Crypto.com token needs a breather before CRO kick-starts a 30% upswing

- Crypto.com token has sliced through multiple hurdles, signaling the start of an uptrend.

- Despite the recent rally, CRO is likely to retrace again before triggering a 30% run-up.

- A daily candlestick close below $0.316 will invalidate the bullish thesis.

Crypto.com token has seen a considerable surge in bullish momentum, resulting in a quick run-up. There is, however, a good chance CRO will retrace before triggering a new leg-up. This pullback will allow the altcoin to recuperate and prepare for the next rally.

Crypto.com token to take a break

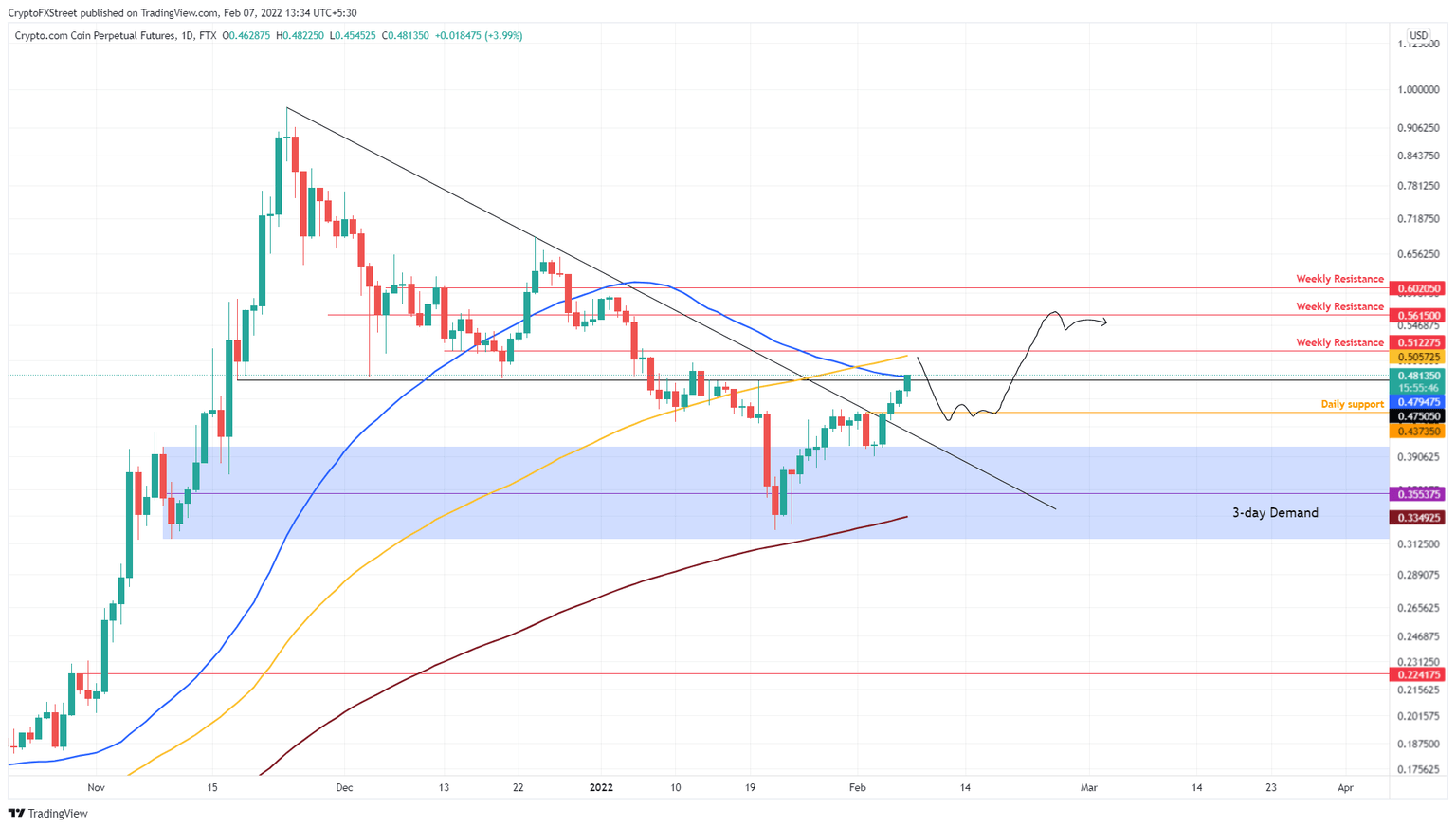

Crypto.com token rose 23% over the last three days, signaling an increase in buying pressure. This rally accomplished two major tasks - first it broke through the declining trend line, and then it retested the 50-day Simple Moving Average (SMA) at $0.479.

The move has pushed the Crypto.com token to what seems like a local top, at around $0.512, a confluence of a weekly resistance barrier and the 100-day SMA. Investors should expect a minor retracement from here to $0.437 before the uptrend resumes. A bounce off this barrier could be the key to triggering a 28% ascent to $0.562.

Investors can bank on this opportunity by taking bullish positions at $0.437 and booking profits at $0.517 and $0.562. In a highly bullish case, CRO could retest the $0.602 hurdle, bringing the total gain to 38%

CRO/USDT 1-day chart

While the bullish narrative makes sense, a reentry into the 3-day demand zone, extending from $0.316 to $0.400, will signal weakness among buyers. A daily candlestick close below $0.316 will create a lower low and invalidate the bullish thesis for the Crypto.com token.

Market participants can place their stop-loss at this barrier. A swing low below $0.316 could foreshadow a potential 30% crash to $0.224.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.