Cryptocurrencies Price Prediction: Bitcoin, AAVE & Binance Coin – European Wrap 23 August

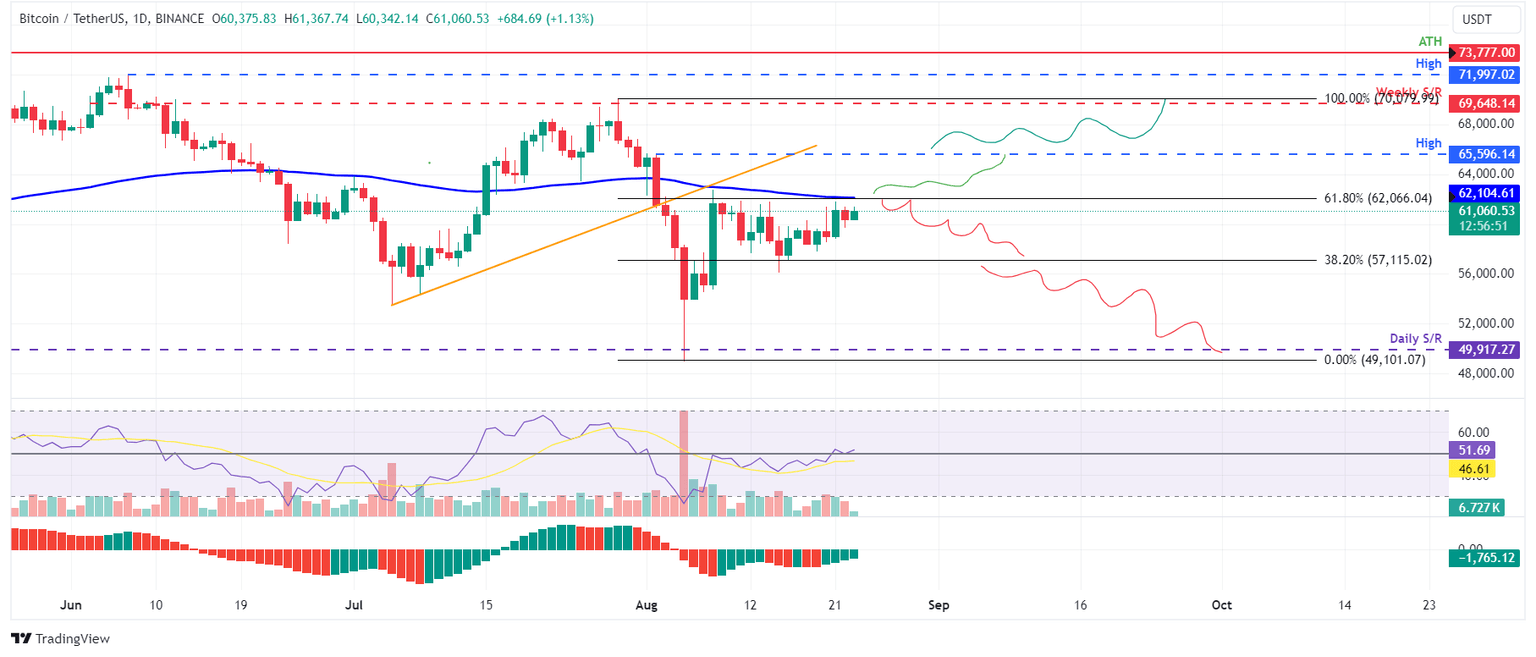

Bitcoin Weekly Forecast: Can BTC break above $62,000 barrier?

Bitcoin (BTC) trades above $60,000 on Friday, gaining more than 4% this week so far, but fluctuating within a range between $57,000 and $62,000 for the last 15 days. On-chain data shows contradicting signs, with institutions accumulating Bitcoin while some whales are selling. Additionally, the US spot Bitcoin ETFs recorded inflows this week, and continued Mt.Gox fund movements could bring volatility in Bitcoin's price in the coming days.

According to data from Data Nerd, Ceffu and Cumberland, an institutional-grade custody solutions company for cryptocurrencies and digital assets, withdrew 246.33 and 300 BTC worth $14.99 million and $18.36 million, respectively, from the Binance exchange on Friday. This indicates that institutions are accumulating BTC as the coin’s price fluctuates between $57,000 and $62,000.

