Cryptocurrencies Price Prediction: Axie Infinity, Solana & Matic – Asian Wrap 21 Dec

Axie Infinity price to provide a buying opportunity before AXS rallies 40%

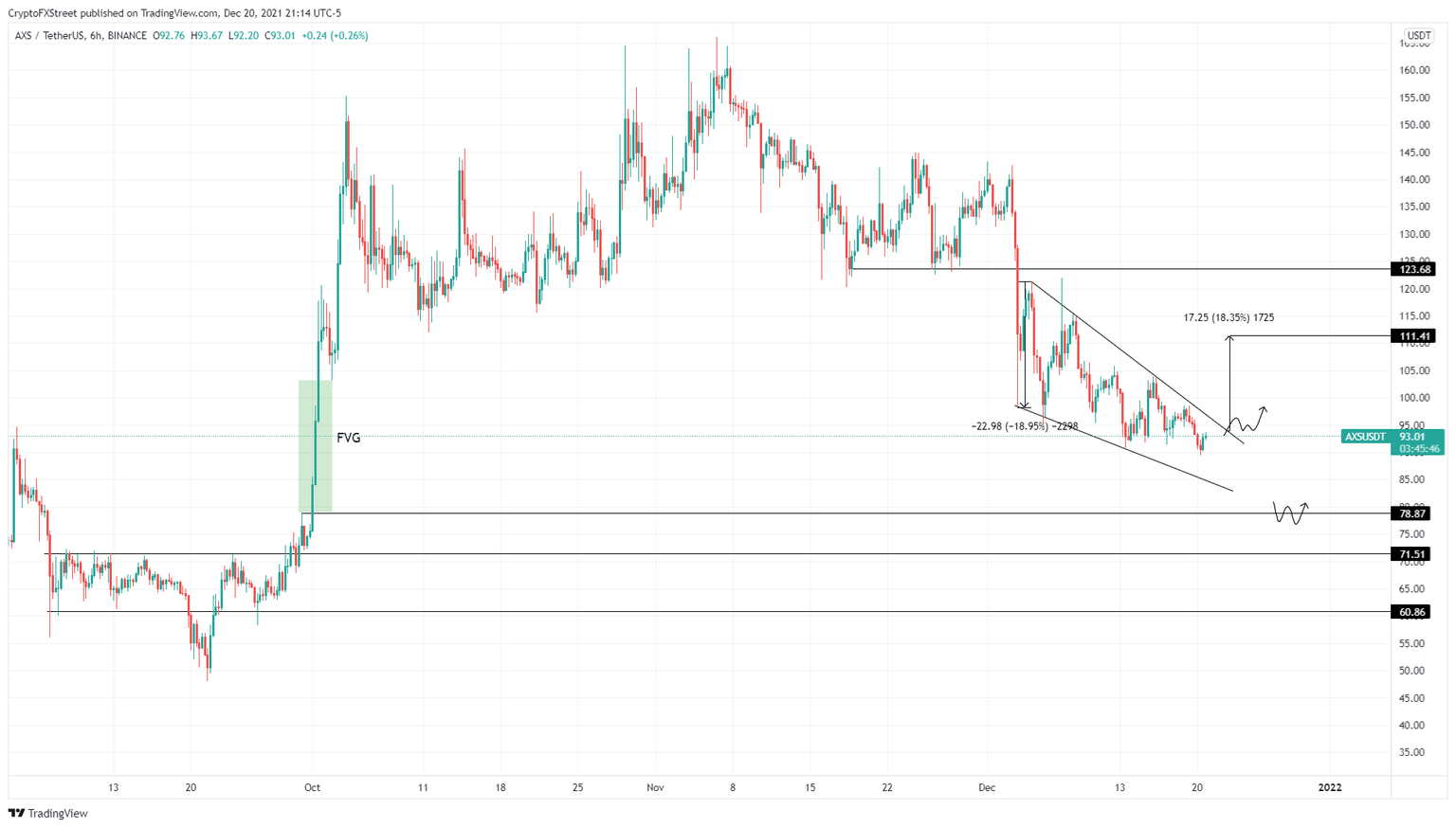

Axie Infinity price set up five lower highs and three lower lows, which, when connected using trend lines, reveals a falling wedge formation. This technical formation forecasts an 18% upswing to $111.41, obtained by adding the distance between the first swing high and swing low to the breakout point at $94.02.

This scenario assumes that Axie Infinity price breaks out of the said pattern and reaches its target. However, this narrative is unlikely due to the fair value gap (FVG) present from $103.22 to $79. Investors should expect AXS to fill this void by retesting the $79 barrier, which will provide them with an opportunity to accumulate at a discount.

Solana price prepares for an 18% upswing as SOL approaches launching pad

Solana price is approaching a demand zone, extending from $157 to $166 after setting equal highs at $188. The double top formed on December 18 is a result of the 27% upswing that started on December 13.

Since this upswing, SOL price has been on a retracement and is likely to find support as it dips into the said demand zone, which also harbors the December 4 swing low at $163. A bounce from either of the two barriers is likely to kick-start an ascent to collect liquidity resting above $188.

MATIC price choppy, hinting return to $1.70

MATIC price is positioning for a bearish fakeout on the daily candlestick chart. The oscillators show that momentum has tapered off a bit, and participants could see MATIC begin a slight shift to the downside. The ultimate downside risk should be limited to the $1.70 value area.

A move to $1.70 would be a fantastic opportunity for bulls to give the bears a little taste of what a fakeout feels like. There have been four attempts by buyers to push MATIC up and out of the rising wedge, but all attempts have failed and have resulted in MATIC returning inside the rising wedge.

Author

FXStreet Team

FXStreet