Crypto.com token hints at a 20% rally as CRO bulls take control

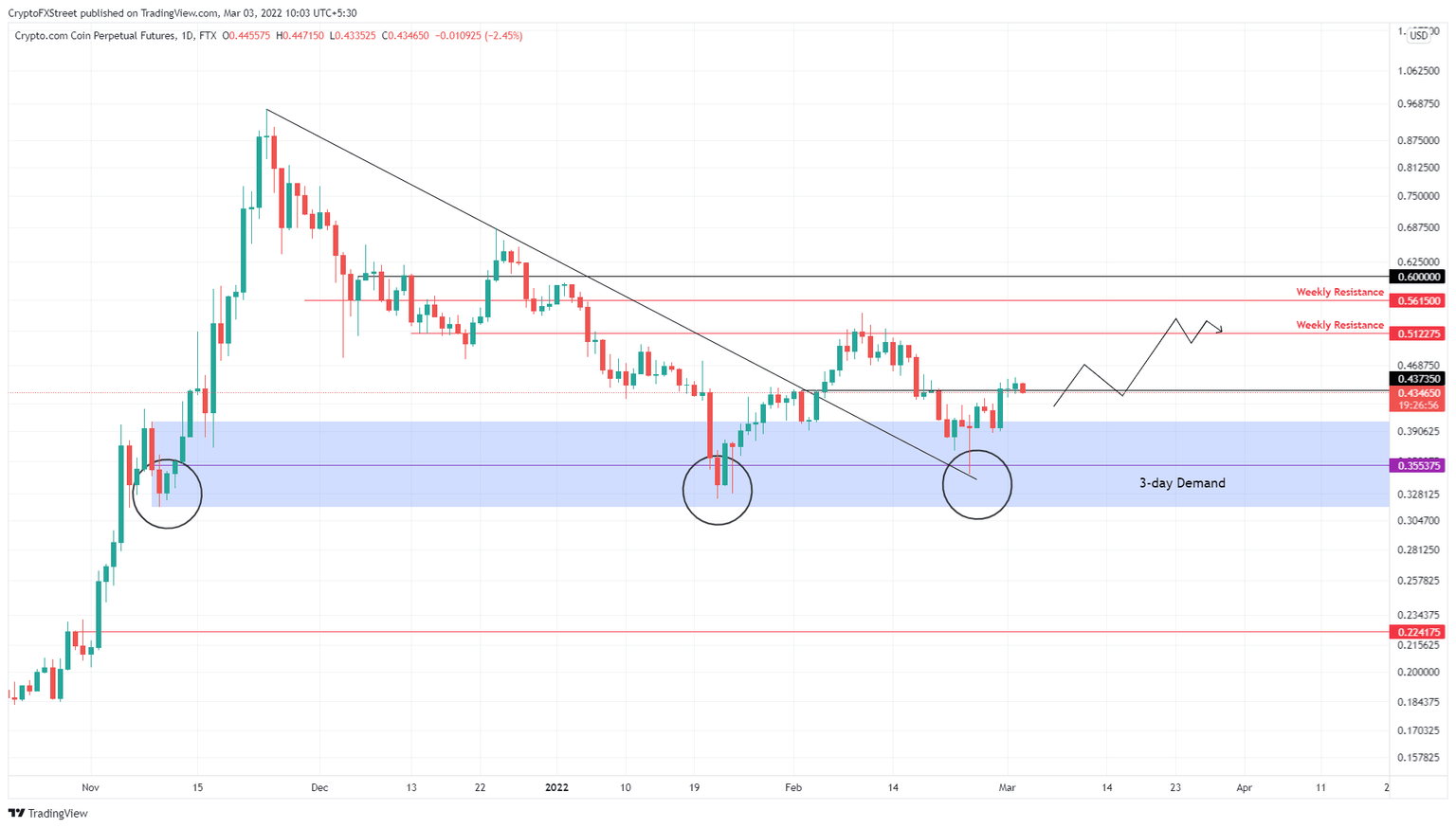

- Crypto.com token created a triple bottom setup as it bounced off the $0.316 to $0.400 demand zone.

- The recent run-up will likely extend by another 20% and retest the $0.512 resistance barrier.

- A daily candlestick close below the three-day demand zone’s lower limit at $0.316 will invalidate the bullish thesis for CRO.

Crypto.com token is at an inflection point as it retests a crucial resistance barrier. This move comes after CRO bounced off a vital support floor.

Crypto.com token faces a decisive moment

Crypto.com token bounced off the $0.316 to $0.400 demand zone for the third time on February 24, completing a triple bottom setup in the process.

This technical formation forecasts a trend reversal supporting bulls. As a result, the Crypto.com token has rallied 30% and is currently facing the $0.437 blockade. A potential surge in buying pressure that flips this hurdle into a platform will be vital in continuing the uptrend.

In such a case, CRO will make a run toward the $0.512 weekly resistance barrier. In total, this move would constitute a 20% ascent from $0.420 and is likely where a short-term high will form. Under special circumstances, the Crypto.com token may extend the rally by tagging the next barrier at $0.562.

Interested investors can open a long position at $0.420 and look to book profits at $0.512 and $0.562 level, respectively.

CRO/USDT 1-day chart

On the other hand, if Crypto.com token reenters the three-day demand zone, extending from $0.316 to $0.400, it will signal weakness with buyers and could also indicate an increase in sell-side pressure.

This downswing would counter the optimistic scenario but not completely kill it. A daily candlestick close below the three-day demand zone’s lower limit at $0.316 would, however, create a lower low and invalidate the bullish thesis for the Crypto.com token.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.