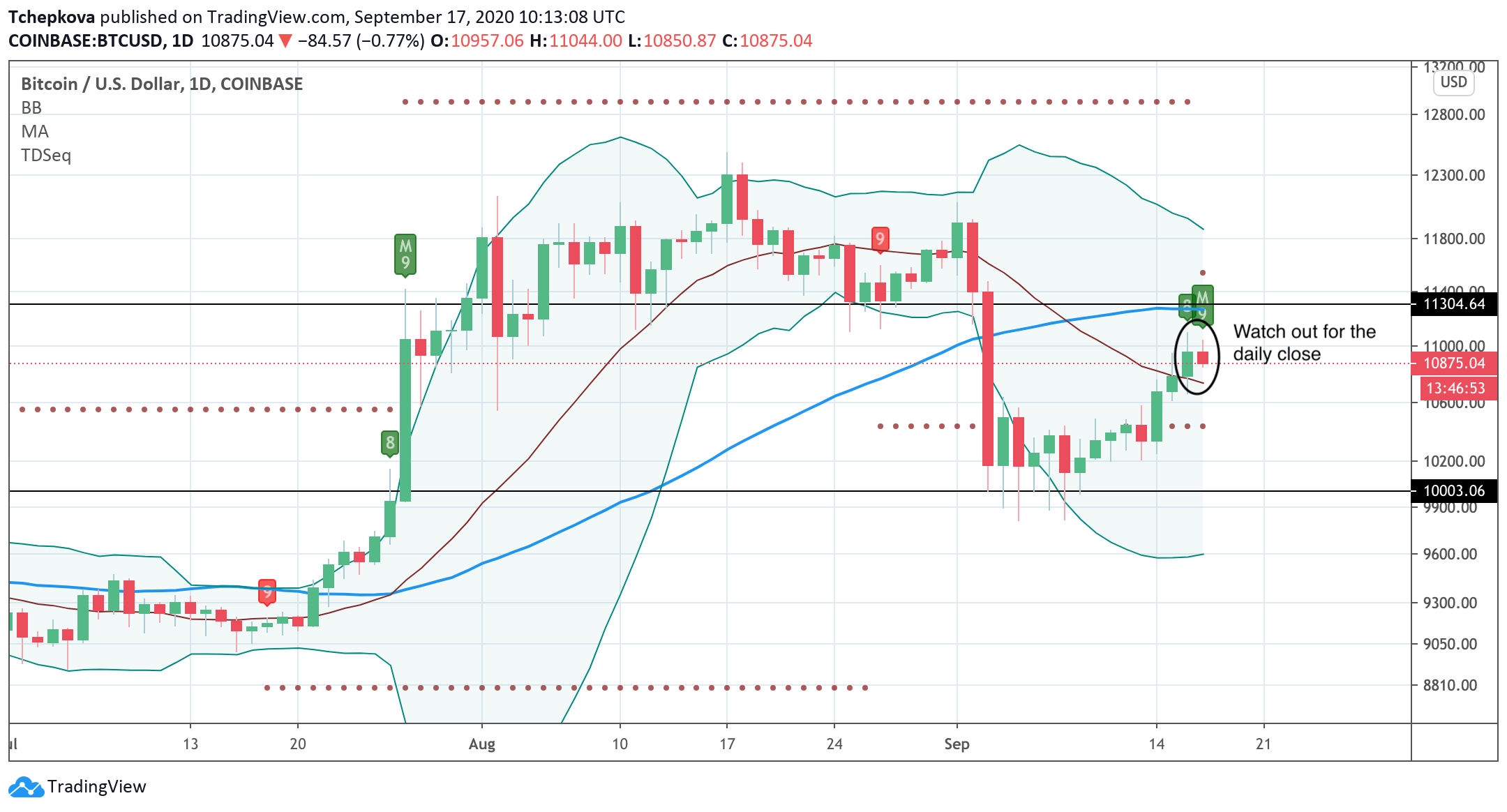

Bitcoin Price Analysis: BTC poised to retest $10,500 before the growth resumed

As we reported in our previous analysis, the TD Sequential indicator created a sell signal, which is now confirmed by the ninth bar and a developing bearish harami pattern. This candlestick formation consists of a long bullish candle followed by the second candle in the body of the first one. Once confirmed, this pattern will increase the probability of Bitcoin's downside reversal with the first target at $10,700 (the middle line of the daily Bollinger Band), and $10,500, the barrier that served as a strong resistance during the first and the second weeks of September. Read more ...

Ethereum Price Analysis: ETH fundamentals imply that something big is brewing

ETH/USD has been one of the best-performing coins out of the top-10 on Thursday. The second-largest digital asset price has gained nearly 4% since the beginning of the day and 4.5% since this time on Wednesday. At the time of writing, ETH/USD is hovering around $380. The coin is moving within a short-term bullish trend amid high volatility. Read more ...

Band Protocol Price Prediction: BAND unstoppable breakdown eyes $5 for support

Band Protocol users become accustomed to declines since its listing on Coinbase. The token embraced an impressive rally following the listing, which saw it almost close in on the critical resistance at $18. However, after forming a double top pattern as previously discussed, the token started to trim the gains that had been accrued. Meanwhile, BAND has dived 60% since the listing on Coinbase and is doddering at $6.91 at writing. Read more ...

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

Bitcoin Weekly Forecast: BTC nosedives below $95,000 as spot ETFs record highest daily outflow since launch

Bitcoin price continues to edge down, trading below $95,000 on Friday after declining more than 9% this week. Bitcoin US spot ETFs recorded the highest single-day outflow on Thursday since their launch in January.

Bitcoin crashes to $96,000, altcoins bleed: Top trades for sidelined buyers

Bitcoin (BTC) slipped under the $100,000 milestone and touched the $96,000 level briefly on Friday, a sharp decline that has also hit hard prices of other altcoins and particularly meme coins.

Solana Price Forecast: SOL’s technical outlook and on-chain metrics hint at a double-digit correction

Solana (SOL) price trades in red below $194 on Friday after declining more than 13% this week. The recent downturn has led to $38 million in total liquidations, with over $33 million coming from long positions.

SEC approves Hashdex and Franklin Templeton's combined Bitcoin and Ethereum crypto index ETFs

The SEC approved Hashdex's proposal for a crypto index ETF. The ETF currently features Bitcoin and Ethereum, with possible additions in the future. The agency also approved Franklin Templeton's amendment to its Cboe BZX for a crypto index ETF.

Bitcoin: 2025 outlook brightens on expectations of US pro-crypto policy

Bitcoin (BTC) price has surged more than 140% in 2024, reaching the $100K milestone in early December. The rally was driven by the launch of Bitcoin Spot Exchange Traded Funds (ETFs) in January and the reduced supply following the fourth halving event in April.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.

-637358479119790484.png)

-637359321532974209.jpg)