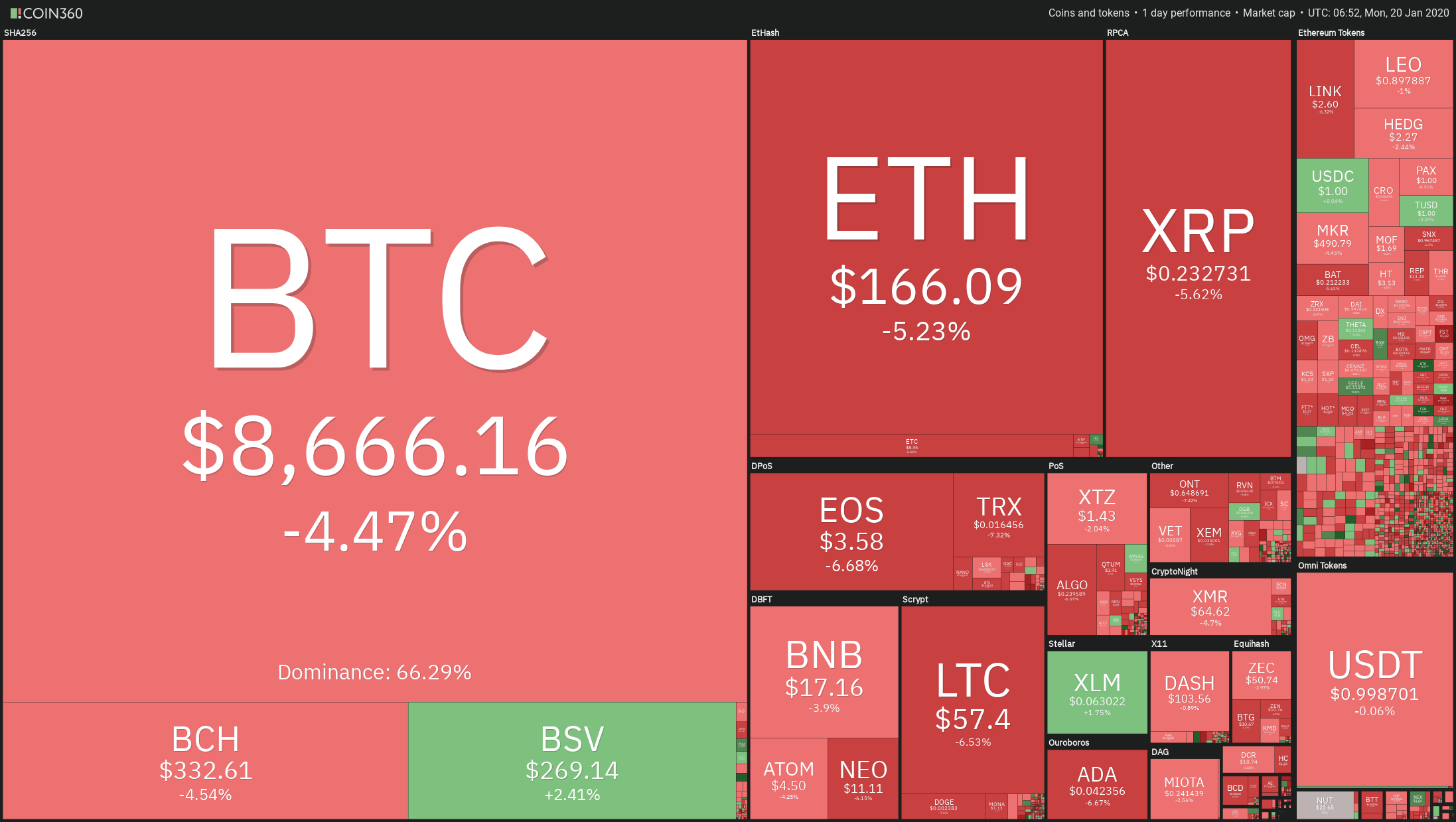

Sunday early morning, a $100 million worth sale order flooded the markets and drove the major cryptocurrencies over 5 percent. Ethereum (-5.3%), Ripple (-5.66$), Litecoin (-6.86%), and Tron (-7.14%) were de worst performers, although Bitcoin (4.46%) is not much ahead. In the Ethereum token sector, falls were generalized, as well., with LINK (-6.14%), SNX(-6.26%), and REP(-7.25%) leading the drops among the top capitalized tokens.

