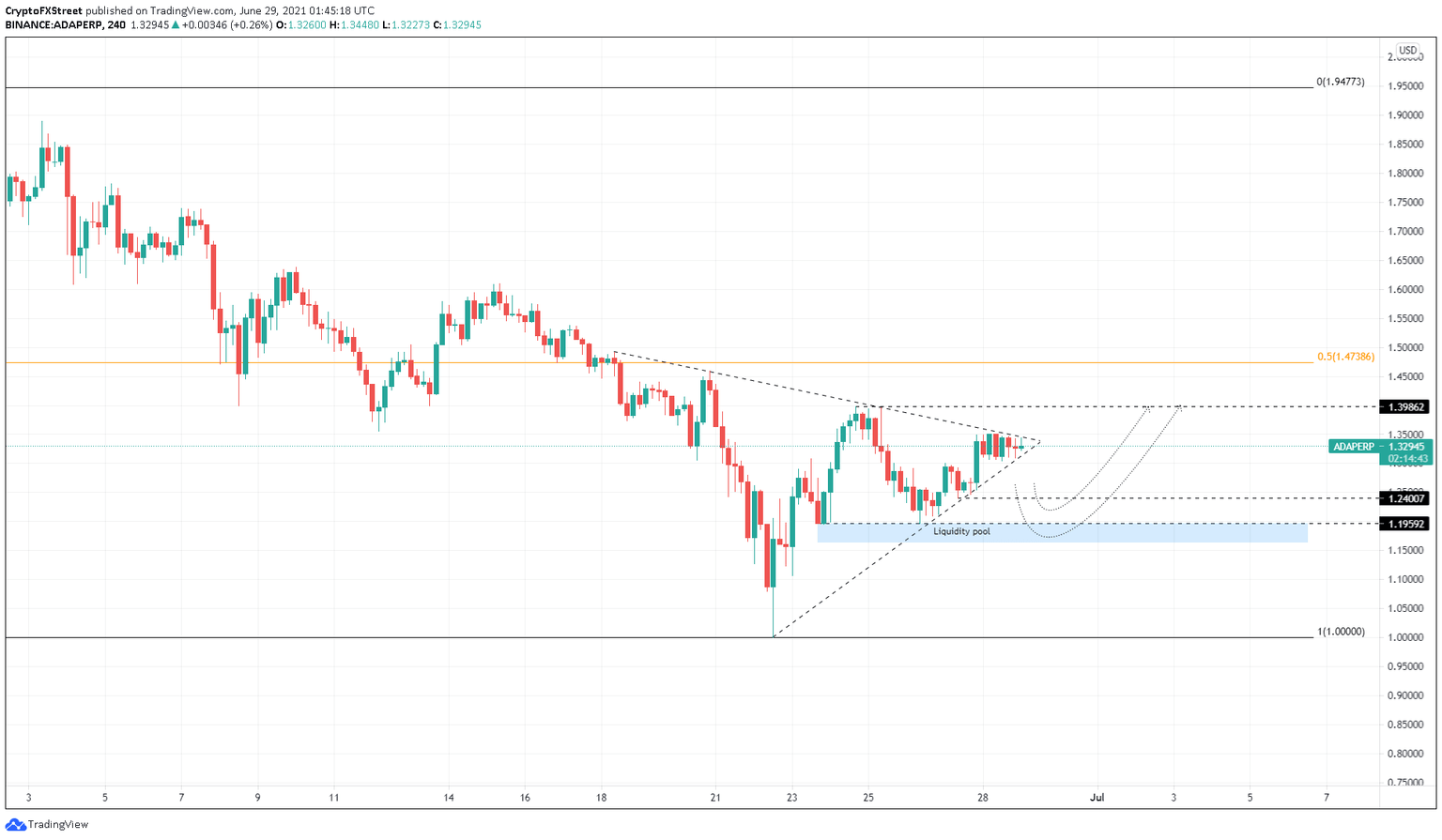

Cardano price has been on a downtrend since June 3 without any substantial higher highs, suggesting that the bears are plaguing the markets. As ADA trades inside a tight range, it consolidates between two converging trend lines and anticipates a massive breakout.

Cardano price was trading above the 50% Fibonacci retracement level at $1.47 until mid-June. However, this changed as ADA slid below it on June 18. Since then, the Cardano price action has been in the form of lower highs and higher lows, indicating a tightening of the range.

Tezos Price Forecast: XTZ boasts solid support, pursues higher prices

Tezos price is attempting to rebound from the second test of the May low in five days, but the bid has not been overwhelming, reflecting a tentativeness to engage XTZ while altcoins remain trendless. However, if a strong volume profile reinforces price strength, the digital token has the support to rally almost 30% from price at the time of writing.

Tezos price fell 75% from the May 7 high of $8.41 to the May 23 low of $2.42, matching the average decline for the altcoins. Interestingly, XTZ did not trigger an oversold reading on the daily Relative Strength Index (RSI), and it did not reach an oversold condition during last week’s test of the May low.

Chainlink Price Analysis: LINK in a balancing act as chart and on-chain metric diverge

Chainlink price successfully holds the May 23 low but does not register an oversold reading or generate substantive investor interest, thereby raising some doubt about the end of the correction. LINK faces notable overhead resistance moving forward, lending some credibility to the cautious outlook in this post.

Chainlink price declined just over 70% from the May 10 high of $52.99 to the May 23 low of $15.00, placing it around the average for cryptocurrency corrections.

Author

FXStreet Team

FXStreet