AAVE could rally 25% as DeFi token breaks out of nearly two-year long accumulation

AAVE, a Decentralized Finance (DeFi) token that ranks in the top 50 cryptocurrencies by market capitalization, has broken out of a nearly two-year long accumulation range after rallying over 25% in the last seven days. Despite the recent price increase, an on-chain analysis from iCryptoAI shows that AAVE holdings from whale wallets have continued to increase in the last 24 hours, suggesting buying pressure persists and making it more likely that the coin extends gains.

Data from on-chain analysis platform iCryptoAI shows consistent accumulation of the DeFi token by large wallet investors. On August 21, AAVE price climbed to a peak of $143.78 on Binance, the highest since mid-March. Analysts at iCryptoAI mention that the buying pressure is stronger than selling across decentralized exchanges.

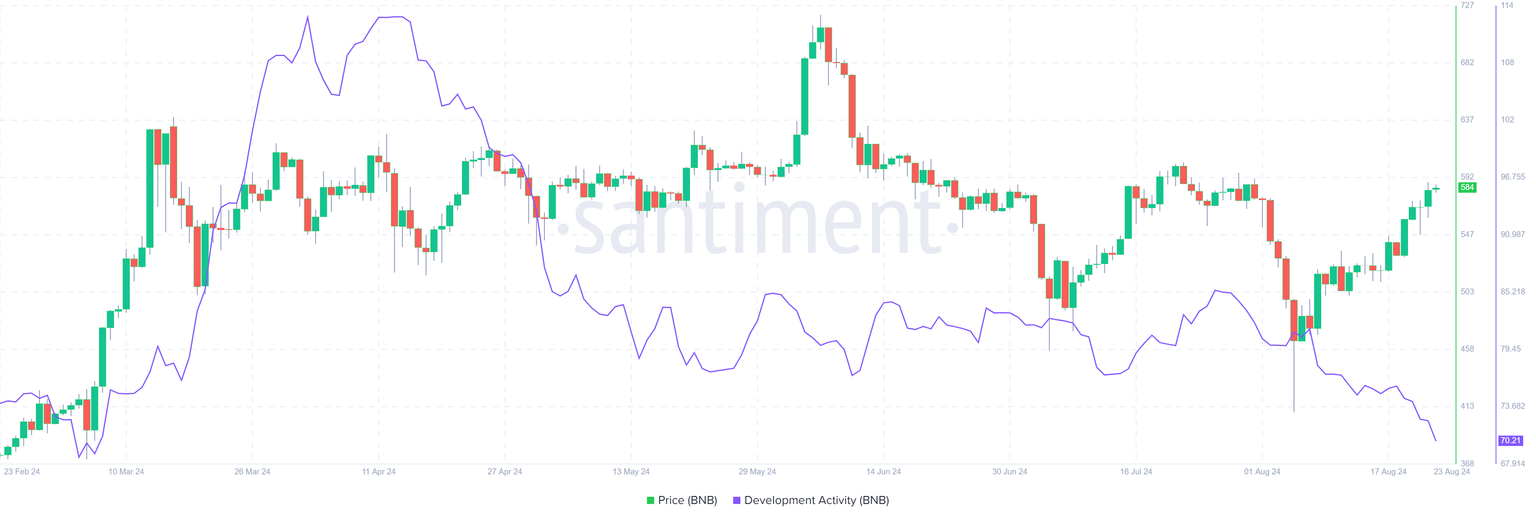

Binance Coin price outlook improves as on-chain metrics support bulls

Binance Coin (BNB) rises 10% this week, posting a third consecutive week of gains, and further gains are likely in the upcoming days driven by Binance Labs’ recent investment in crypto startup projects, rising decentralized exchange (DEX) trading volume and increasing revenue.

Binance Labs has recently invested in four crypto startups through its MVB Accelerator Program. The news, announced on Thursday, led to a more than 2% price jump for BNB. "This season received over 700 applications and the programs' highly selective process admitted less than 2% of the total applicant pool to welcome the 13 MVB Season 7 Accelerator teams," BNB Chain said in a Twitter post.

Author

FXStreet Team

FXStreet