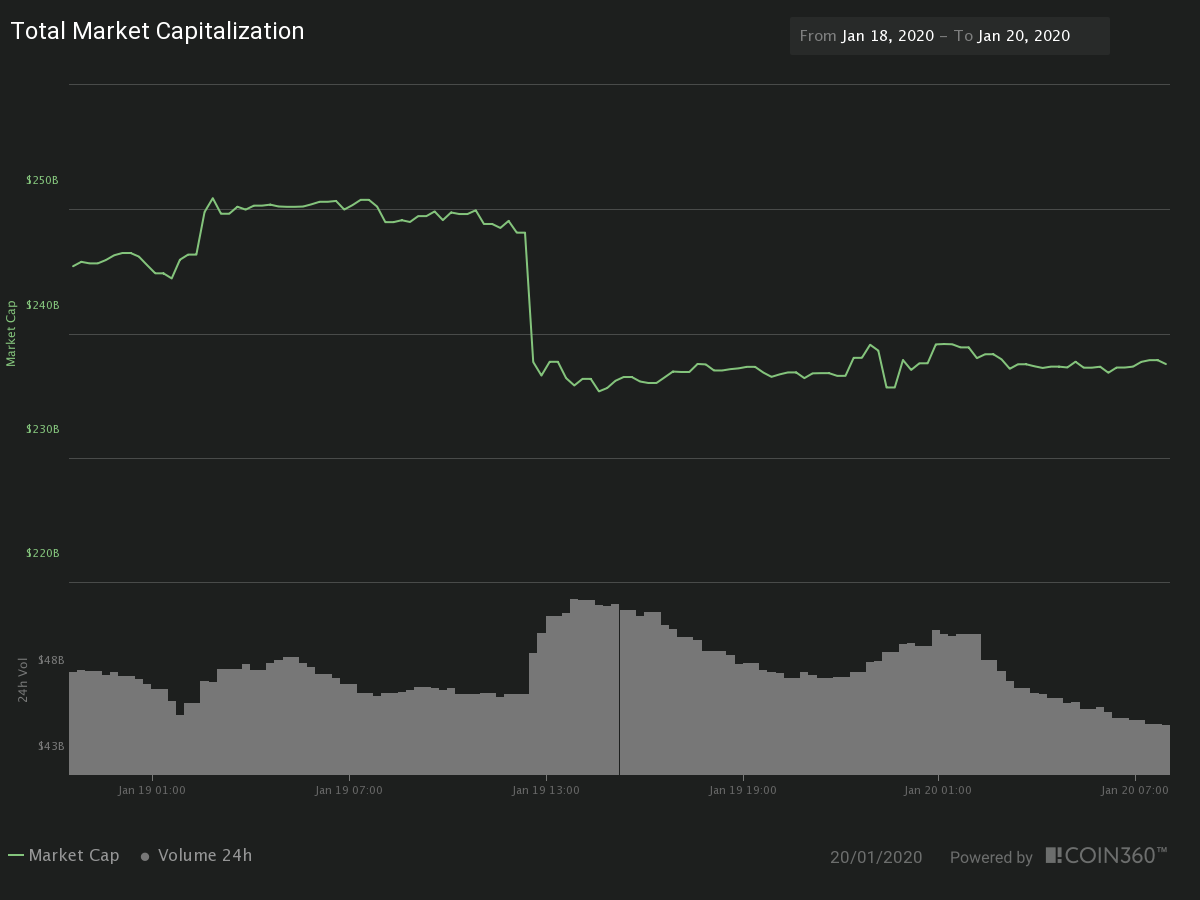

Overall, in the last 254 hours, the market capitalization of the crypto sector dropped by 3.24% to $237.541 billion. That happened on a $45.49 billion of traded volume. Besides that, Bitcoin dominance is kept at 66.35%.

