Cryptocurrencies Price Prediction: Bitcoin, Stellar Lumens and REN – European Wrap 30 September

Top 3 Price Prediction Bitcoin, Ethereum and XRP: Bitcoin slumps to $10,700 as bears return

Cryptocurrencies are in red on Wednesday as we usher in the European session. Major digital assets such as Bitcoin, Ethereum, and XRP have been capped under key resistance levels at $11,000, $360, and $0.25 in that order. On the contrary, some selected cryptocurrencies like Cosmos (ATOM) and THETA are up 12% and 9%, respectively. On the other extreme end, UMA is among the worst-hit digital assets, after plunging more than 10% over the last 24 hours. Read more ...

%2520(38)-637370449405588815.png&w=1536&q=95)

Stellar Price Analysis: XLM prints a scary bearish pattern on its monthly chart

Stellar (XLM) is the 18th largest digital asset with a current market capitalization of $1.5 billion and an average daily trading volume of $115 million. The coin is most actively traded at Binance against USDT and BTC. The coin, created by Jed McCaleb, came to life in July 2014 as a primary competitor of Ripple. Read more ...

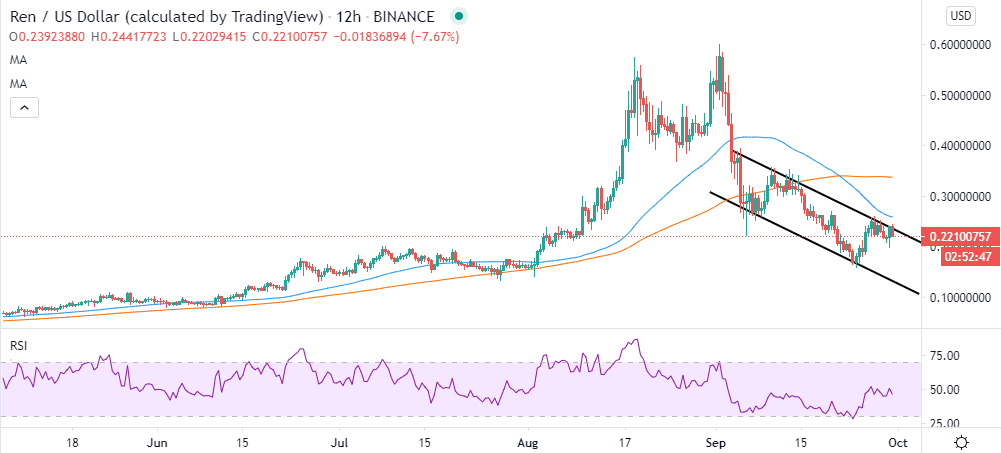

Ren Technical Analysis: REN’s splendid recovery stalls as bears swing into action

Ren is among the few cryptocurrencies that sustained an uptrend in the last week. Before the recovery, a breakdown that came into the picture in the first week of September saw the token explore the rabbit hole to lows of $0.16. A reversal on September 20 sent REN/USD piercing through various resistance zones, including $0.20 and $0.24. Unfortunately, the majestic spike ground into a halt beneath $0.25. Read more ...

Author

FXStreet Team

FXStreet