Crypto.com token to provide a buying opportunity before CRO rallies 33%

- Crypto.com token is likely to retrace to the support level at $0.355 before rebounding.

- This downswing will provide an opportunity for buyers to accumulate before a 33% upswing.

- A breakdown of the $0.316 support floor will invalidate the bullish thesis for CRO.

Crypto.com token faced rejection after setting up a local high around a resistance barrier. The resulting downswing is likely to continue lower, providing short-term buyers an opportunity to capitalize on the incoming gains.

Crypto.com to enter an opportunity zone

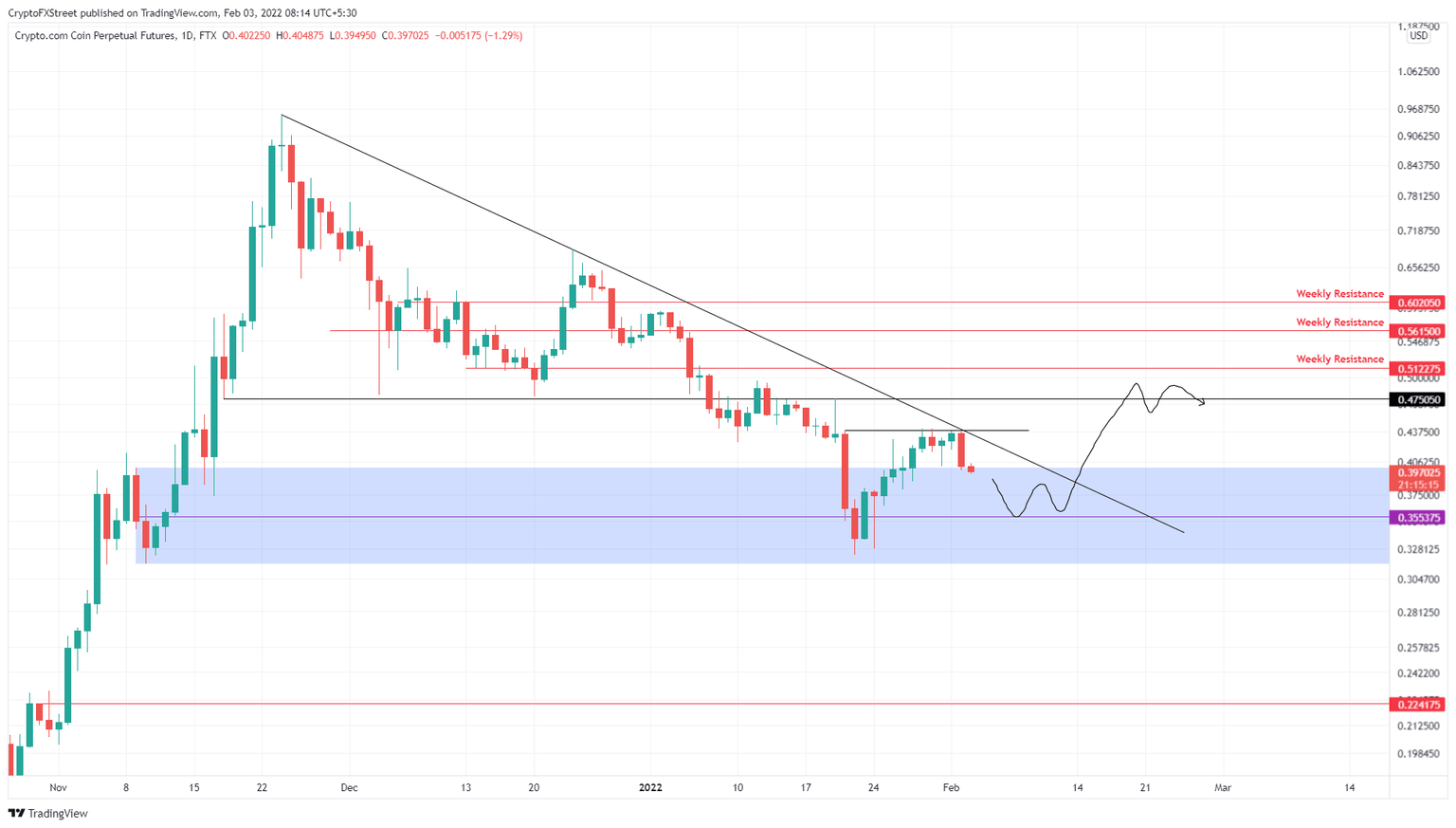

Crypto.com token has been trading below the declining trend line for more than two months. The recent rejection was due to the presence of this hurdle. Investors can expect CRO token to retrace deep into the 3-day demand zone, extending from $0.316 to $0.401.

The support level at $0.355 is likely where Crypto.com token will see some buying pressure creep in, slowing down the descent. This move will provide an opportunity for sidelined buyers to accumulate CRO, triggering a resurgence of bullish momentum.

The resulting spike in bid orders could be the key to starting an upswing that pushes CRO beyond the declining resistance barrier. Investors can expect the Crypto.com token to tag the $0.475 hurdle, signaling a 33% ascent.

CRO/USDT 1-day chart

On the other hand, if Crypto.com token fails to slow down around $0.355, it will indicate an increased sell-side pressure. If this downswing pushes CRO to produce a daily candlestick close below $0.316, it will create a lower low, invalidating the bullish thesis.

This development could see Crypto.com crash nearly 30% to $0.224, where buyers can band together and attempt a comeback.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.