Hot News

South Korea is planning a 20% tax on crypto gains. According to the news outlet The Block, South Korea's Ministry of Economy and Finance has asked his department of income tax to devise a taxation plan for this kind of assets. According to the South Korean news website Pulse, The office of income tax might classify cryptocurrency gains as "other income" such as lottery or prizes, which are charged with 20 percent tax.

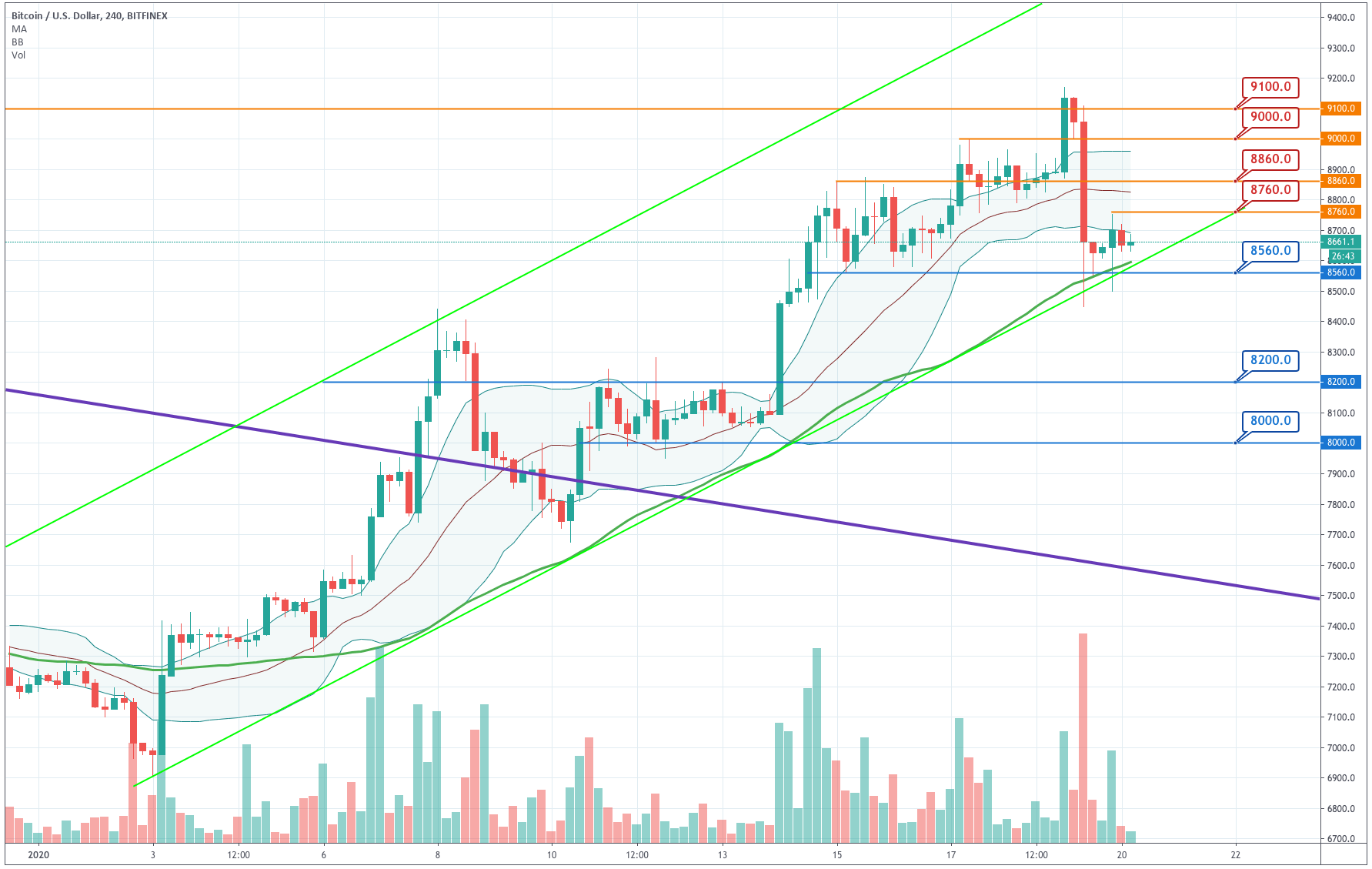

Technical Analysis - Bitcoin

Bitcoin dropped $664 in ten minutes on Sunday, early morning. The price went from $9,100 to $8,450 in a peak of selling activity. Now the price is moving below the -1SD line, although its 50-period SMA is still holding the price, which has been recovered and is currently moving near $7,000. Thus, the upward channel in which the Bitcoin price is moving is still valid. The level to watch is $8,560. A break below this level would mean a new bearish leg could begin for the father of cryptos.

