Cryptocurrencies Price Prediction: Bitcoin, & Ethereum – European Wrap 7 July

Bitcoin Weekly Forecast: Could BTC revisit $25,000 as ETF-induced hype dissipates?

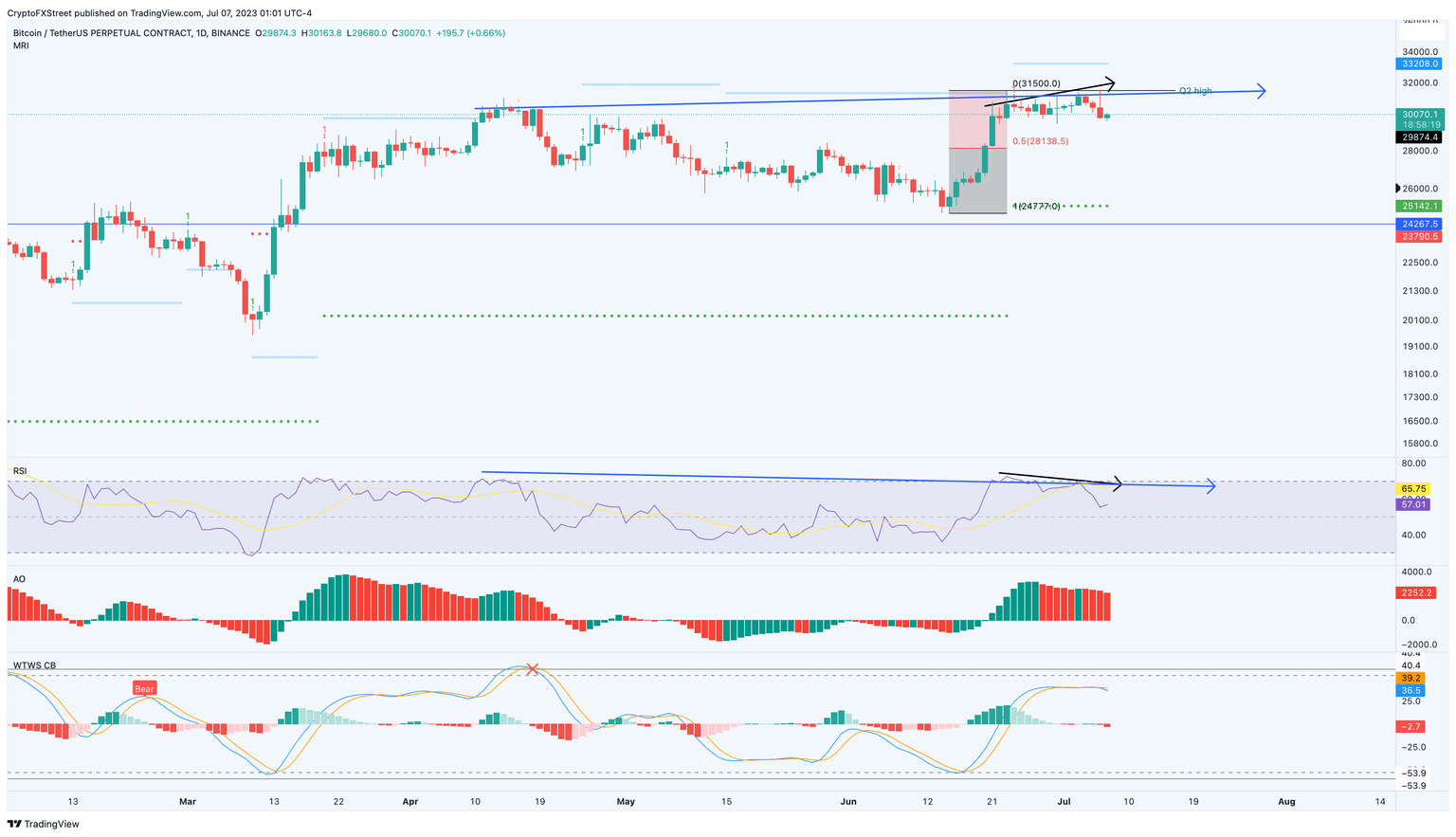

Bitcoin (BTC) price shows multiple sell signals on the daily chart, hinting at a short-term correction. Although the longer-term outlook remains bullish, the hype generated by multiple US-based companies filing for Bitcoin ETF seems to be waning. The decline in investor-frenzy coupled with short-term traders booking profits could be the main driver of the incoming sell-off.

Bitcoin (BTC) price shows an evident bearish divergence. This setup contains BTC producing a higher high while the Relative Strength Index (RSI) sets up a lower high. The non-conformity eventually leads to a decline in the underlying asset’s market value.

