Cryptocurrencies Price Prediction: Bitcoin, Dogecoin & Ethereum – Asian Wrap 04 March

Crypto Today: Trump tariffs trigger $1.1B sell-off 24-hours after crypto strategic reserve proposal

Bitcoin’s 13% decline in early Asian trading on Tuesday triggered a $125 billion market cap decline, wiping out gains recorded on Sunday. Bitcoin ETFs recorded only $3.8 million inflows on Monday according to Fairside.co.uk data.

Dogecoin Price Forecast: DOGE’s bearish trend persists despite Musk’s support

Dogecoin (DOGE) extends its decline, trading around $0.19 on Tuesday after falling nearly 17% the previous day. The recent correction in DOGE has triggered a wave of over $20 million in liquidations in the last 24 hours and more than $100 million last week. The technical outlook and long-to-short ratio suggest a further pullback targeting the $0.14 mark.

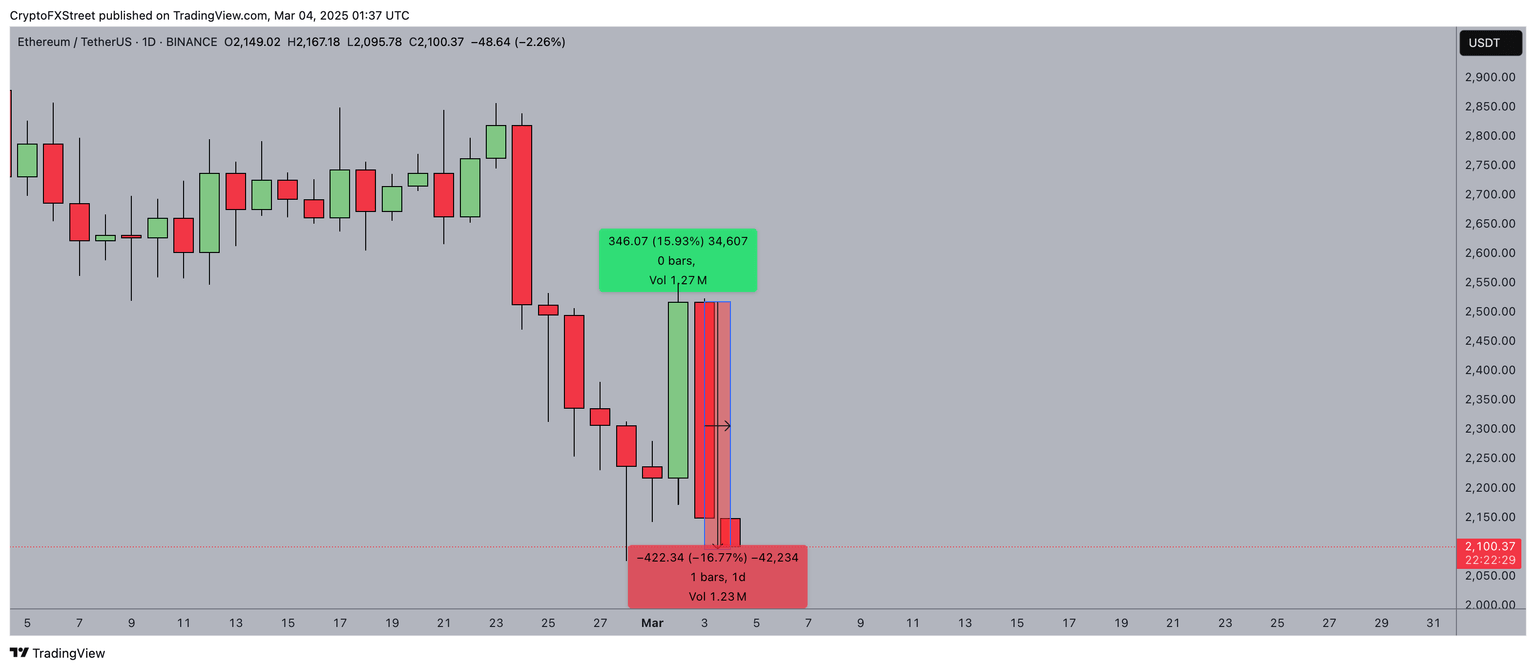

ETH sellers mount $1.8B resistance as tariffs nullify bullish catalysts from Trump and Ethereum Foundation

Ethereum price dipped 16% to hit $2,100 on Monday, after climbing 15% from $2,200 to $2,550 hours after Trump confirmed the inclusion of ETH in a proposed US Crypto Strategic Reserve. With short-term traders booking profits, market sentiment now hangs in the balance.

Author

FXStreet Team

FXStreet