|

Support |

Pivot Point |

Resistance |

|

8,650 |

8,760

|

8,860 |

|

8,350 |

9,000 |

|

|

8,200 |

9,100 |

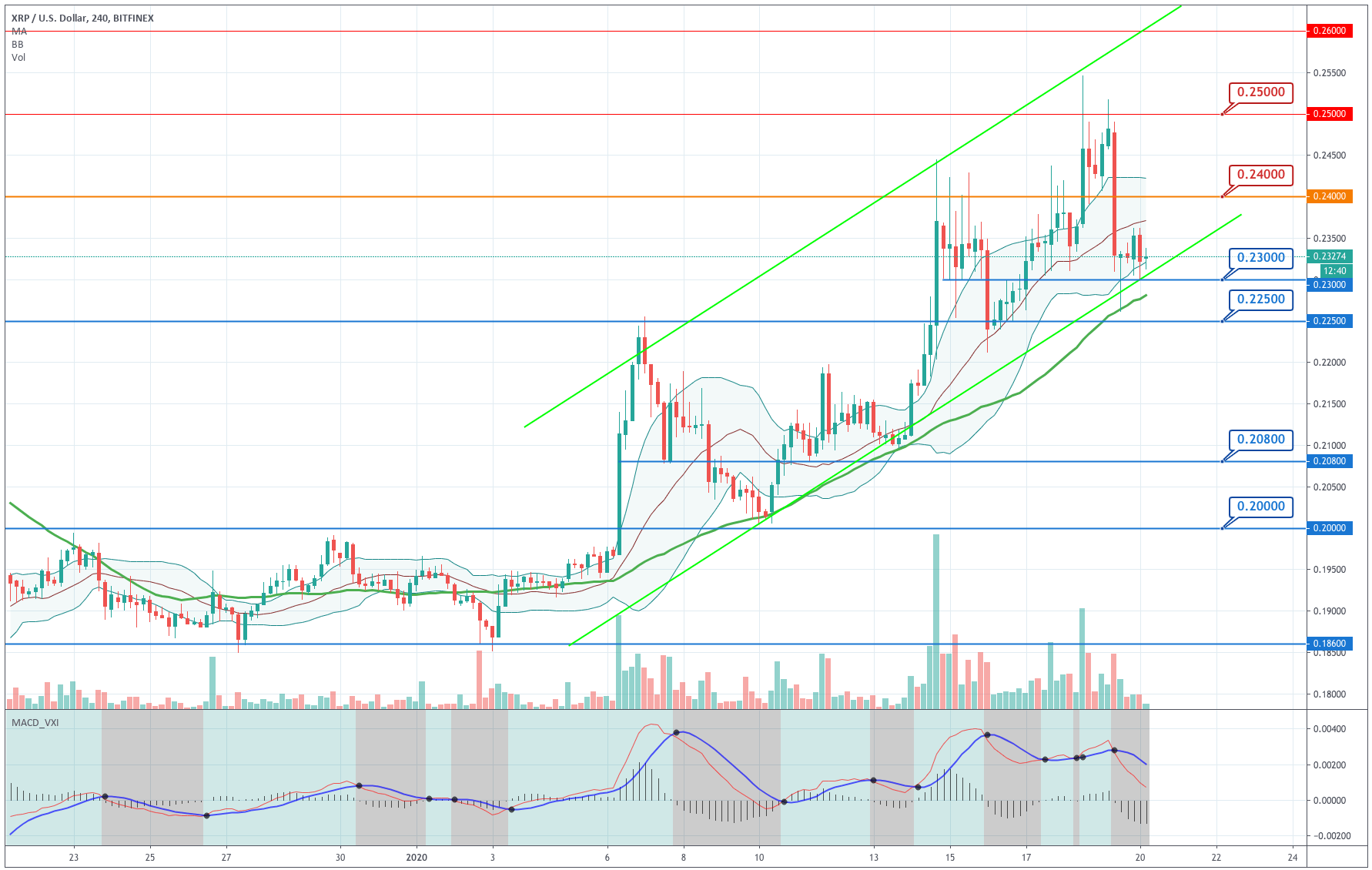

Ripple

Ripple was also dropped, following the spike of selling pressure that affected all the sectors. The price was moved below the Bollinger Bands, but the 50-period SMA rejected it sand now it is moving inside the Bollinger lower channel. The MACD shifted and made a bearish crossover, but, although the price action is worrisome, the rest of the technical signs are leaned to a continuation of the bullish action: The Bollinger bands move still upward, the price is still inside the ascending channel, and the 50-period SMA also points upward. The level to hold is $0.23. A break below it would change XRP's technical outlook.