US NFP reaction: Bitcoin price wavers as investors reassess Fed expectations after jobs report

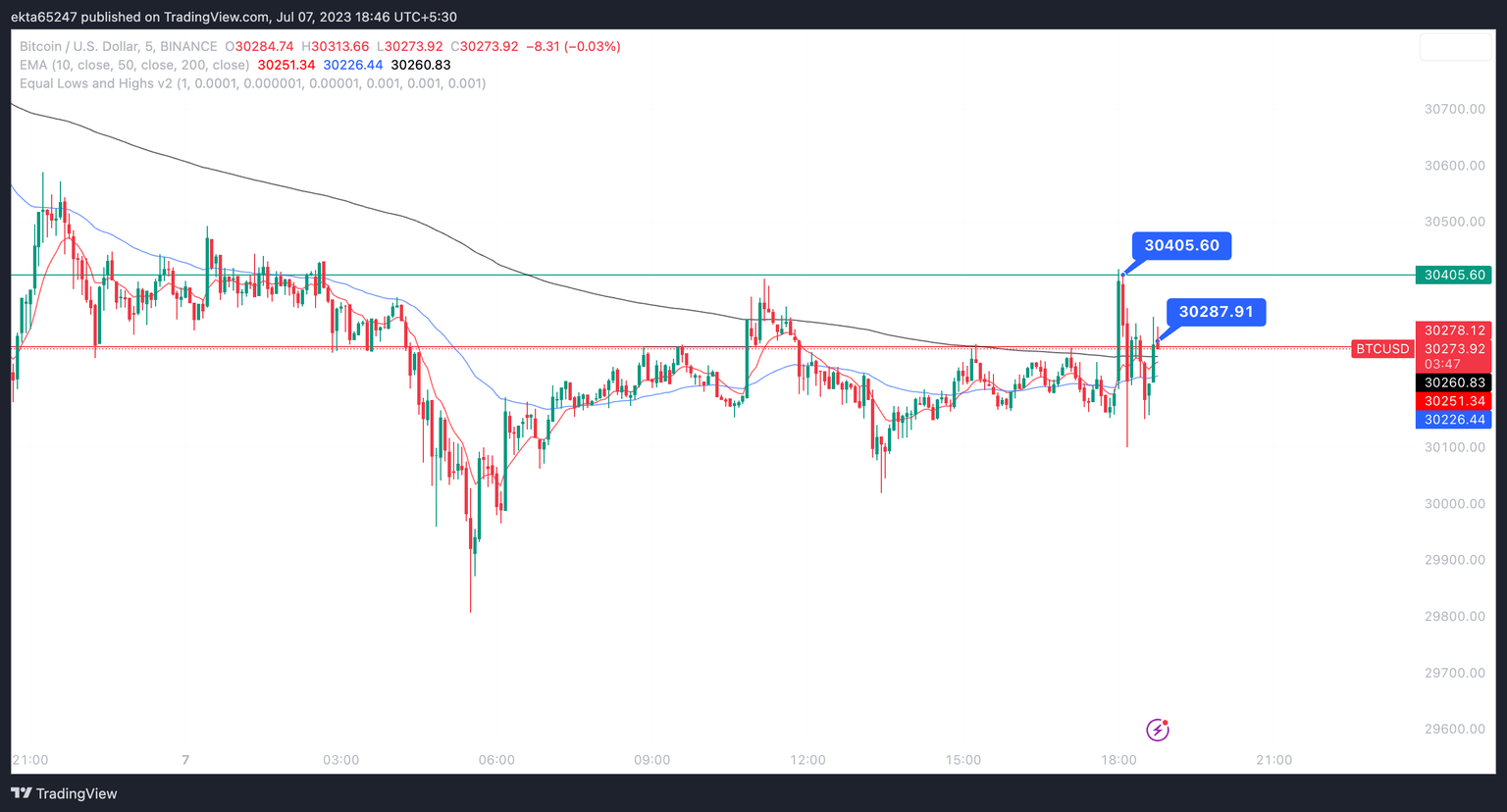

US Nonfarm Payrolls data for June revealed an addition of 209,000 jobs, below the market’s expectation of 225,000. The reading could imply fresh gains in Bitcoin, Ethereum and risk assets.

Bitcoin price sustained above the key psychological level of $30,000 and Ethereum price steadied above $1,800 in response to the US NFP data release. Bitcoin and Ethereum prices are coiling in response to the addition of 209,000 Nonfarm Payrolls in the US. US NFP data came in below market expectations for the first time since April 2023. The unemployment rate edged lower, meeting the expectation of 3.6%. These data points have reduced the likelihood of future rate hikes by the US Federal Reserve.

