Cryptocurrencies Price Prediction: Bitcoin, Ripple & SUI – European Wrap 4 February

Bitcoin’s rollercoaster continues on US-China trade war fears – Is a reversal coming?

Bitcoin and other cryptocurrencies are facing renewed selling pressure on Tuesday as trade tensions between the US and China ramp up. These tensions are rattling market confidence and fueling risk-off trade.

Bitcoin has fallen 3% lower to 98,000, while other major tokens such as ether and Solana are trading 4% and 5% lower, respectively. Washington imposed a 10% trade tariff on all Chinese goods, which came into effect today.

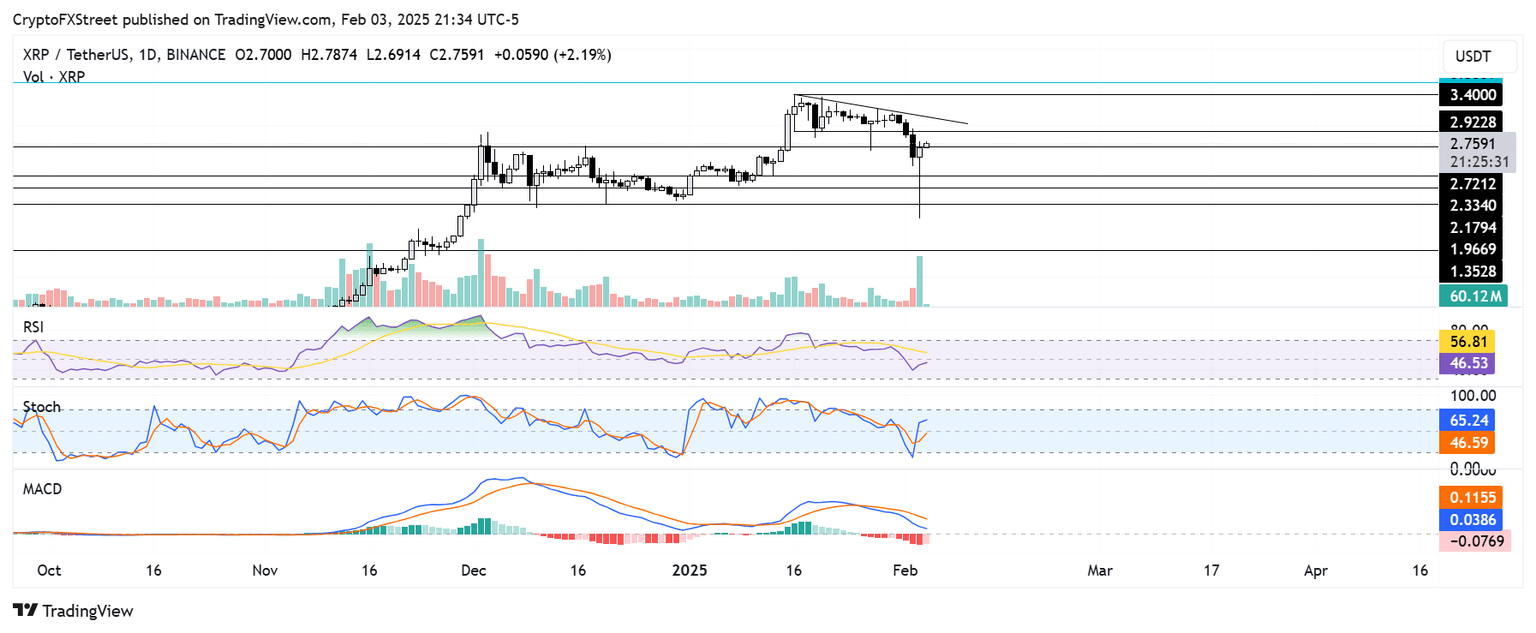

Ripple's (XRP) soars 30% as crypto market bounces back

Ripple's XRP is up 30% in the early hours of Tuesday as bulls are looking to stage a recovery from the recent crypto market crash. While on-chain data shows prevailing bearish sentiment in the market, bulls could return to help the remittance-based token secure a move above the $3.00 psychological level.

Since the crypto market crash after Trump announced tariffs on Canada, Mexico and China, XRP investors have realized nearly $2 billion in profits in the past three days — one of the highest in its history.

SUI Price Forecast: Bears aim for 40% crash

Sui (SUI) price edges down, trading around $3.54 on Tuesday after falling nearly 15% the previous week. The technical outlook and Coinglass’s OI-weighted funding rate data are negative, suggesting potential downward pressure on Sui’s price.

Sui price broke below an ascending trendline (drawn by connecting multiple daily close levels since November 26) on January 19. However, it recovered slightly to retest the broken trendline the next two days, but it was rejected, leading to a crash of 29% until Sunday. At the time of writing on Tuesday, it continues to trade down, facing rejection from its 200-day Exponential Moving Average (EMA) at $3.76.

Author

FXStreet Team

FXStreet

-638742714708711935.png&w=1536&q=95)