|

Support |

Pivot Point |

Resistance |

|

0.2250 |

0.2400

|

0.2500 |

|

0.2190 |

0.2600 |

|

|

0.2080 |

0.2660 |

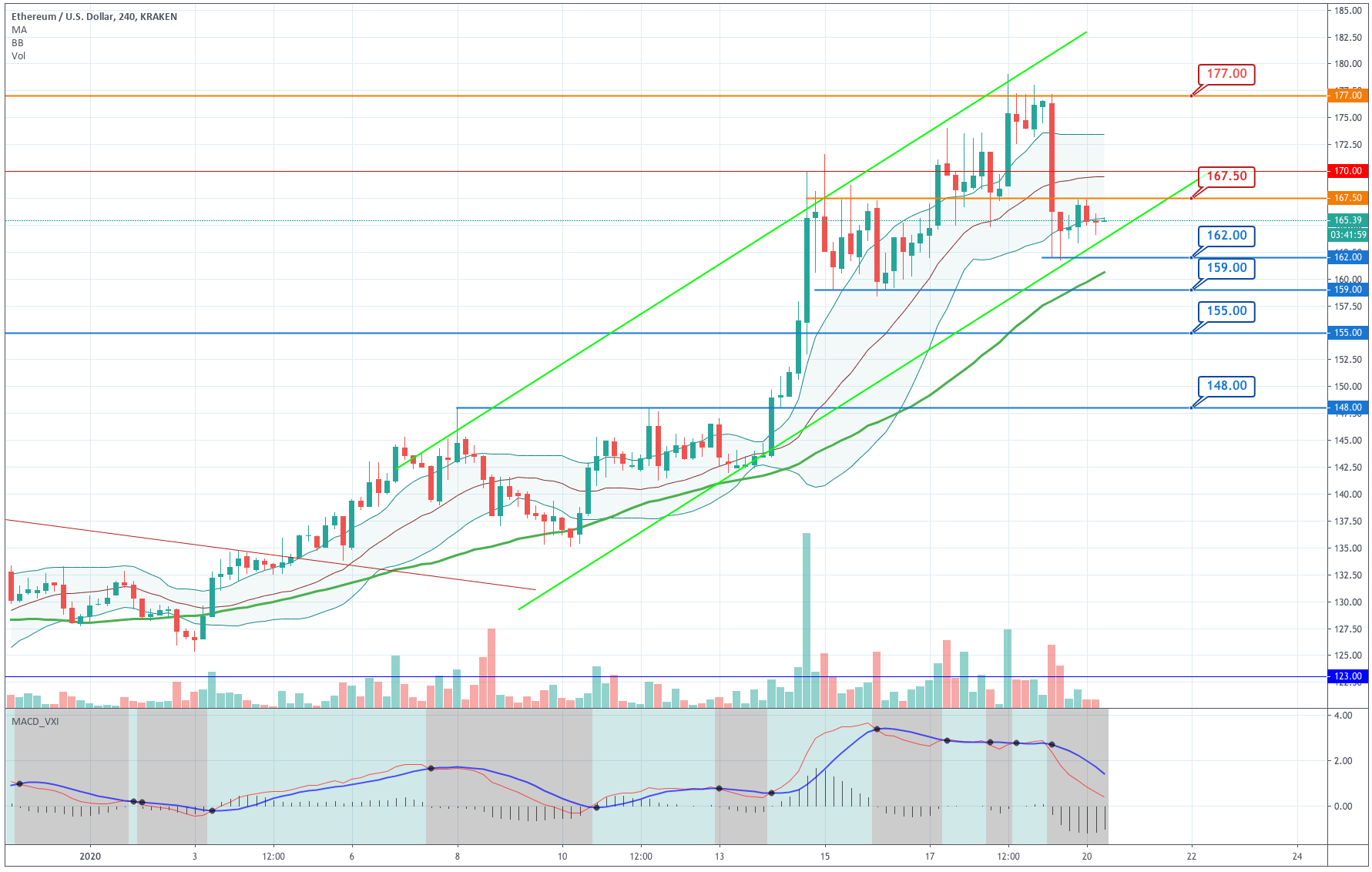

Ethereum

Ethereum also dropped heavily on Sunday. The price now moves touching the -1SD line but inside the ascending channel. The technical situation is similar to Ripple. After the drop, the price is slowly moving up, but the asset would need more buying pressure to move it to the upper channel of the Bollinger Bands. The current outlook is still bullish, but the MACD and the big selling candlestick that wiped five days of activity is a call to caution. The critical level this time is $162. A break above $167.5 would be good to attract more buyers.

