Cryptocurrencies price prediction: Bitcoin, Ethereum & XRP American Wrap - 10 October

Bitcoin to reach $80,000: Bitwise, US government give green light for Bitfinex to recover hacked funds

Bitcoin (BTC) could reach $80,000 by year-end if the market sees no surprises and the upcoming elections do not affect investor sentiment, according to Bitwise Chief Investment Officer (CIO) Matt Hougan. Meanwhile, the US government considers Bitfinex the sole victim and potential recipient of 119,754 BTC seized from hackers.

Crypto Today: Bitcoin, Ethereum, XRP stay put as market faces potential supply overhang from Bitfinex and US

Bitcoin (BTC) maintained its move above the $62,000 psychological level, trading around $62,120 on Wednesday despite $58.2 million in outflows across BTC ETFs, per Farside Investors data. However, the top cryptocurrency could face potential selling pressure in the coming months if the US government decides to sell the 69,730 BTC seized from Silk Road that it recently gained control over.

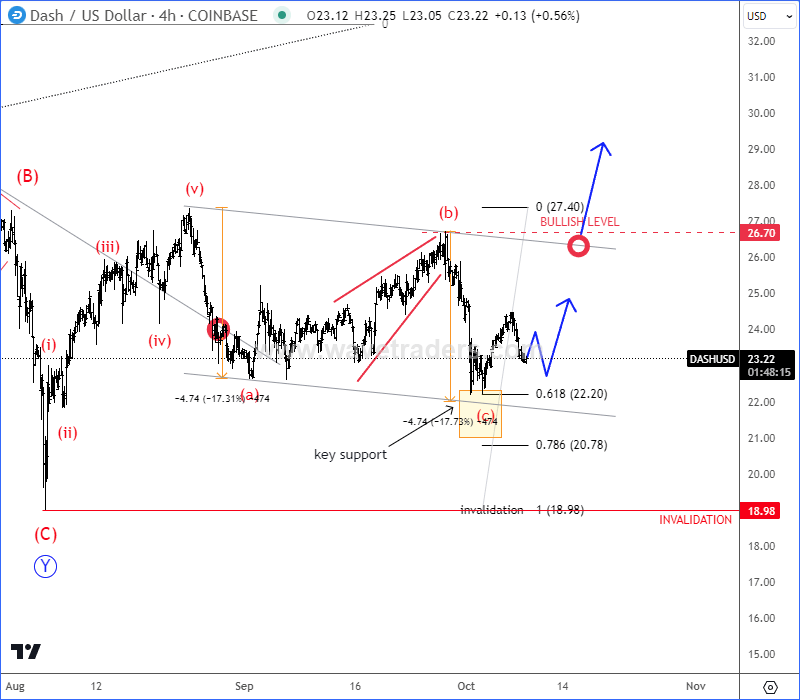

Dash forms bull setup

Looking at the 4-hour chart of Dash with ticker DSHUSD, we can see sharp and impulsive bounce from August lows after that final leg (C) of Y of 5, so strong support can be actually in place, if we consider it’s breaking above channel resistance line by a five-wave impulse. That said, watch out on more upside after current a-b-c correction that can finished at projected 22-20 support area, but only impulsive five-wave recovery back above channel resistance line and 26,70 region would be confirmation for bulls. Invalidation level is at 19.

Author

FXStreet Team

FXStreet