Cryptocurrencies Moving in a Range

In the last 24 hours, cryptocurrencies were moving in a range. The bounce after the large drop was minimal for the Bitcoin and Ethereum, which show investors are still in the sidelines, as equity markets may continue sliding by the economic consequences of the coronavirus and the oil price war between Russia and Saudi Arabia.

Bitcoin(-1.07%) and Ethereum (-0.95%) show a slight drop, whereas minor coins such as Waves (+19%), Ark (+19.5%), EDC(+23.7%), and SBD(+91.4%) continue ascending.

The major Ethereum-based tokens show slight drops, or small gains, indicating they are in the same situation as the leading cryptocurrencies. There are exceptions, though, such as HEDG(-6.06%) moving bearishly, and BAT (+6.9%), KNC(+10.3$), REN(+15.47%) and SNX(+21%) moving nicely up.

The market cap of the sector is mostly unchanged at $222.579 billion, while the traded volume in the last 24 hours shrunk to $43.45 billion (-34.22%). Meanwhile, Bitcoin dominance remains at 64.37 percent.

Hot News

The US Federal Reserve injected $168 billion into the economy, as a measure to stop the stock market collapse and help the economy cope with the effects of the coronavirus spread. Many cryptocurrency advocates say this is why cryptocurrencies such as Bitcoin are needed.

The IOTA network resumes its operations after several weeks down. IOTA users have been unable to transfer their coins over the network since February 14, after a security event, the Trinity Attack, resulting in the steal of account seeds and $1.97 million in user funds. Although anyone who lost funds will be refunded, people were not happy with how things have developed, and fear IOTA will be heavily sold in exchanges the following days.