|

Support |

Pivot Point |

Resistance |

|

162 |

167.5

|

172 |

|

159 |

177 |

|

|

155 |

180 |

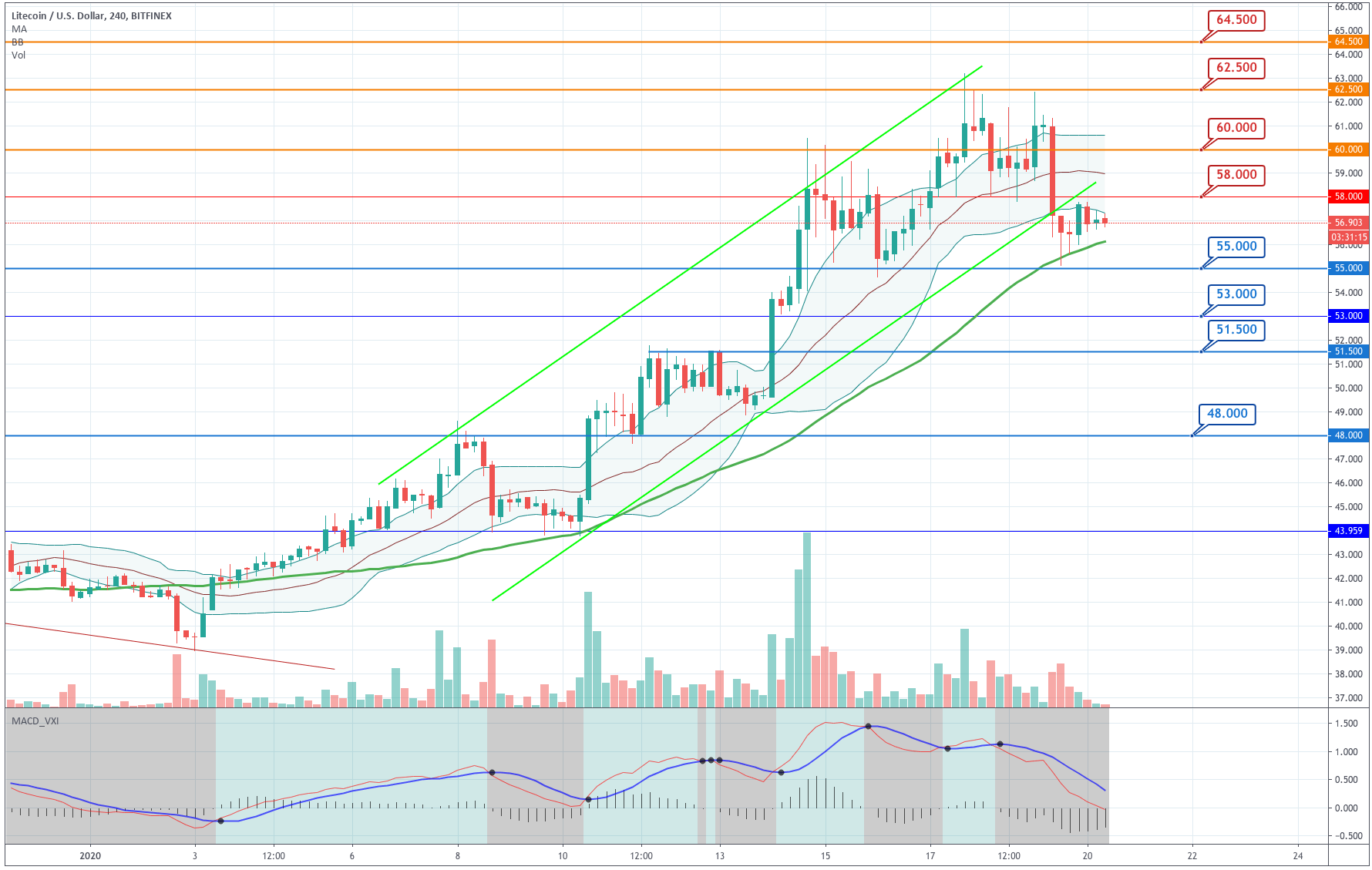

Litecoin

After Sunday's heavy drop, LTC's price bounced off of the $55 support level, but it was held by $58. Now the price moves below the -1SD line but above the 50-period SMA. The Bollinger bands started to turn its slope to negative. Thus, buyers should come in soon, or the price would break to the downside. The support level to hold is $55. A break of this level would mean trouble for the crypto asset, as it would make a Head-and-shoulders pattern. The price has already broken the ascending channel, but not the 50-period SMA, so we still keep a bullish bias on LTC.

|

Support |

Pivot Point |

Resistance |

|

55 |

58

|

62.5 |

|

53 |

64.5 |

|

|

51.5 |

67 |

Try Secure Leveraged Trading with EagleFX!

Risk Warning: CFD and Spot Forex trading both come with a high degree of risk. You must be prepared to sustain a total loss of any funds deposited with us, as well as any additional losses, charges, or other costs we incur in recovering any payment from you. Given the possibility of losing more than your entire investment, speculation in certain investments should only be conducted with risk capital funds that if lost will not significantly affect your personal or institution’s financial well-being. Before deciding to trade the products offered by us, you should carefully consider your objectives, financial situation, needs and level of experience. You should also be aware of all the risks associated with trading on margin.

Recommended Content

Editors’ Picks

