Cryptocurrencies Price Prediction: Bitcoin, Ethereum & Litecoin – European Wrap 20 April

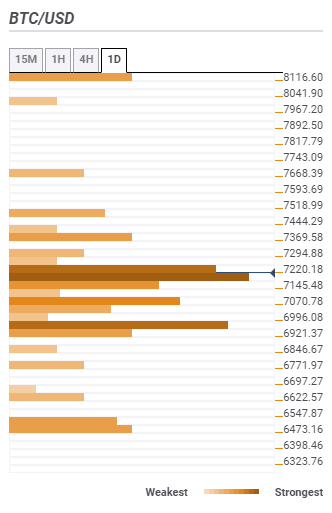

Bitcoin Price Prediction: BTC/USD lift-off to $9,000 in the Q2 of 2020 imminent – Confluence Detector

Bitcoin commenced the week’s trading in the positive territory after defending support above $7,200. Last week’s surge above $7,000 was the second after Bitcoin crashed more than 50% in March amid a widespread COVID-19 triggered selloff. At the moment, Bitcoin is trading over 85% higher from the lows trade in March. The gains last week were reminiscent of the upward correction in the United States stock market. Bitcoin has lately become more and more correlated with the stock market and other traditional asset. A situation that has had people questioning Bitcoin’s safe haven status.

Ripple Price Analysis: XRP/USD vulnerable to short-term losses as bulls fail to take price above local resistance $0.1975

Ripple's XRP settled above $0.1900. The third-largest digital asset has recovered after a sharp sell-off under $0.1800 during early Asian hours but the further upside seems to be limited at this stage as the price lost bullish momentum on approach to $0.1970. XRP/USD has gained 2.0% since the beginning of the day and stayed unchanged on a day-to-day basis. Ripple's trading volume is registered at $8.5 billion, while an average daily trading volume settled at $2.0 billion.

Ethereum price analysis: ETH/USD may retest $160.00 before another bullish leg towards $200.00

Ethereum hit $190.00 on April 18 only to retreat to $181.80 by press time. The second-largest digital asset hit the low at $176.55 on Sunday and has been range-bound with bullish bias ever since. However, the recovery seems to be is limited for now. ETH/USD has gained 1% since the beginning of Monday and stayed unchanged on a day-to-day basis. Ethereum's market value is registered at $20.3 billion, while an average daily trading volume settled at $18.8 billion.

Author

FXStreet Team

FXStreet

-637229671992029999.png&w=1536&q=95)

-637229697191780572.png&w=1536&q=95)