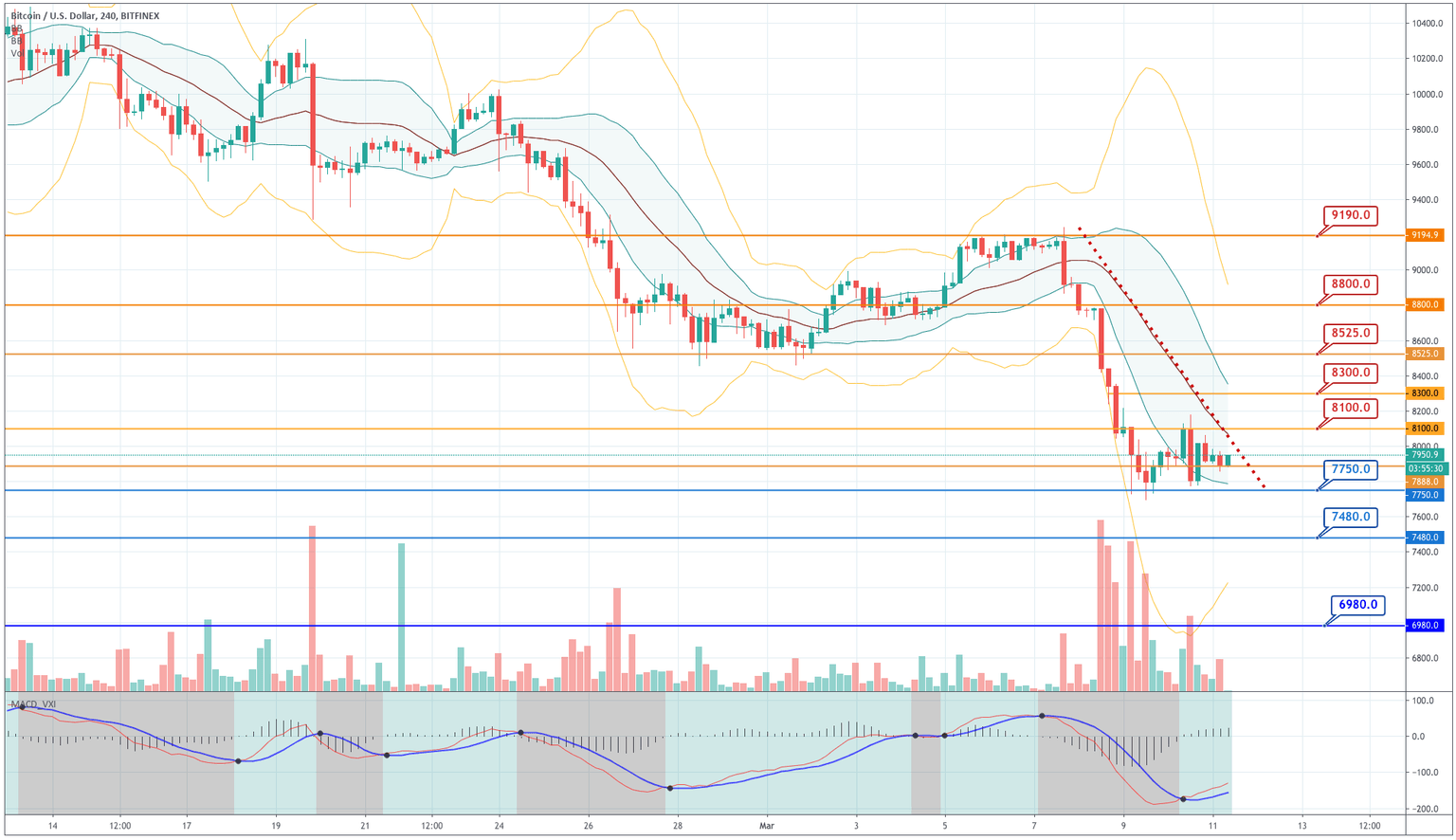

Technical Analysis - Bitcoin

Bitcoin is struggling to hold the level of $7,900 as it is drifting sideways and now is close to the Bollinger mean line. That line, highlighted with a dotted line, is likely to act as a dynamic resistance. If the market action can break past it, it will be good news for the buyers.

We see, though, that the price is repulsed by the line, and the current situation has a negative bias. The main levels to keep are $7.750 to the downside and $8,100 to the upside.

|

Support |

Pivot Point |

Resistance |

|

7,750 |

7,900

|

8,100 |

|

7,480 |

8,300 | |

|

7,250 |

8,525 |

Ethereum

In the last 24 hours, Ethereum moved in a tight range, like the rest of the leading coins. ETH is moving towards its mid-Bollinger line, which acts as a consensus of value for the last 20 4H periods. That means the price moved out of oversold and is ready for its next move. Thus, we should watch the breakouts of the $194 level to the downside and the $204 level to the upside.

|

Support |

Pivot Point |

Resistance |

|

194 |

204 |

216 |

|

187 |

235 | |

|

179 |

248 |

Ripple

Ripple continues moving between $0.20 and $0.217, its price touching the mid-Bollinger line. Traders should observe these two values for breakouts. Although the MACD is currently in a bullish phase, it moves in the negative territory, and since the price is mainly in the lower channel of the Bollinger bands, the current bias is bearish. Thus, upward breakouts may fail and trap the bulls in wrong bets.

|

Support |

Pivot Point |

Resistance |

|

0.2000 |

0.217

|

0.2290 |

|

0.1860 |

0.2440 | |

|

0.1690 |

0.2570 |

Chainlink

Chainlink is making a sideways action between the 3.9 and 4.15 levels. The price is still moving on the lower side of the Bollinger bands, so we need to wait for the confirmation of the end of this correction. On the chart, we see that the price is still holding the pattern of higher highs and higher lows; thus, we conclude that the primary bullish trend is still in place.

|

Support |

Pivot Point |

Resistance |

|

3.9 |

4.15

|

4.4 |

|

3.7 |

4.6 | |

|

3.39 |

4.88 |

Author

EagleFX Team

EagleFX

EagleFX Team is an international group of market analysts with skills in fundamental and technical analysis, applying several methods to assess the state and likelihood of price movements on Forex, Commodities, Indices, Metals and