Bitcoin Price Forecast: Chances of pullback increase as miner selling ramps up

Bitcoin (BTC) price extends its decline for a second consecutive day on Wednesday, trading slightly down at around $87,600 after a 30% surge since November 5 pushed BTC to a new all-time high at $89,940.

Crypto fraudster pleads guilty of taking part in $73 million laundering scheme

Daren Li, a Chinese citizen, pleaded guilty to conspiracy to help launder $73 million stolen in cryptocurrency scams. Li laundered funds using a network of shell companies and international bank accounts.

Cardano bulls show signs of exhaustion

Cardano’s price is falling on Tuesday as it faces rejection around $0.624 and traders engaged in profit-taking following the recent rally. Technical indicators show signs of weakness in upward momentum as the RSI exits from the overbought territory.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: BTC, ETH and XRP could face pullbacks

Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) trade in the red on Tuesday following strong rallies since last week, driven by crypto-friendly candidate Donald Trump's election victory.

Bitcoin: Further upside likely after hitting new all-time high

Bitcoin hit a fresh high of $76,849 on Thursday as crypto-friendly candidate Donald Trump won the US presidential election. Institutional demand returned with the highest single-day inflow on Thursday since the ETFs’ launch in January.

Best Forex Brokers with Low Spreads

VERIFIED Low spreads are crucial for reducing trading costs. Explore top Forex brokers offering competitive spreads and high leverage. Compare options for EUR/USD, GBP/USD, USD/JPY, and Gold.