Bitcoin, Ethereum brace for volatile week with upcoming Nonfarm Payrolls data release

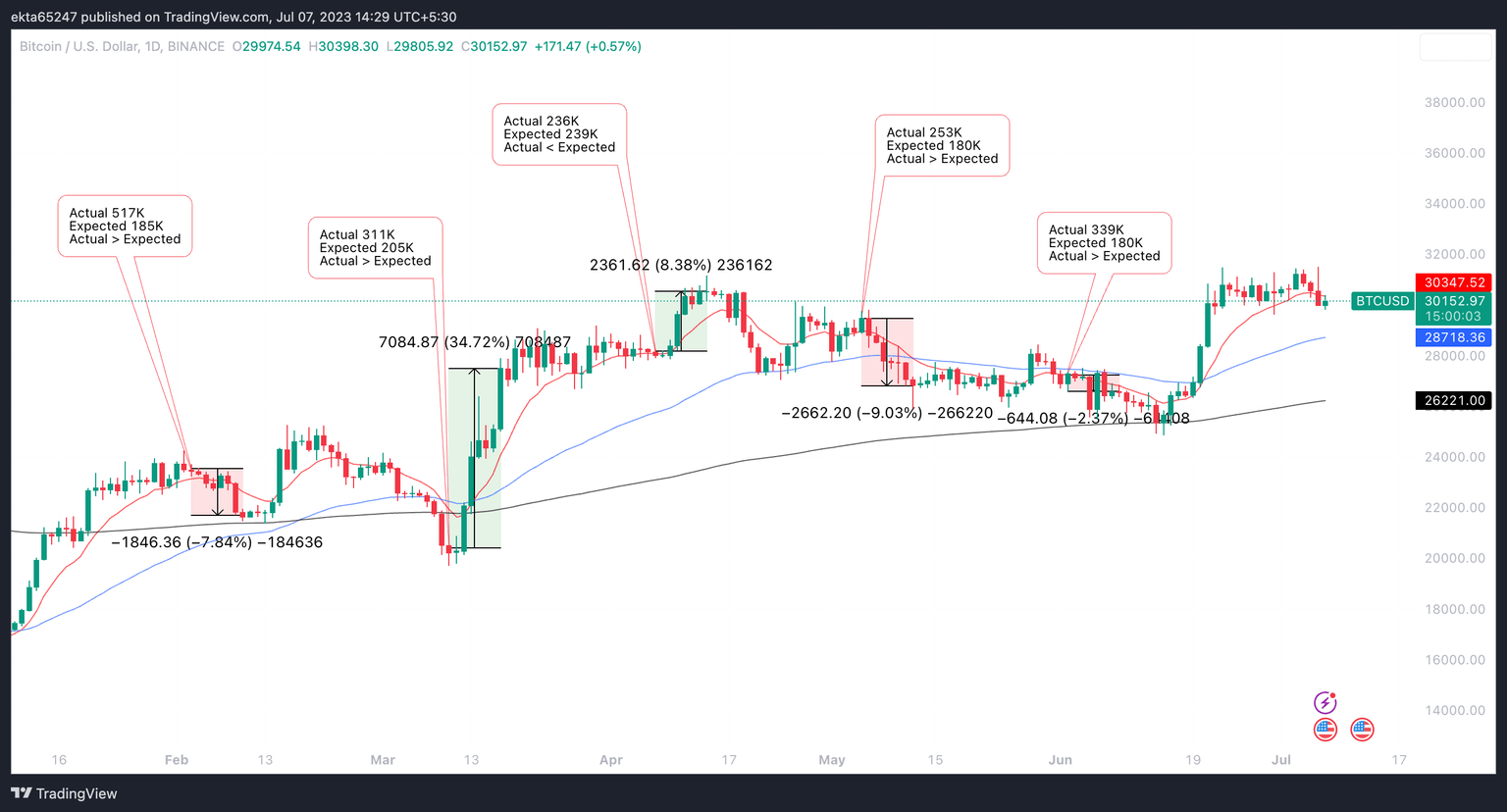

Crypto market participants are gearing up for a volatility-filled week ahead of the US Nonfarm Payrolls (NFP) data for June. The consensus estimate is the addition of 225,000 jobs in June, and the unemployment rate is estimated to come in at 3.6% vs. 3.7% seen in May.

A hotter than expected jobs report could trigger volatility in risk assets like Bitcoin and Ethereum in the following week. Typically, the release of US NFP data has ushered volatility into Bitcoin price action. The asset rallies in the event the actual payrolls figure is below the forecast. In other cases, there is a decline in BTC price as seen in the chart below.

Author

FXStreet Team

FXStreet