Crypto.com’s CRONOS price sees gains strength to break stiff resistance and target $0.46

- Crypto.com price is trading sideways over the weekend, seeing bulls buying at the low-end of the range.

- CRO price action looks ready for bulls to jump above three price caps at once.

- Expect a 10% pop somewhere this week with an additional catalyst to set fire to the fuse.

Crypto.com (CRO) price has been trading to the upside in a relief rally on Friday and Saturday but then saw a paring back of those gains on Sunday and early this morning. Bulls came in quickly to buy the dip, and the momentum was set for them to take out three key resistances at once. Before that happens, an additional catalyst is needed to light the fuse for the dynamite breakout to $0.46.

Crypto.com price set to jump

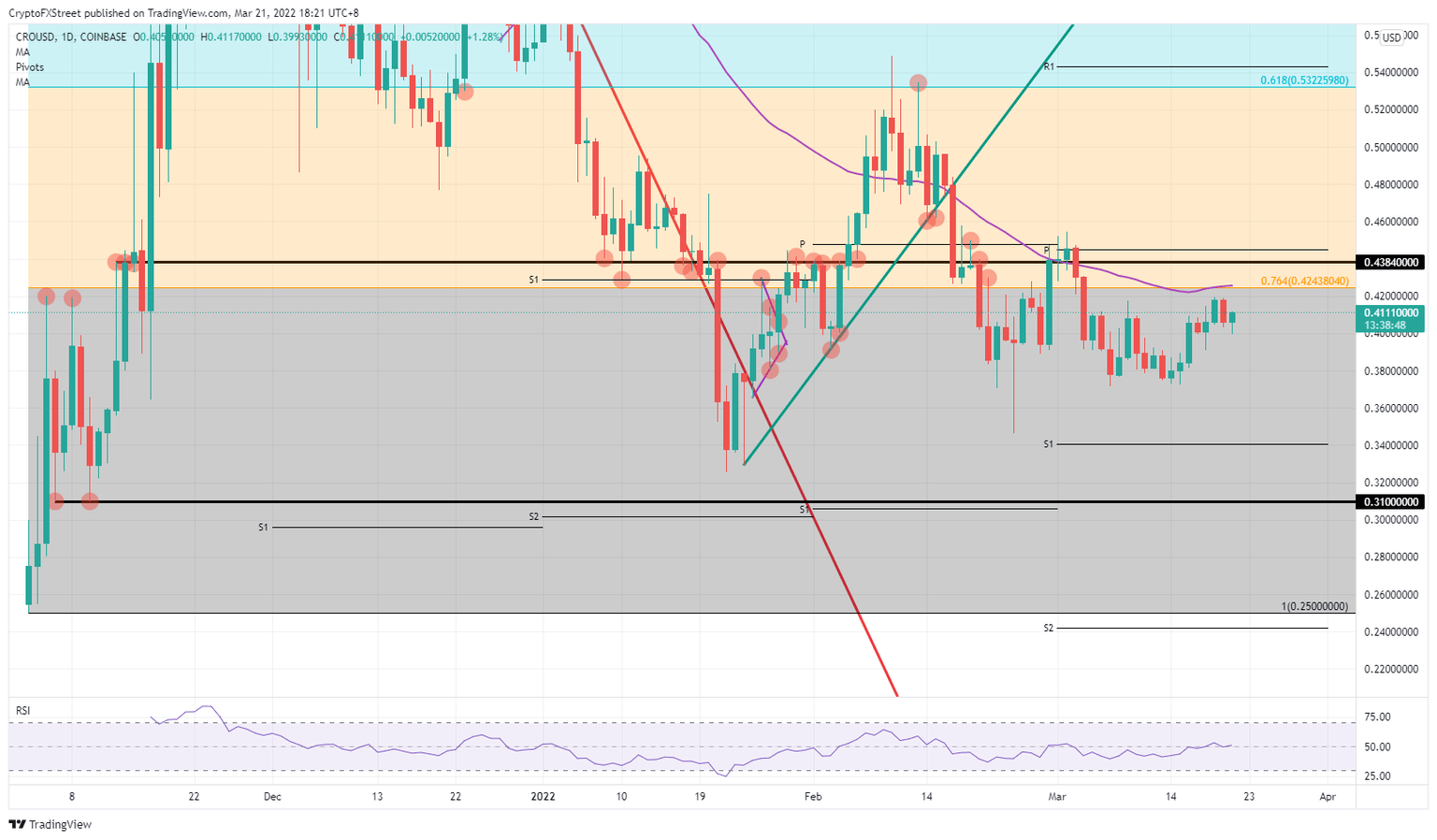

Crypto.com price action had an excellent leg-up during the relief rally from last week, but over the weekend remained subdued below $0.4244, which is the 76.4% Fibonacci level that coincides with the 55-day Simple Moving Average (SMA). On Sunday, even a complete pairing back happened from the gains booked on Saturday. The price action has come to a tipping point, and just one catalyst could be enough to blow CRO price action sky high and take out three toppish elements on the way.

CRO price action will first need to address the 76.4% Fibonacci level mentioned in the paragraph above. The following fundamental level after that is the $0.4384 level that has seen tremendous respect in the past from both upside and downside moves. The monthly pivot at $0.4450 is the last line of defence before bears get squeezed out and see their stop-losses hit, opening more room for bulls into the next trading week.

CRO/USD daily chart

Markets may have got too far ahead of themselves in pricing in a peace agreement. Seeing the strong language from Russia this morning on Mariupol and the tight window of escape before heavy bombing takes place shows that Russia is reverting to more heavy violence and has no interest in preserving any cities along the way to gain control of specific areas. With that in mind, expect peace talks to be ongoing and start to be a long process, weighing on the sentiment of traders that do not see their prepositioning paying off. This might lead to them cutting their positions and in the process pushing CRO back to $0.34 with the monthly S1 support and the low of February 24 as anchors.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.